2025

Global Data Center Market Report

Introduction to Data Centers

02 | Introduction to Data Centers

Data Center Evolution

The evolution of the global data center market has been driven by continuous innovation and adaptation in response to the growing demands of digital infrastructure in an increasingly digitalised world. Historically thought of as centralised facilities housing mainframe computers, the role of the data center has transformed over the past few decades to offer much more than local computing power and data storage.

In the 1980s and 1990s, the rise of technologies involving interconnected computer networks like client-server architecture and Local Area Networks (“LANs”) decentralised data processing. This shift allowed organisations to manage data more flexibly and efficiently, leading to the proliferation of on-premises data centers. The commercialisation of the internet in the mid-1990s further accelerated this trend, as businesses required reliable hosting solutions for online services. This period saw the emergence of colocation services, where companies could rent space in third-party data centers, offering a flexible and scalable digital infrastructure solution.

The late 1990s and early 2000s were significant turning points for the global data center market with the explosion of the internet, which led to a surge in demand for data centers to support websites, email services, e-commerce platforms, and online applications. It also saw the development of cloud computing, with companies like Amazon Web Services (“AWS”), Google Cloud, and Microsoft Azure revolutionising the industry by offering scalable, on-demand cloud services. These cloud providers had the capability to run multiple virtual machines on a single physical server, optimising resource usage and enhancing scalability. This led to the surge of hyperscale data centers as companies recognised the benefit of offloading their physical Information Technology (“IT”) infrastructure and switching to Infrastructure-as-a-Service (“IaaS”), Platform- as-a-Service (“PaaS”) and Software-as-a-Service (“SaaS”) models.

The mid-2010s saw the continued growth of cloud service adoption, with companies opting for both hybrid cloud models and multi-cloud models, blending public cloud services with their own on-premises data centers, allowing for full control over sensitive data while taking advantage of cloud scalability for non-critical workloads, as well as avoiding vendor lock-in and boosting resilience. However, the rise of edge computing was the key development in the global data center market, which addressed the need for real-time data processing resulting from the proliferation of Internet of Things (“IoT”) devices and time-sensitive applications by deploying data centers closer to data sources, reducing latency and improving performance.

More recent developments in the data center market have centered around operational efficiencies and sustainability. As corporates, governments and Intergovernmental Organisations (“IGOs”) race towards Net Zero, the sustainability of data centers is becoming an increasingly hot topic, particularly given the significant amounts of energy facilities consume, leading to the development of green data centers that employ renewable energy sources and energy-efficient hardware. The need to decarbonise data centers has been particularly prominent, given the growing need to deploy data centers, at scale, to cope with the increasing demands of a digitalised world, driven by the rapid adoption of Artificial Intelligence, big data analytics, the rollout of 5G networks and continued growth in demand for cloud service provision.

Today, the data center market is characterised by rapid growth and intense competition, a trend expected to continue, with further innovations in Artificial Intelligence (“AI”), sustainability, and decentralised data processing. As the digital infrastructure requirements of businesses and consumers continue to grow, data centers will remain a critical component of the global digital landscape, inevitably evolving to meet the challenges and opportunities involved.

Data Center Universe

Data centers are physical rooms, buildings, or facilities that house critical IT infrastructure, such as networked computers, computing hardware, and storage systems, essential for developing, running, and delivering applications and services and for processing, storing, and managing associated data.

Historically, data centers have been thought of as privately owned, tightly controlled, on-premise facilities, housing essential IT infrastructure for the exclusive use of one company, commonly referred to as enterprise data centers. However, following the rise of the internet in the late 1990s, and as the global megatrend of digitalisation has gained momentum, driving demand for computing power, data processing, data storage and low latency communication, data center types, use cases and business models have rapidly evolved.

