2024

Energy Storage Report

Technology Development

Technology Developments

The market for Lithium-Ion battery technology remains strong, but within this technology, there’s been a notable shift towards the use of different material chemistries.

Commercializing Promising Technology Options

The current visibility of emerging energy storage technologies is primarily based on pilot projects or demonstration initiatives. These technologies often require financial support, such as upfront subsidies or viability gap funding, to establish their credibility among stakeholders like developers, grid operators, and regulators. However, it’s worth noting that most funding in this space is directed towards electric vehicle (EV) battery production, with energy storage receiving considerably less support.

Unlike EV batteries, which prioritize energy density for range and charging time, energy storage batteries focus on parameters like cost, durability, and lifespan. Stationary batteries must compete with conventional energy resources in peak and frequency changes, requiring a longer lifespan of up to 10,000 charging cycles—about three times that of EV batteries Wood Mackenzie, 2023). The divergence between EV and energy storage batteries is driven by a combination of policy support, private sector innovation, and overall market demand.

Recent Grant-based Funding Support for Battery Technologies

| Funding Authority | Amount | About the Funding |

|---|---|---|

| US Department of Energy | $325 million |

The funding announced in September 2023, will be shared by nine projects qualified for LDES grants. |

| California Energy Commission | $30 million |

A grant-based funding was confirmed in December 2023 for a pilot on Form Energy’s 100-hour battery storage project. |

| Swedish Energy Agency | $8.4 million |

A grant for a pilot and the world’s first zinc-iron battery production unit. The targeted throughput is 100MWh. |

|

UK Research and Innovation (UKRI) |

£11 million |

Total funding outlay for competing projects in early-stage feasibility and those in advanced research. |

Source: Clean Technica, Energy Storage News, Enerpoly and UKRI

The market for Lithium-Ion battery technology remains strong, but within this technology, there’s been a notable shift towards the use of different material chemistries. Lithium Iron Phosphate (LFP) cathode chemistry has seen increased demand, particularly in the electric vehicle market for shorter driving ranges. However, its application is also growing in the energy storage sector due to its relative cost advantage in raw material usage compared to the dominant Nickel-Manganese-Cobalt (NMC) cathode chemistry Fastmarkets, 2023).

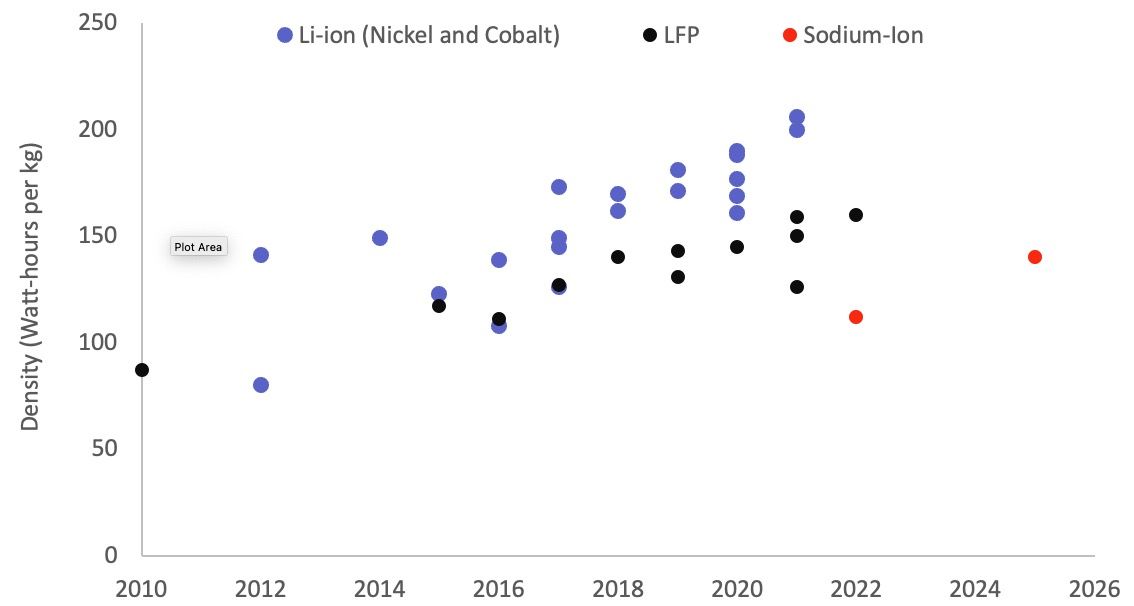

Energy Density of the Lithium- and Sodium-based Batteries

Note: Data refers to share of energy units generated by renewable and coal-based sources.

