2025

Global Data Center Market Report

Industry Size, Growth and Key Drivers

03 | Industry Size, Growth and Key Drivers

Industry Size

Estimates of the size of the global data center market vary due to differing assumptions and related parameters. However, all align on the sector’s trajectory, involving significant growth in the medium term and a few regions dominating the space. Global data center size (by revenue) is estimated to be $125.4 Bn in 2024, which is forecast to grow at an 11.3% Compound Annual Growth Rate (CAGR) to $364.6 Bn by 2034, largely driven by the continuation of the global megatrend of digitalisation (Precedence Research, 2024).

Continued adoption of cloud computing by enterprises globally will be a key driver in the hyperscale market, as businesses continue to move away from on-site enterprise models to flexible and scalable IT solutions. Digital transformation, namely AI-based solutions and big data analytics will continue to demand significant computing power, particularly as machine learning improves and evolves. An expansion of the edge data center market is also expected, as the IoT universe expands, and consumers demand lower latency and improved real-time data processing through their devices.

Source: Precedence Research

The optimistic outlook for the global data center market is a testament to its essential role in enabling the modern digital world. It supports the seamless operation of digital services, from cloud computing to online transactions, and plays a crucial role in the roll-out of transformative technological advancements, such as AI.

North America, being the largest market by revenue, plays a pivotal role in the global data center landscape. The US market has seen a significant surge in data center capacity, driven by the proliferation of cloud service providers, the rise of the IoT, and advancements in AI technologies. Between the second half of 2020 and the second half of 2023, the data center capacity under construction in the US increased nearly ninefold, from 611.0MW to 5,341.0MW (JLL, 2024). The Northern Virginia region, in particular, has become a focal point, with a data center vacancy rate of less than 1.0% in 2023, reflecting the rampant demand for data center capacity (Statista, 2024) (Statista, 2024). The region’s popularity is driven by its strategic location near major internet exchange points, access to a highly educated workforce, favourable business climate with tax incentives, ample land and reliable power availability. Additionally, proximity to federal government agencies and the growing demand for secure, low-latency data services further improve its appeal as a data center hub.

This rapid expansion in the North American region is also supported by the high penetration of 5G technology and the widespread adoption of digital services. The US leads in 5G mobile connections, expected to rise from 15.0% in 2021 to 68.0% by 2025, driving significant data usage and, consequently, the growing need for data centers.

The European data center market, following closely behind North America, has also seen significant growth over recent years. The FLAPD regional markets—Frankfurt, London, Amsterdam, Paris, and Dublin—remain central hubs due to their excellent connectivity, infrastructure and strategically important locations, despite headwinds in the form of declining land availability and, correspondingly, increasing land cost. This has expedited the emergence of secondary data center locations, such as Berlin, Milan, and Madrid, which are increasingly being seen as a viable alternative due to cost, speed of development and connectivity.

Note: Regional share is based on market size by revenue of 2023.

Source: Precedence Research

In particular, the European market has led the way in the decarbonisation of data centers, an increasing focus of governments and organisations as the world grapples with the challenge presented by climate change. This has largely been EU-led, with the Energy Efficiency Directive (“EED”), which was implemented in 2023 and aims to reduce Europe’s energy consumption by 11.7% by 2030, supporting the EU Green Deal’s objective of cutting carbon emissions by 55.0% by the same year. Under the EED, data centers within the EU that exceed 500kW will be required to report their energy use and emissions as a first step, which encompasses floor area, installed power, data volumes, energy consumption, PUE, temperature set points, waste heat utilisation, water usage, and use of renewable energy.

Amidst competition and rising regulatory requirements, developers and investors are progressively shifting attention to the Asia- Pacific (APAC) region. Its currently lagging position in the global data center market share is compensated by exponential growth. In terms of installed capacity, the APAC region is anticipated to reach more than double the existing levels within the next 3-4 years (Aurex, 2025). Collectively, the region’s emerging market economies and their public/private digitalisation projects, innovation hubs, and 5G rollouts are shaping the market contours.