Broad Outline of the Data Center Types

Enterprise

-

An enterprise data center is a traditional, small-scale, company-owned facility, used to store and process internal data as well as host applications, often built on-site at company offices or key location

-

With the growth in demand for cloud service provision, which offers both flexibility and scalability, enterprise data centers are making up an increasingly small part of the global data center market

-

However, some inherent advantages of enterprise data centers remain, including enhanced control, visibility and security, particularly for companies in possession of sensitive data

Colocation

-

Colocation data centers operate under a leasing model, where companies can rent space, hardware, power, interconnection, security and cooling services for a monthly fee

-

The colocated model differs from that of the enterprise model, by offering businesses flexibility and scalability in their IT operations and alleviating the need for significant upfront capital investment associated with on-premise facilities

-

Interconnection, involving direct, private data exchange, in a secure, efficient and low latency manner, between businesses is a significant business driver and competitive advantage for collocated data centers

-

They can offer one-to-one, one-to-many or many-to-many connectivity between partners, customers and employees, often without the need to traverse the internet (Equinix, What is Interconnection, 2017)

Hyperscale

-

Whilst there is no globally recognised metric for a “hyperscale” data center, they are differentiated by both size and scalability. Hyperscale data centers typically cover over 10,000 square feet, house over 5,000 servers and have the capacity to scale, materially, at speed

-

Like enterprise data centers, hyperscale data centers are, typically, owned and operated by the company they support

-

The growth of cloud computing, AI and big data have all contributed to the rapid expansion of the hyperscale data center market, where the Cloud Service Providers (“CSPs”) are dominant, with Google Cloud, Microsoft Azure and Amazon Web Services (“AWS”) accounting for ~65.0% of the hyperscale data center market globally (SDxCentral, 2023

Edge

-

Located on the “edge” of the network, edge data centers are designed to process time-sensitive data faster, while sending less time-critical information to larger, centralised data centers (Hewlett Packard Enterprise, 2024)

-

By processing data services as close to end users as possible, edge data centers allow organisations to reduce communication delay and improve customer experiences

-

Edge data centers have been critical in the growth and success of the IoT, which encompasses smart technologies and devices from smart home security systems to automated cars

-

Edge data centers reduce latency, improving real-time data analytics and processing, and customer experience

Source: Equinix, SDxCentral

Data Center Value Chain

The evolution of the data center market has spurred material capital deployment across the value chain as developers, constructors, operators and service providers look to capitalise on the market opportunity presented by the growing importance of data centers in an increasingly digitalised world.

Some of the major hyperscalers, including the CSPs, have the size, scale, and skillset to develop, construct, own, and operate their own data centers. However, given the technical, operational, and regulatory complexities involved, most owners require the services of third-party contractors and early-stage developers to bring a project to fruition.