Note: Sodium-Ion data for 2025 is a projection Source: MIT Technology Review

Another promising challenger in the battery landscape is Sodium-ion (Na-ion) batteries. In July 2023, the Chinese market saw the first grid-scale application of Na-ion batteries with a 5MW unit, signaling their potential for broader adoption Energy Storage News, 2023). Major producers like CATL and BYD have integrated Na-ion batteries into their mass production schedules, and companies like Northvolt are investing in Na-ion battery cell manufacturing for energy storage applications CnEV Post, 2023) Northvolt, 2023).

Early production estimates suggest a steady improvement in battery density, with Northvolt reporting over 160 watt-hours/kg in energy density for Na-ion batteries. Trend data indicates that by 2022, the energy density of Na-ion batteries was approaching the level of lower-end Lithium-ion batteries in 2012 MIT Technology Review, 2023). However, it’s important to note that the scale and learning curve advantages of Lithium-ion batteries have been relatively higher due to their larger production base.

As existing mass production plans for alternative battery technologies come to fruition, there’s potential for even greater improvements in battery performance parameters. Many of these planned ventures are occurring outside of China as developers and major consumers seek to diversify their supply chain options. While Chinese manufacturers like CATL and BYD lead in sodium-ion battery supply, their focus has primarily been on the electric vehicle market. However, the market for sodium-ion batteries can deepen as more storage developers collaborate with manufacturers and technology providers for battery development tailored to energy storage applications.

As alternative battery technologies continue to advance, storage developers are presented with a broader array of options. Among these, iron-air batteries stand out for their promising technical capabilities and cost-effectiveness. Notably, major utility companies like Xcel Energy and Puget Sound Energy are spearheading efforts to deploy large-scale iron-air battery storage projects Energy Storage News, 2023). Recently approved by regulatory authorities in Minnesota and Colorado, these initiatives align with state mandates to phase out coal-based power generation and achieve carbon neutrality by 2030 Energy Tech, 2023).

Notable Mass-production Ventures in Sodium-Ion Batteries Beyond China

| Entity | Initiative in Mass Production | |

|---|---|---|

| Natron Energy |

The company partnered with Lithium-Ion battery producer Clarios International for a 600MW sodium-ion facility at Michigan, US. |

|

| LiNA Energy |

|

|

| Tiamat Energy |

A 5GWh sodium-ion facility planned in northern France, helped by part-funding from automaker Stellantis. |

|

| Northvolt |

The planned sodium-ion battery cell differentiates against Chinese suppliers by obviating the Cobalt, Nickel or Manganese mineral usage |

In a similar vein, zinc-based hybrid batteries are gaining traction, supported by significant investment from the US Department of Energy. Eos Energy, a leading provider in this space, has secured substantial funding to expand its production capacity for zinc-halide batteries MIT Technology Review, 2023). With a planned 8GWh capacity by 2026, Eos Energy’s endeavors are bolstered by incentives provided under the Inflation Reduction Act of August 2022 PV Magazine, 2023). Moreover, these emerging technologies are strategically positioned to capitalize on opportunities arising from the decommissioning of coal-fired power plants. In essence, the commercialization of alternative battery technologies hinges on several factors, including mass production feasibility and raw material sourcing costs. As the industry evolves, a select few leading technologies are expected to emerge victorious, challenging the dominance of incumbent Lithium-Ion batteries in the energy storage landscape.