Latin America, the Middle East, and Africa hold the residual market share. This is largely driven by Latin America, which has benefitted from strong economic growth, rapid adoption of digitalisation trends, and favourable policies promoting digital economies and innovation hubs, particularly in Brazil, Mexico, and Chile.

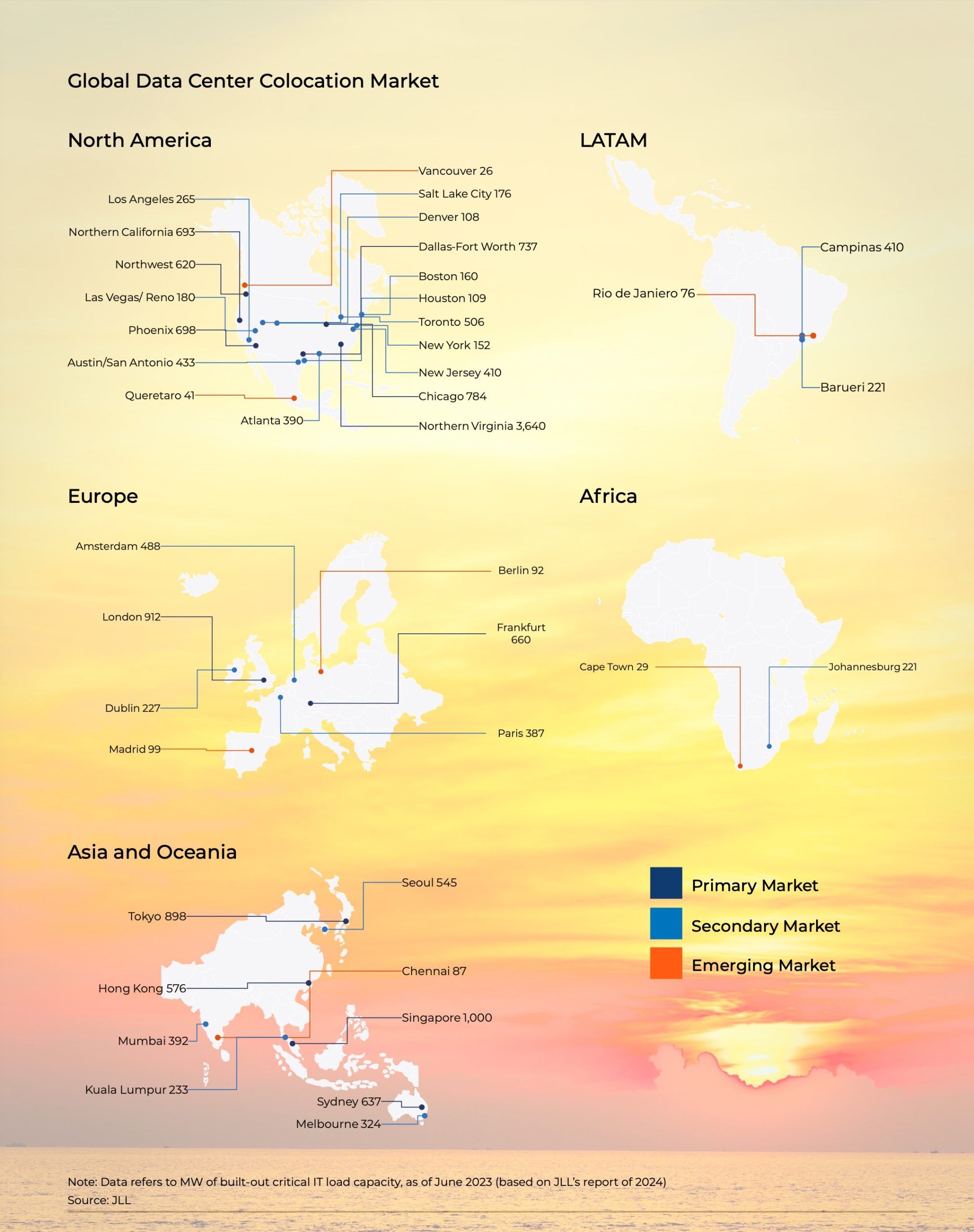

Within regions, primary markets, characterized as those with at least 600MW of supply, continue to see robust growth as colocation and hyperscale providers consolidate their positions in key metros due to their connectivity and advanced infrastructure. However, secondary markets, with 100-600MW of supply, have gained attention from investors, developers, and lenders seeking new opportunities in less crowded markets where land can be more readily available, and cheaper.