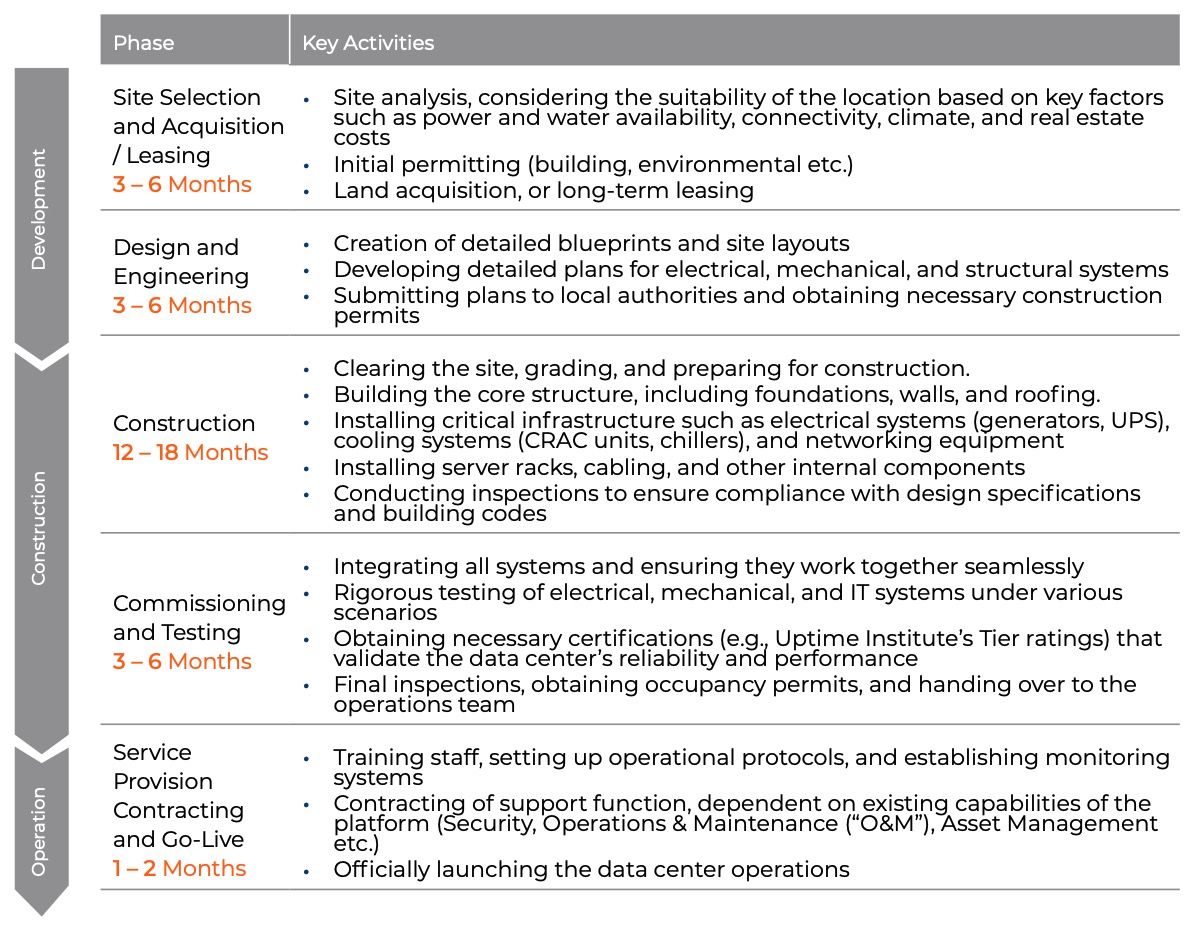

Whilst the development, construction and operation of data centers are nuanced, depending on the size, complexity and location, the below summarises the key activities and milestones to be navigated in each phase:

Major Stages in Data Center Development

Major Players

Hyperscalers

Whilst enterprise data centers have historically dominated the data center market, the hyperscale market is experiencing rapid growth and will soon dwarf on-premise sites, given the proliferation of digitalisation trends across cloud computing, AI and big data analytics.

Hyperscale data centers are primarily operated by leading cloud service providers (CSPs) such as AWS, Google Cloud, and Microsoft Azure, which deliver scalable cloud computing services, supporting everything from simple data storage to complex machine learning, 5G rollout and big data analytics

| Company | Role of Data Centers | REcent Transactions |

|---|---|---|

| Amazon Web Services (AWS) | Operates a vast network of data centers worldwide, providing cloud computing services to businesses of all sizes. AWS’s data centers support a wide range of services, including computing power, storage options, and networking capabilities. |

|

| Google Cloud | Leverages its global network of data centers to deliver scalable cloud services, including data storage, machine learning, and data analytics. Their infrastructure is designed for high performance and energy efficiency. |

|

| Microsoft Azure | Operates a comprehensive network of data centers that provide a wide range of cloud services, including computing, storage, and databases. Azure’s infrastructure supports both hybrid cloud solutions and on-premises data management. |

|

Colocation Service Providers

Major colocation service providers such as Equinix and Digital Realty also play a pivotal role in the data center ecosystem. While these companies are traditionally known for offering colocation and interconnection services, they have expanded into the hyperscale market, providing tailored solutions to meet the needs of large-scale cloud providers. Equinix’s xScale program, for instance, is a dedicated initiative aimed at supporting hyperscale deployments, with an investment pipeline of over $3.0 Bn (Equinix, 2021). Meanwhile, Digital Realty has also made significant investments in hyperscale facilities, particularly through joint ventures, like their recent $7.0 Bn partnership with Blackstone to deliver 500.0MW of hyperscale IT capacity (Blackstone, 2023)

However, despite the strong push into hyperscale, colocation services continue to be essential for both firms. Digital Realty operates 300+ data centers with colocation and white space services (Dgtl Infra, 2023) (Digital Realty, 2023). Equinix, with a network of 260 centers, maintains colocation as a major revenue stream (Dgtl Infra, 2023) (Equinix, 2024)

Major Colocation Providers

| Company | Role of Data Centers | REcent Transactions |

|---|---|---|

| Equinix | Leading global provider of colocation and interconnection services. Their data centers enable businesses to securely deploy their IT infrastructure and connect with a vast ecosystem of partners and providers. |

|

| Google Cloud | Provides colocation, interconnection, and custom data center solutions. Their facilities support mission-critical applications and deliver scalable infrastructure for enterprises and service providers. |

|

Source: BT and Data Center Dynamics