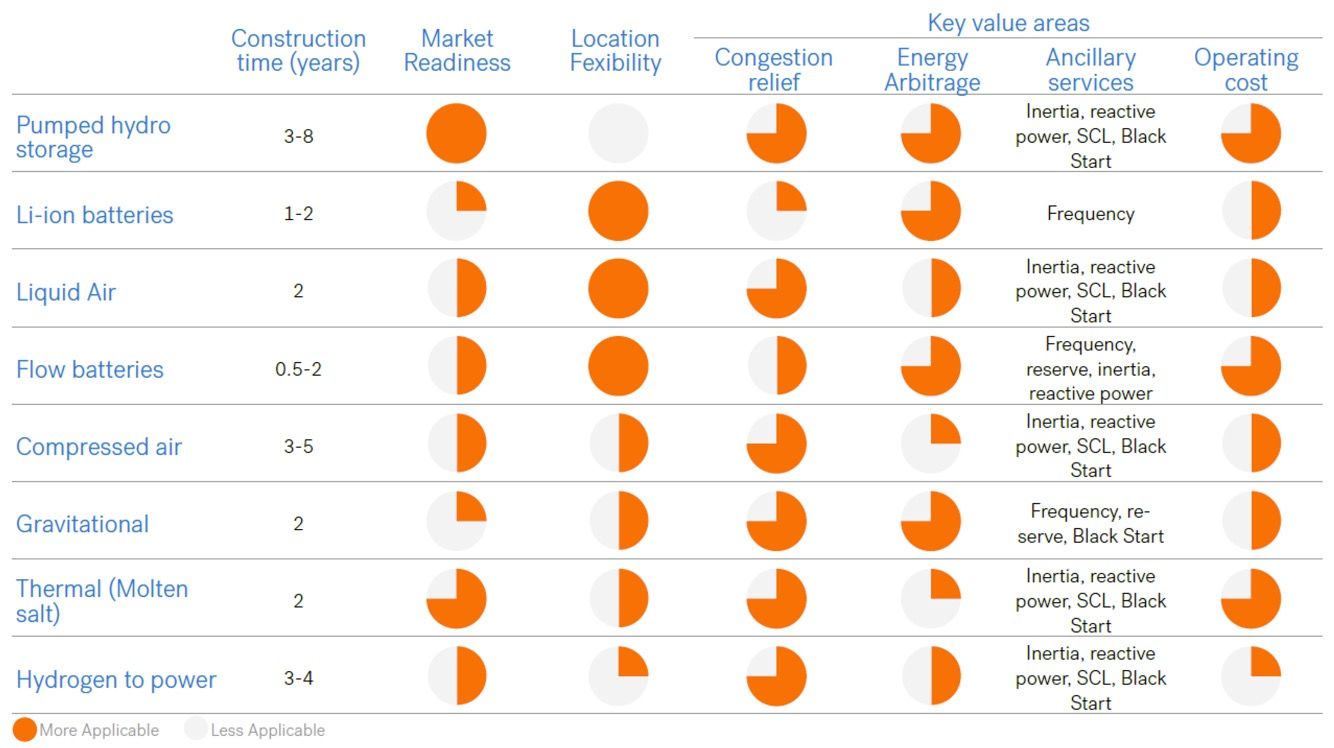

Long-Duration Energy Storage is Key

The global energy storage technology landscape is increasingly influenced by the demand for long-duration energy storage (LDES), typically defined as storage lasting beyond 4 hours. Many emerging technologies, whether in pilot phases, testing, or demonstration, aim to address this segment. With the rising penetration of renewable energy into the grid, LDES becomes essential for ensuring reliability and stability. However, commercially viable options in this space are still limited.

Technologies like Pumped Hydro Storage (PHS) and Compressed Air Energy Storage (CAES) are well-suited for long-duration storage. Projects utilizing these technologies are gaining traction. For instance, in July 2023, Dutch energy storage technology provider Corre Energy signed an exclusivity agreement to acquire a 280MW CAES project in the US, with plans for a final investment decision by 2025 Renews Biz, 2023). Corre Energy has also secured agreements for CAES projects in the Netherlands and Germany Renewables Now, 2023). Similarly, Canadian company Hydrostor is repurposing existing mining assets in Australia to develop CAES storage capacity Energy Storage News, 2023). Meanwhile, there is a growing momentum for PHS-based projects, supported by various policy and regulatory incentives and targets.

Long Duration Energy Technologies in Focus

Note: 1) Short duration Li batteries are market ready, long duration is not yet seen to be established in the market; 2) Suitable power conditioning system required; 3) Molten salt refers to concentrated solar power with storage; 4) Hydrogen-to power refers to CCGT only; 5) Under operating cost category, a full Harvey ball implies favourable operating costs, i.e., low.

Source: Aurora Energy Research

Policy support plays a crucial role in the commercial development of early-stage Long Duration Energy Storage (LDES) technologies. Examples abound in regulatory directives, such as those seen in California and Arizona, explicitly requiring LDES solutions. Notably, California recently approved an 8-hour Lithium-Ion LDES project, with other proposals under evaluation. These battery technologies, including iron-air batteries, are tailored to meet LDES demand and receive grants and support from regulatory authorities.

In the United States, the Department of Energy (DoE) oversees the Earthshot program, a $1 billion initiative aimed at reducing LDES costs by 90% to achieve Net-Zero targets US DoE, 2021). The DoE plans to extend the Earthshots program globally, starting with collaborations with Canada and India Clean Technica, 2023). Meanwhile, the UK government pursues LDES through different avenues, defining it as storage duration of 6 hours and above. The government has floated consultations on proposed measures, such as cap-and-floor regulations and exclusion of Lithium-Ion, to promote the LDES sub-segment. Stakeholders have until March 5, 2024, to provide feedback on these consultations (Energy Storage News, 2024).

The significance of major policy support measures lies in their role in bolstering experimental initiatives that stabilize the energy storage business and its nascent technologies. LDES technologies are critical for achieving Net-Zero objectives and facilitating the energy transition process by providing economical options that enhance energy system flexibility.