Some key industry dynamics outline the changing landscape of the data center market. One of them refers to hyperscale data centers, which are mostly associated with the top and well-entrenched players in the cloud services market. Hyperscale data centers, particularly in the US, dominate the global capacity, followed by significant contributions from Europe and China.

According to the first chart, the US holds 51.0% of the hyperscale data center capacity, reflecting its leading position in the market. Colocation markets are expanding in both primary and secondary regions, reflecting the growing demand for flexible and scalable data center solutions. These trends collectively indicate a transformative period for the data center industry, characterized by a shift towards more efficient, scalable, and strategically located facilities that meet the evolving needs of the digital economy.

Note: Data is as of Q4 2023.

Source: SDx Central

Data Centers Market by Type

Global data center dynamics continue to evolve due to technological innovations, regulatory changes, and growing consumer demands, all of which are impacting the type, size and number of data centers required to support an increasingly digitalised world.

The changing composition of the global data center market is most stark when analysing the historical and forecast decline in enterprise data center capacity, which totalled 58.3% in 2017 but just 40.3% in 2022 and is expected to decline further to 28.1% by 2027. This is primarily a result of the roll-out of hyperscale data centers, driving both absolute growth in the data center market and, therefore, a declining share of enterprise data centers, but also a reduction in enterprise data centers that they have replaced, as companies continue to opt for scalable, affordable cloud solutions.

Resultingly, hyperscale data centers are expected to account for over 50.0% of global data center capacity by 2027, up from 20.1% in 2017 and reflecting a 9.6% CAGR (can we show a CAGR of market share?). Worldwide, the capacity of hyperscale data centers has doubled since 2020, and further expansion is forecast, with over 440 hyperscale data centers in the pipeline as of April 2024 (DCD, 2024). This trend is fuelled by the growing cloud adoption detailed above, but also the rise in AI, the rollout of 5G, big data analytics and crypto mining, all of which require significant computing power, storage capacity and advanced security systems provided by Hyperscalers.

Source: Synergy Group

Despite the decline in relative importance, on- premise data centers still play a vital role in the digital infrastructure landscape. Enterprises continue to invest in on-premise facilities to support hybrid cloud strategies that combine internal IT resources with third-party cloud infrastructure. Factors such as resiliency, cost economics, and existing investments influence the decision to maintain or expand on-premise data centers.

Colocation data centers have also grown substantially from about 6.0GW in 2019 to over 19GW by 2023, albeit dwarfed by that of the hyperscalers but reflecting a forecast increase in absolute terms (Citi Research, 2024). Many enterprises that previously operated on-premise data centers are now opting for colocation services to leverage cost efficiencies, scalability and the advanced infrastructure offered by colocation providers, supported by a Uptime Institute survey, which revealed that 79.0% of colocation providers reported growth in demand for colocation capacity in 2023 (Data Center Frontier, 2024).

However, colocation facilities have also been impacted by hyperscale expansion. Previously considered a more dynamic, cost-effective and scalable solution to enterprise data centers, some inherent disadvantages of colocation facilities are driving consumers to go one step further and transition to a full-scope cloud service provision. Increased scalability, pay-as- you-go models, geographical reach, technology integration and reduced maintenance expenses offered by hyperscale cloud service providers can deliver both cost and operational efficiencies to consumers that are otherwise difficult to achieve through a more centralised IT solution.

The global colocation data center market was valued at approximately $66.3 Bn in 2023 and is projected to reach around $221.9 Bn by 2032 (Expert Market Research, 2023) (GlobeNewswire, 2023). Meanwhile, the global hyperscale data center market was valued at $37.1 Bn in 2023 and is anticipated to grow from $44.9 Bn in 2024 to $262.1 Bn by 2032, with a higher CAGR of 24.7%, indicating stronger growth potential (Fortune Business Insights, 2024).

