2025

Global Data Center Market Report

Emerging Trends

04 | Emerging Trends

The expansion in the global data center market is marked by several notable factors shaping the opportunities. Fundamentally, this is demand-led growth. The technology companies are seeking to make the most of this demand through their large-scale facilities.

The top cloud providers, by their predominant share in installed data center capacities, are shaping the growth pattern. This includes areas like energy efficiency, clean power sourcing, or the adoption of advanced cooling systems.

The pressure of efficiency and sustainability, however, extends to all market players. The trend in this regard shows a discernible shift towards lowering energy intensity. However, these gains are offset by the advanced graphics processing units that require greater energy. Added pressures come from the need to locate the data centers strategically – either closer to demand for technologies like 5G and IoT, or to adhere to the data localisation requirements for privacy and protection. This chapter aims to take a brief review of some of these salient points of emerging trends in the global data center market.

Hyperscalers in Investment and Practices

Hyperscalers are increasingly shaping the dynamics of sustainability and best practice adoption in the data center industry. Major cloud service providers such as Amazon, Google, Meta, and Microsoft are at the forefront of capital expenditure (capex) commitments, often setting the tone for industry-wide investments.

The trend shows a spike in capex in 2024. In 2023, the overall capex of hyperscalers grew by a modest 2.4%. The focus on AI has drastically changed investment priorities, as evidenced by the doubling of capex by the end of 2024. Infrastructure augmentation, as with data centers, is becoming a high priority for the hyperscalers.

Between 2020 and 2024, the major AI- centric companies Alphabet, Amazon, Meta, Apple, Oracle and Microsoft increased their spending classified under Property, Plant, and Equipment (PPE), at a compound annual growth rate (CAGR) ranging between 5% and 34%. These entities also hold significant stakes in generative AI and large language models, which require substantial computing resources.

Notably, they control over 60.0% of the global hyperscale data center capacity. The rise in spending commitment is directly related to the intensifying competition for market share in the digital marketplace.

In addition to leading in capex, hyperscalers play a pivotal role in the corporate Power Purchase Agreement (PPA) market, contributing significantly to the growth of corporate 329 renewable energy purchases. Together, Amazon, Microsoft, Google, Meta and Apple are the largest corporate buyers of renewable power globally, with a contracted capacity worth 50GW (GlobalData, 2025). In 2024, Amazon stood out as the world’s largest corporate clean energy buyer for five consecutive years (DCD, 2025).

The leading technology companies have signed long-term contracts across a diverse range of renewable power resources. Driven by their carbon reduction pledges, sustainability goals, and regulatory pressures, hyperscale data centers have taken the lead in renewable power purchases. However, with the rising demand for firm power, renewable energy resources are not the best choice. The focus has thus lately shifted to nuclear power, as a source of clean baseloads power supply. Recent agreements point to planned nuclear-powered data centers in the US, including a mix of new and refurbished capacities (Goldman Sachs, 2024).

Recent Corporate Nuclear Power Capacity Agreements

Large-scale Nuclear Power

| Corporate | Technology provider | Date | Scale | Timing |

|---|---|---|---|---|

| Microsoft | Constellation | Sep-24 | 835MW | Restarted unit is expected to be online in 2028, 20-year PPA |

| Amazon | Talen Energy | Mar-24 | 960MW | Minimum commitments that ramp up in 120MW increments and two 10-year extension options, tied to license renewals |

Small Modular Reactors

| Corporate | Technology provider | Date | Scale | Timing |

|---|---|---|---|---|

| Amazon | X Energy | Oct-24 | 5+ GW target | Targeting full capacity in 2029 |

| Amazon | Dominion | Oct-24 | 300MW minimum target | Targeting development in 2029 |

| Alphabet | Kairos | Oct-24 | 500MW target | First reactor by 2030 |

| Equinix | Oklo | Apr-24 | Max target of 500MW | 20-year PPA with a right to a further 20-year renewal |

Note: The above data is indicative in coverage

Source: Goldman Sachs

The Drive Towards Efficiency and Sustainability

To further enhance their leadership in AI and cloud computing, the data center providers/ operators are making substantial investments in energy efficiency and related infrastructure. The investment by the big five—Microsoft, Amazon, Meta, Alphabet, and Apple—has jumped from $8.8 Bn in 2023 to $37.0 Bn in announced investments for 2024 (Verdict Media Limited, 2024). Additionally, Meta has announced plans to build an $800.0 Mn data center in Indiana optimized for AI services, while AWS is planning a $10.0 Bn investment in two data center complexes in Mississippi to meet the growing demand for cloud services (DataCenter Knowledge, 2024).

