2025

Global Data Center Market Report

Outlook

06 | Outlook

The data center business is headed for at least a three-fold rise in capital expenditure between 2024 and 2029, reaching the $1 Tn mark. The growth in spending commitments has been relentless and seemingly unaffected by various extraneous factors in the global economy or the IT industry. The strong demand for such infrastructure and the urgency to capture the opportunity make this a unique situation. The scale of the planned capacity addition is unprecedented, especially with AI technology leadership taking center stage – the latest example being that of Stargate in the US.

The bullish business outlook of data centers includes sustainability among key factors. Developers and operators must factor efficiency requirements in their existing and planned facilities. There are stringent regulations to report efficiency requirements. Sustainability is why US-based companies are planning dedicated nuclear power generation units to meet long-term clean energy demand. Countries with high renewable energy penetration, such as Spain, are attracting rising interest from globally leading data center developers and operators. The sustainability concerns also extend to the resource intensity of such facilities, especially in terms of power. As power utilities struggle to manage the short- term spike in power demand from data centers, developers could be exposed to potential delays or cancellations.

Projected Spending and Demand

Investment outlays for AI-based technologies are on the rise. Even tight enterprise IT budgets have not impacted AI-based spending plans. The survey results (conducted during October- November of 2024) of research and advisory firm ISG show enterprise leaders planning an average 5.7% rise in AI spending during 2025 despite a modest 1.8% rise in the total IT budgets. (ISG, 2024). Enterprise AI investments are part of an ecosystem gearing up for promised efficiency gains from high-end computing capabilities. The pursuit has become a rush to keep up with the competition.

All major categories and players in the emerging AI value chain – semiconductor/chips and related hardware, AI hyperscalers, developers and integrators contribute to the current accelerated capex cycle. (JP Morgan, 2024). But the Big Tech incumbents in the hyperscaler segment are the drivers. The latest financial results indicate that by the end of 2024, the four top global cloud service providers, i.e. Alphabet, Amazon, Microsoft and Meta, collectively spent $244 Bn in 2024. By the end of 2025, it is set to rise by over 30% (WSJ, 2025). The investment commitments are good pointers to reconfirm the outlook for data centers – the critical infrastructure to be added for AI capabilities.

Estimates from Gartner and Dell’Oro point to global data center spending exceeding $1 Tn by 2029 (Gartner, 2025). These projections could be revised upwards by a significant margin, depending upon the progress achieved in the $500 Bn Stargate Initiative for US-based AI infrastructure. Led by OpenAI, SoftBank and Oracle, the Stargate project started with a $100 Bn investment, with the rest to be spent over the next four years. (Forbes, 2025). Notably, in February 2024, OpenAI sought funding worth $5.0-$7.0 Tn to set up specific chip-building capacities that could propel the large language models of AI systems. (WSJ, 2024). Around the same time, the head of Nvidia, a predominant company in the global AI chip market, held that about $1 Tn worth of data center infrastructure and its related hardware could be built in the next 4-5 years (DCD, 2024). Actual investments, even with a fair discount to such estimates, will still amount to a significant quantum for the industry.

The substantial investment momentum relies on the robust demand outlook. McKinsey’s projected CAGR of 12%-15% in global data center demand during 2023-2030 appears more likely to be met in excess. The wide-ranging mainstream applications of AI technologies, such as through the advent of large language models, add to the demand-pull in this business. Larger capacities, as with hyperscalers, are typical to avail of economies of scale in the emerging market opportunity. Progressively, third-party infrastructure providers are working with the hyperscalers to achieve the targeted capacity addition (KKR, 2024).

Source: Gartner and Dell’Oro

Note: The data points for 2023 and 2024 were sourced from Gartner. The data points for 2025 were derived using Dell’Oro’s projected spending for 2029.

Even as hyperscale data centers occupy the maximum attention in the industry outlook, edge data centers are gradually emerging as another key market segment opportunity. Generative AI, IoT, and other technologies require edge infrastructure support. The global real estate consulting firm JLL’s projections place the edge IT data center market at $317 Bn by 2026 – more than double the valuation in 2020 (JLL, 2024). The segment’s demand is strong due to the low latency and high bandwidth requirement, among other things. The segment’s strength is also attested by the fact that about 20% of the US data center market’s developments occur in the edge geographies.

The market opportunity from the planned or announced data center spending could be much broader. It would include additional supporting infrastructure such as power transmission networks, dedicated power generation or backup units, advanced cooling systems, energy efficiency systems such as waste-heat recovery systems, etc. Technological innovations and solutions should be considered to address the typical data center requirements. Meta, for instance, achieved about 33% cost reduction in data centers by deploying AI solutions. In the case of Alphabet, its DeepMind AI system helped reduce cooling costs by 40%. By the end of 2025, about half of the cloud data centers could be equipped with AI/ML robots, which can enable energy efficiency of up to 30% (Data Center Knowledge, 2024).