In conclusion, the data center market is experiencing robust growth driven by the shift towards hyperscale and colocation facilities, technological advancements, and the increasing need for scalable, efficient, and sustainable data storage solutions. The evolving landscape presents numerous opportunities for investors, developers, and businesses to capitalize on the expanding demand for digital infrastructure.

Rise of AI-driven Solutions

Artificial intelligence is a major force behind the increasing demand for data centers, given the significant infrastructure required to support its computational power and data storage needs. Whilst the AI industry is still in its nascent stages, it has developed rapidly, growing from $95.6 Bn in 2021 to $214.0 Bn in 2024 transforming industries and enhancing operations, with 42.0% of enterprise-scale organisations now having AI solutions integrated into their business models according to multinational IT company, IBM (Acropolium, 2024) (NMSC, 2024) (Forbes Media, 2024).

AI’s success is largely driven by its diverse use cases, spanning nearly every industry. These transform processes, enhance efficiency and decision-making, improve customer experiences, drive automation, and enhance security. The impact of these has been so profound that companies not adopting AI solutions are increasingly finding themselves at risk of being rendered obsolete and irrelevant.

For example, Estée Lauder, a global cosmetics company, released a voice-enabled makeup assistant designed to assist visually impaired people with applying makeup, enhancing their customer experience and, resultingly, its global brand. Meanwhile, companies such as Pentagon Credit Union (PenFed) are using chatbots and conversational AI to help customers get answers to common questions faster, reducing the load on customer service reps and improving employee satisfaction (CIO, 2023).

At General Electric (“GE”), AI is leveraged regularly for predictive maintenance purposes, analysing data directly from aircraft engines to identify problems and required maintenance. Rolls-Royce has also found use for AI in identifying predictive maintenance, improving the efficiency of jet engines and reducing the amount of carbon planes produce, while also streamlining maintenance schedules through predictive analytics (CIO, 2023).

Whilst these examples highlight some of the flagship AI solutions being implemented by multinational organisations, the democratised nature of AI enables small, medium and large enterprises to implement AI-based products, helping to streamline everyday business functions, including accounting, marketing, process automation and recruitment.

In addition to existing use cases, several emerging trends are creating new pockets of computing workloads driven by AI, including autonomous vehicles, which rely on real-time data processing for navigation and safety, personalised medicine, creating tailored treatment plans for patients, and deepfake technology, which allows for the creation of realistic visual effects and character animations by synthesising faces and voices.

These emerging AI-based applications can capture demand almost overnight, leading to unexpected spikes in computing capacity requirements. Most notably, ChatGPT, the popular chatbot from OpenAI, is estimated to have reached 100 Mn monthly active users in January 2023, just two months after its launch (Reuters, 2023).

The speed of deployment, extensive use cases and rapid evolution and uptake of AI solutions mean that demand for computer processing power, data storage and connectivity is growing at an unprecedented rate and underscores the crucial role that data centers continue to play in the global digital infrastructure landscape. Resultingly, global AI infrastructure spend —including data centers, networks, and other hardware that supports the use of AI applications—is expected to reach $422.6 Bn by 2029, growing at a CAGR of 44.0% over a six-year period. (WSJ, 2023).

As AI continues to evolve, advance, and integrate into various aspects of our daily lives, the supply of data centers capable of supporting these computationally intensive applications will need to follow suit. This will highlight the interdependent relationship between AI development and the expansion of the data center market and reaffirm data centers’ position as essential infrastructure in the era of digitalisation.

5G Networks

The global growth of 5G technology has been transformative, reshaping industries and enabling innovative applications by offering substantially faster data speeds, reduced latency, and enhanced connectivity. This makes it a catalyst for the continued rollout and evolution of data centers, reshaping their architecture, operations, and role in the digital ecosystem.

In particular, 5G technology has had a profound effect on the demand for edge computing. 5G networks utilise a more decentralised architecture, which distributes computing and data processing closer to the edge of the network, reducing the load on centralised servers and enhancing the ability to handle numerous connections simultaneously. This trend requires the establishment of smaller, localised edge data centers, which can handle the data processing requirements without impacting the user experience through higher latency.