These developments underscore the increasing role of data centers in driving global and U.S. electricity demand, with data center power demand projected to grow by 160.0% by 2030, representing an increase of about 650.0TWh (Goldman Sachs, 2024). The demand-led growth in the data center market, driven by the accelerated pace of digitalization, underscores the need for sustainable energy solutions and advanced cooling technologies.

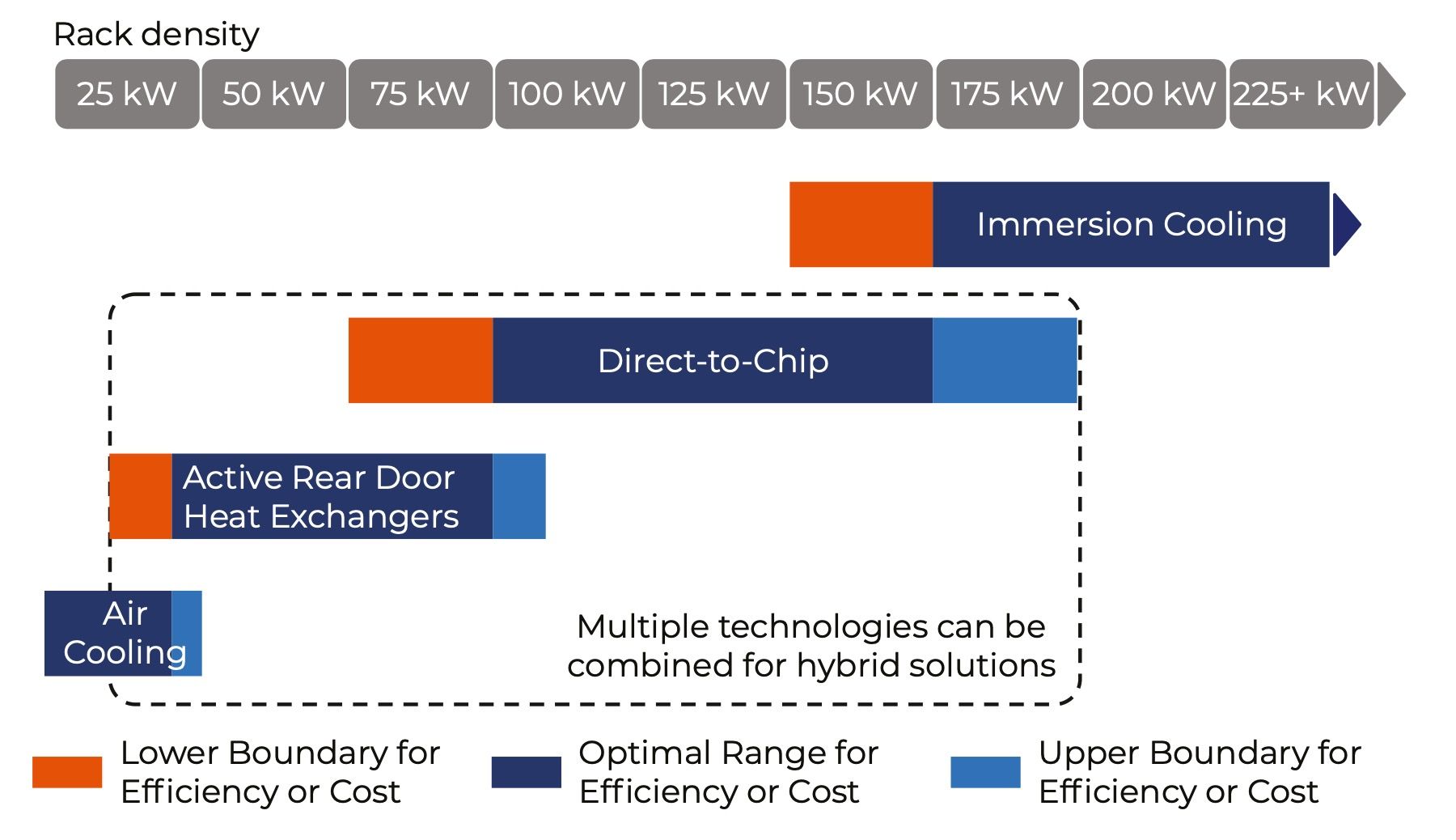

The rapid adoption of AI and high-performance computing (HPC) requires high-density infrastructure. Rack power density in Europe, for example, is expected to grow from an average of 6.0−8.0kW in 2021 to about 12.0−15.0kW by 2027, while globally, the average is expected to rise from 12.0kW in 2023 to about 20.0kW by 2030 (Arizton Advisory and Intelligence, 2023) (Data Center Knowledge, 2024). The rise in power densities requires new thermal management strategies. An example in point is NVIDIA’s latest AI chips, which consume up to 300% more power than the older variants. The data center facilities are, therefore, seeking a mix of solutions to address the issues (JLL, 2025).