Sustainability as an Investment Theme

The planned investments in data centers must factor in the sustainability implications. Globally, as critical digital infrastructures, data centers stand out for their contribution to carbon emissions (between 1.5% and 4% of the total) and the pressure on land and water (World Bank, 2023). As a result, there is a thrust on green data centers – those that can be powered by sustainable energy resources or can demonstrably minimise their carbon emissions. The market size of green data centers, estimated at $72 Bn in 2024, shows rapid growth (Precedence, 2025), reflecting the investment theme taking shape due to sustainability regulations and policy guidelines.

The steadily expanding segment of green data centers would entail investment commitments across multiple interlinked segments such as clean energy sourcing, power usage efficiency, cooling, etc. Leading data center operators are also tapping into sustainability-linked financing to help raise resources in this context. It is partly related to the pressure on the developers and operators to address sustainability in the data center project pipeline. The technology consulting entity Gartner, in a study using survey results of May 2023, projected that by 2027, about three-quarters of the organisations are likely to implement a data center infrastructure sustainability plan (Gartner, 2023). In 2022, it stood at less than 5.0%.

Initiatives Towards Integrating Sustainable Energy in Data Center Operations

| Company | Country | Initiative |

|---|---|---|

| Alphabet | US | $20 Bn partnership with Intersect Power and TPG Climate to develop data centers powered by co-located renewable power projects. |

| Equinix | France | PA10 data center in Paris demonstrated how the systems could repurpose waste heat for the surroundings and reduce overall energy consumption and emission footprint. |

| Meta | US | Partnered with SRP, Ørsted to procure 100% renewable energy (300MW solar power plant) for its Arizona-based data center operations. |

| Hive | Paraguay | In July 2024, the company signed an agreement to develop a 100MW hydropower-based data center for Bitcoin mining operations. |

| Crusoe | Iceland | A planned 80MW data center harnessing the region’s geothermal and hydropower resources to support AI and other high-performance computing workloads. |

Sustainability-linked Bonds and Financing Raised in Data Center Business

| Company/Operator | Amount | Date |

|---|---|---|

| Equinix | $1.2 Bn | Nov-24 |

| Stack Infrastructure | $3.0 Bn | Aug-24 |

| Vantage Data Centers | $3.0 Bn | Jun-24 |

| EdgeConneX | $1.9 Bn | Apr-24 |

| Digital Realty | $6.0 Bn | Mar-24 |

Note: The above data includes green bonds, debentures and syndicated loans

Source: ESG Today, Data Centre Solutions, Data Centre Dynamics, Blackridge Research

Some of the toughest challenges could be around sourcing cleaner energy for the data centers. As 100% renewable-based operations are still not an entirely feasible route (due to the variability of the renewable energy sources, primarily wind and solar), the data center operators are considering a range of measures to supplement their efforts at sustainability and emission profile. One is the strategic location of the capacities – regions with high renewable energy penetration are in active consideration. The European region thus presents a significant growth opportunity.

Spain, for instance, has seen a jump in its data center pipeline – there are 74 facilities in total, of which 28 are in the planning or under construction stage. (Arthur D. Little, 2023). About 56% of the country’s total grid-connected power is based on renewable energy sources. Notable Nordic countries such as Norway are similarly better placed because of their low- cost hydropower supply in the energy mix and the cold weather’s natural cooling ability. As of February 2025, the real estate consulting firm CBRE estimated 937MW worth of new data center capacity in the European region by the end of 2025 (CBRE, 2025). Renewable energy- based power is a critical element for such capacities.

The data center operators’ quest for reliable and clean energy is also driving a resurgence of nuclear power. The top global hyperscalers are leading the way here. The investment announcements in this regard have been mainly about partnerships to establish small and modularised reactors (SMR) to power the large- scale data centers through a steady baseload- grade supply with a minimum carbon emission profile. The technology sector’s planned investments in nuclear power appear to be an outlier against the global declining trend in such power plants. The progress in this regard remains to be seen, mainly when all the major announcements are centered on the US market.

While the shift to sustainability-led data centers is clear, its cost implications are yet to be fully clear. Energy-efficient data centers entail upfront investments, as does clean energy sourcing. The capex of a typical data center ranges between $7 Mn and $12 Mn per MW of commissioned IT load (Dgtl Infra, 2023). The capital cost of Green data centers exceeds the upper limit. The investments, therefore, must pay off through their long-term benefits in the operational costs.