However, it is not just reduced latency that is driving data center deployment through the rollout of 5G. The high volume of data generated by 5G applications necessitates significant storage and processing capacity as well. 5G enables a substantial increase in the number of connected devices at any given time, having been specifically designed to support large-scale IoT deployments, allowing up to 1 Mn devices per square kilometre. This results in significantly more data being generated, necessitating robust processing and storage solutions in the form of data centers, meaning businesses must invest in scalable storage solutions to accommodate both short-term and long-term data retention, whilst ensuring accessibility and compliance.

Whilst 5G networks have already been rolled out globally, its growth story is far from over. According to Ericsson’s mobility report, approximately 50.0% of the world is now covered by 5G networks, marking a significant milestone in global connectivity, but also highlighting some notable regional disparities. Whilst North America, Europe, India and China each have achieved significant market penetration of between 70.0% and 95.0%, Latin America, Middle East and Africa and APAC have achieved 20.0% or less, representing a significant scope of 5G expansion and underpinning the need for infrastructure across these less developed markets (Ericsson, 2024).

The global 5G infrastructure market, projected to reach $517.2 Bn by 2030 with a compound annual growth rate (CAGR) of 10.5% from 2021 to 2030, underscores this potential increase in demand for enhanced data center capacity (Allied Market Research, 2021). Furthermore, by the end of 2023, it is expected that 1.5 Bn devices will be connected to 5G networks worldwide, necessitating robust data center infrastructure to manage the surge in high-speed data traffic (GSMA, 2024).

This adoption of 5G technology is positioned to significantly boost the data center networking market, which is projected to reach a revenue of $38.3 Bn by 2030, growing at a CAGR of 7.5% (Data Centre Magazine, 2024). This growth is fuelled by 5G’s capabilities, including low latency, high-speed connectivity, and large bandwidth, which improve operational efficiency within data centers (Data Centre Magazine, 2024). Following the development of this technology, it is projected to contribute almost $900.0 Bn to the global economy by 2030, significantly impacting the manufacturing, service, and ICT sectors (GSMA, 2024).

Additionally, in 31 of the 39 markets analysed in a GSMA Intelligence report, the median price per gigabyte for 5G plans is lower than that for non-5G plans, with most having a 5G unit price that is less than half of 4G (GSMA, 2024). This affordability is likely to accelerate 5G adoption, further increasing the demand for data center services. This article also mentioned that 123 operators in 62 markets worldwide had launched 5G fixed wireless access (FWA) services by the end of 2023, indicating significant growth potential (GSMA, 2024).

Another growth indicator is that approximately 64.0% of enterprises plan to deploy private 5G networks by the end of 2024 to leverage the enhanced security and performance for critical applications (GSMA, 2024). This trend highlights the importance of 5G in enterprise environments, where data centers play a crucial role in supporting these private networks.

Moreover, 5G networks are expected to be up to 90.0% more energy-efficient per unit of traffic compared to 4G networks, contributing to overall sustainability goals in telecommunications (Nokia, 2020). This energy efficiency is vital as the industry strives to reduce its carbon footprint while expanding its infrastructure to meet growing data demands.

Cloud Computing

Additionally, another key driver of the data center market is the development of cloud computing, which requires a significant amount of computing power to operate and is gaining importance across sectors. There is a clear trend towards adopting this technology to make operations more efficient, as reflected in the McKinsey Global Survey of 2022, where 90.0% of respondents confirmed pursuing at least one large-scale digital transformation in the past two years (McKinsey, 2022).

Another indicator of the growth of this technology adoption is provided by Gartner’s estimates on global IT spending. By the end of 2024, over $5 Tn was spent globally across various segments of the technology sector, marking a 9% year-on-year growth (Gartner, 2025). Importantly, the data center segment had the highest annual rise in spending at 35%. The estimates are indicative of the accelerated capex cycle in the overall digital infrastructure space.

The transition to a cloud computing environment is a central part of the digital transformation initiatives. Cloud computing’s advantage relative to in-house IT systems is driving exponential growth in its adoption. Spending with the three largest cloud companies (Amazon, Microsoft, and Alphabet) rose by 337.0% in the five years up to 2023 (BCG, 2024). The tight relationship between cloud computing and data centers is clear as the same leading cloud service providers are also some of those with the maximum footprint in the global data center market through their hyperscale infrastructure.