Applicable Cooling Technologies by Rack Density

Source: JLL

With cooling typically accounting for roughly 40.0% of a data center’s electricity use, the shift to liquid cooling technologies, such as direct liquid cooling and immersion cooling, offers significant energy savings and supports higher computational capability (Jones Lang LaSalle IP, 2024). The global data center liquid cooling market is expected to grow from $2.9 Bn in 2023 to $15.3 Bn by 2032, exhibiting a compound annual growth rate (CAGR) of 20.3% (IMARC, n.d.).

Policy developments worldwide are increasingly focused on improving the energy efficiency of data centers. For example, the EU’s Climate Neutral Data Center Pact, China’s data center Minimum Energy Performance Standards (MEPS), and other similar regulations set strict targets for Power Usage Effectiveness (PUE) and encourage the adoption of renewable energy and heat reuse (IEA, 2024).

The EU Energy Efficiency Directive 2023 mandates that data centers with a total rated energy input greater than 1MW must utilize waste heat unless it is technically or economically infeasible (IEA, 2024). In response, companies like Fortum and Microsoft in Finland and Apple in Denmark are already implementing heat reuse projects, highlighting the growing interest in energy conservation in data centers (Fortum, 2022) (Datacenter Forum, 2022).

As hyperscalers and cloud data centers continue to manage the dual challenges of reducing emissions and escalating power consumption, sustainability has become a top business priority. Leading operators such as Amazon, Microsoft, Google, and Apple have set ambitious targets for achieving carbon neutrality and transitioning to 100.0% renewable energy by the mid-2030s (Sunbird DCIM, n.d.). Several companies, including Kao Data and Equinix, have already transitioned to operating 100.0% renewable- based data centers (Sustainability Magazine, 2023).

Note: (1) Power Usage Effectiveness (PUE) is the ratio of total facility energy to IT equipment energy used in a data center. (2) The data above refers to survey results (Uptime Institute’s Global Data Center Survey).

Source: Uptime Institute

Edge and Co-location

Edge data centers are also emerging as critical components in the evolving data landscape, particularly as the volume of data generated at the enterprise edge continues to grow. By 2025, IDC estimates that there will be 41.6 Bn IoT devices capable of generating 79.4ZB of data (Network World, 2024).

The global edge data center market is projected to grow from $9.3 Bn in 2022 to $41.6 Bn by 2030, driven by AI, 5G, and the proliferation of IoT devices (Fortune Business Insights, 2024). Key applications for edge data centers include autonomous vehicles, smart cities, healthcare, manufacturing, and retail, which all require high-throughput, low-latency data processing closer to the point of generation (Forbes, 2024). Investments in edge data centers are on the rise, with companies like I Squared Capital and NTT Data leading the way in Europe and beyond (IPE Real Assets, 2023) (DataCenter Knowledge, 2024).

The retail co-location business model is also gaining traction, with data center operators increasingly serving organizations with smaller rack capacity demands. Local and regional retail co-location platforms are expanding, particularly in regions like Southeast Asia and Europe, where saturation in the FLAP (Frankfurt, London, Amsterdam, and Paris) regions is driving construction in new markets such as Oslo, Berlin, and Madrid (EY, 2023) (Yahoo Finance, 2024). In January 2024, Brookfield completed its $775.0 Mn purchase of Cyxtera, merging it with the Evoque colo brand to create a retail co-location provider with over 330.0MW of capacity across North America (Data Centre Dynamics, 2024).

The Focus on Data Sovereignty

Data sovereignty regulations are increasingly impacting data center demand, particularly as countries implement laws requiring data to be stored and processed locally. In response, many leading entities are opting for on-premise data centers to comply with localization requirements, with data sovereignty laws in countries like India, Indonesia, and Malaysia driving these trends (ETCIO Southeast Asia, 2024).

The potential migration of training models from the U.S. to Europe to adhere to these requirements may also drive the reinforcement or relocation of existing data centers, further influencing demand in the sector (DCD, 2024). In February 2025, Microsoft completed its EU Data Boundary for its cloud data sovereignty project. The work on this had commenced in early 2023. EU and US are signatories to a Data Privacy Framework allowing data transfers subject to privacy guarantees and protections. provider. In France, US-based cloud providers are required to partner with local businesses. While not mandated by other EU countries, many tech majors are taking the joint venture route for data center localisation (DCD, 2025).