Nuclear Power Capacities Planned to Support Hyperscale Data Centers

| Company | Investment Details |

|---|---|

| Microsoft | The agreement with Constellation Energy to restart a mothballed nuclear reactor at Three Mile Island is expected to cost $1.6 Bn to bring online. |

| Amazon | Agreement with Talen Energy for a 960MW data center powered by the Susquehanna nuclear power plant. Also partnering with Dominion Energy and X-energy for small modular reactors (SMR). |

| Collaboration with Kairos Power to build up to seven SMRs, providing up to 500MW of power. | |

| Oracle | Plans to construct a gigawatt-scale data center powered by three SMRs. |

| Oklo | Master Power Agreement with Switch for 12GW of Oklo Aurora powerhouses by 2044. |

Challenges and Workarounds

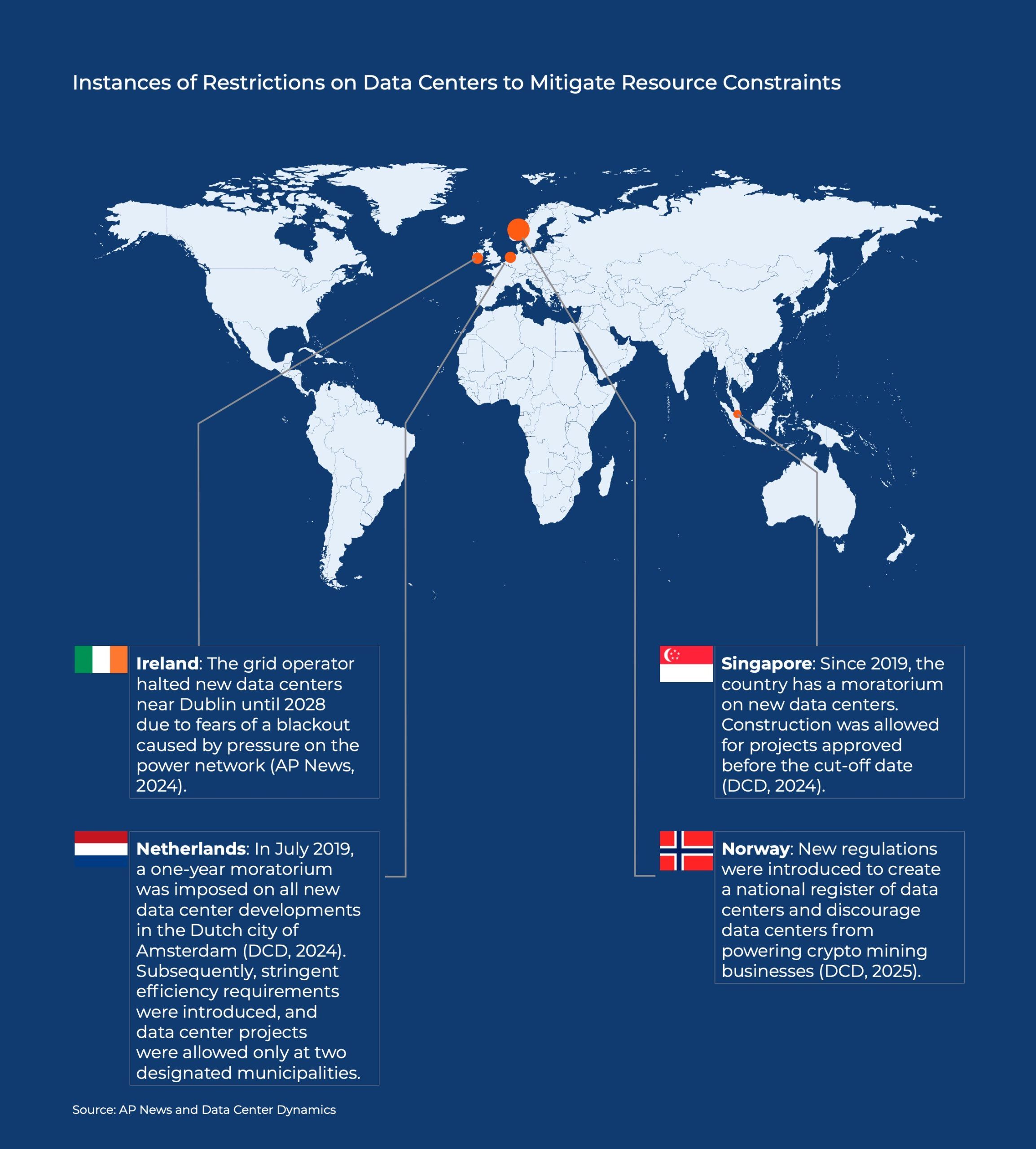

Worldwide, constraints are surfacing not just in total power demand but also in the transmission network’s capacity to manage such loads. In many cases, grid operators have voiced concerns about potential blackouts. The restrictions imposed on data center construction thus impacted the market. European energy efficiency standards should be looked at in this context. Developers and investors must factor in the risk of delayed or rejected applications if the grid or the power supply is not available in time.

Data center development is gradually shifting to secondary markets as developers and other key stakeholders seek options to manage costs and resource uncertainty. In Europe, secondary markets such as Madrid, Milan, Barcelona, Lisbon, Stockholm, Oslo, and Copenhagen are all expected to grow significantly as options beyond the primary markets of FLAP-D (Frankfurt, London, Amsterdam, Paris and Dublin) (JLL, 2024). The secondary market growth is estimated at an impressive 49% across Europe, with Southern Europe and Nordics at anywhere between 30%-55% on a year-on-year basis in 2024 (JLL, 2024).