Source: Gartner (press releases of 2024 and 2025)

Due to the importance of this technology in creating efficiencies within businesses, there is a rapid and steady growth in its adoption. In 2023, global end-user spending on public cloud services stood at $563.6 Bn. Gartner’s projections point to a 20.4% growth in global spending by the end of 2024 (Gartner, 2023). The cloud computing industry is divided into different segments focusing on various ways to provide its services. All these segments are experiencing a buoyant growth outlook, but the infrastructure- as-a-service (IaaS) is the most prominent, followed by the platform-as-a-service (PaaS) segment. Additionally, an important trend is the rise of industry cloud platforms—a combined whole-product offering including IaaS, PaaS, and software-as-a-service (SaaS) services. Such platforms address specific industry requirements and are gaining popularity in the market.

Moreover, cloud services have a bilateral relationship with other technologies and trends such as AI and machine learning technologies, where their development is tied to each other’s performance. The infrastructure must adapt to meet the demand. Most companies use the cloud for training and running large AI applications. Cloud service providers must align the computing infrastructure and facility to address the AI boom. Most of the existing cloud infrastructure may not be fully ready to cater to this demand, especially for generative AI (GenAI) applications. This is because they were originally meant as an alternate solution to on-premise infrastructure (WSJ, 2023). Hence, there will still be an increased demand for the development of cloud computing services, which may lead to the need for further data center capacities.

To keep things in perspective, it should also be pointed out that the rise of public cloud adoption does not necessarily mean an end to on-premise data centers/infrastructure by companies. As of the end of 2022, expenditure on such data centers crossed $100.0 Bn (The Economist, 2023). Some characteristics about it are still regarded in the market. For example, industries find on-premise facilities advantageous for their increasingly connected factories and products. On the other hand, the public cloud has downsides in some applications. One of them is regarding the required data transfer, which, when needed, almost instantaneously becomes a constraint for centralized data centers.

Notable cases of critical real-time data requirements are in industrial automation, where digital twins of factories and related product developments need constant and real-time data analysis. For this matter, industrial/manufacturing companies such as Volkswagen (German automotive), Caterpillar (US-based earth-moving equipment), and Fanuc (Japanese industrial robot manufacturer) are notable examples of entities devoting resources to on-premise data centers while hiving off the less sensitive parts to hyperscale cloud service providers.

The surge in hybrid cloud strategies is also noteworthy, with companies opting for a combination of public and private clouds to optimize performance, security, and cost. This hybrid approach allows businesses to maintain sensitive operations in private clouds or on- premise data centers while leveraging the scalability and flexibility of public clouds for less critical workloads.

In conclusion, cloud computing is a pivotal driver of the data center market, pushing forward the development of all types of data centers— on-premise, colocation, and hyperscale. The continuous evolution of cloud technologies, coupled with their integration with AI and other advanced technologies, ensures sustained growth and expansion in data center capacities worldwide. As businesses increasingly rely on cloud computing to enhance efficiency and drive innovation, the demand for robust, scalable, and efficient data centers will continue to rise, solidifying their role as critical infrastructure in the modern digital economy.

Edge Computing

Building on the momentum of cloud computing, edge computing is emerging as another key driver of the data center market. The global edge computing market, valued at $10.1 Bn in 2022, is projected to reach $140.0 Bn by 2030, reflecting a significant CAGR of 38.8% (Polaris Market Research, 2022). This surge is fuelled by the need for real-time data processing and reduced latency, crucial for applications such as autonomous vehicles and industrial automation. By 2025, it is estimated that 75.0% of enterprise- generated data will be created and processed at the edge, outside of traditional centralized data centers (Gartner, 2018).

The proliferation of IoT devices, expected to reach close to 30.0 Bn by 2030, further underscores the importance of edge data centers in managing the massive influx of data (Statista, 2024). The synergy between 5G and edge computing enhances the performance of edge applications and services, providing high-speed, low-latency connectivity essential for modern digital infrastructure (STL Partners, n.d.).

Edge computing not only optimizes bandwidth usage and reduces data transmission costs but also improves security and compliance by processing data locally. This local processing power is particularly beneficial for sectors such as healthcare, retail, manufacturing, and telecommunications, which are rapidly adopting edge computing and data center technologies to enhance operational efficiency and deliver better customer experiences (Forbes, 2024).

Furthermore, edge computing offers scalable solutions that can be expanded as the volume of data and the number of connected devices grows, providing significant cost savings and advanced analytics capabilities (McKinsey, 2024). It also extends the reach of digital services to remote and rural areas, offering local processing where traditional data centers are not feasible.

In response to these benefits, demand for edge data centers continues to grow. According to a 2023 survey conducted by DCD, the most compelling factor for deploying edge data centers is the low latency and high bandwidth they provide, cited by 41.0% of respondents. This is closely followed by concerns over data security and privacy, which 38.3% of respondents identified as critical, highlighting the importance of secure data handling at the edge. Other factors, accounting for 20.7%, also contribute to the increasing need for edge data centers, reflecting the diverse benefits that these facilities offer in enhancing overall data center performance (JLL, 2024).

Overall, the integration of edge computing with existing data center infrastructure is driving the market forward, enabling real-time data processing, enhancing efficiency, and supporting the growing demand for digital services. This trend is solidifying the role of data centers as critical infrastructure in the global digital environment.

Source: JLL

Crypto Mining

Following the discussion, crypto mining, which is the CPU-intensive process of creating new crypto tokens like Bitcoin, is gaining an important role as a demand driver for data centers. The intensiveness of computer power required for this process results in significantly higher investments in data centers and data center hardware compared to other businesses outside this industry. Furthermore, the mining process necessary for the upkeep of most major cryptocurrencies demands more investment in computing power. To respond to this high demand, a common solution is turning to hyperscale server farms in the data center market. In addition, crypto miners typically need to lease or own at least 1.0MW to 5.0MW of data center power to mine effectively (Datafloq, 2022).

As a result of these requirements, there is an increasing number of dedicated data centers in the pipeline for crypto mining around the globe. The particularities and power capacities of each vary by project, but there is a clear impact of the crypto mining industry on the data center market.

Dedicated Data Centers in Pipeline for Crypto Mining

| Location | Particulars | |

|---|---|---|

| Genesis Digital Assets (GDA) | South Carolina, US | Three new data centers are to be connected to renewable energy sources |

| Bit Origin | Wyoming, US | Securities purchase agreement in December 2023 for a 25.0MW crypto data center |

| Bitdeer Technologies | Norway | Construction is underway for a 175.0MW data center for targeted completion by mid-2025 |

| Ethiopia Investment Holdings | Ethiopia | The government’s strategic investment arm signed a $250.0MW MOU for data center infrastructure to support crypto surge |

The global cryptocurrency mining market is facing a CAGR of around 12.2% between 2023 and 2032, reaching a total revenue of $8.3 Bn by the end of 2032. The attached chart from Expert Market Research illustrates this projected growth trajectory, starting at $2.9 Bn in 2023 and rising steadily each year. The market size for 2024 is estimated at $3.3 Bn, followed by $3.7 Bn in 2025, and continuing this upward trend through the decade. This growth reflects the escalating investment and expansion in crypto mining operations, driving further demand for data center capacities globally.

Another critical factor is crypto mining’s energy consumption. Bitcoin mining alone consumes approximately 110.0TWh per year, similar to the energy consumption of some entire countries, such as Malaysia or Sweden. This substantial energy requirement is leading to innovations in data center energy efficiency and the adoption of renewable energy sources to power these operations (Cambridge Centre for Alternative Finance, 2023).

Overall, the cryptocurrency market is driving further demand for data center capacities around the globe, and there is an expectation for incremental growth in the sector. As cryptocurrencies continue to gain mainstream acceptance and their underlying blockchain technology evolves, the demand for specialized data centers equipped to handle the unique requirements of crypto mining will likely continue to rise, solidifying this industry as a crucial driver of data center market growth.