2025

Global Data Center Market Report

Financing and Investment

05 | Financing and Investment

The evolution of data centers has spurred material capital deployment over the past 20 years, as investors look to exploit the market opportunity presented by the increasing importance of data centers in providing the critical IT infrastructure essential to a digitalised world. This surge in demand for data processing, storage, and cloud services has attracted substantial financing from banks, corporates, private equity and other institutional investors, eager to capitalise on the sector’s robust growth prospects.

As the digital economy continues to expand, the financing and investment strategies in the data center market will play a pivotal role in shaping the industry’s future, with major stakeholders recognizing the long-term value proposition of these critical assets. The key pointers of the emerging landscape are tracked here through the broad categories of equity investments, debt financing, equity returns and major trends.

Data Center Equity Investments

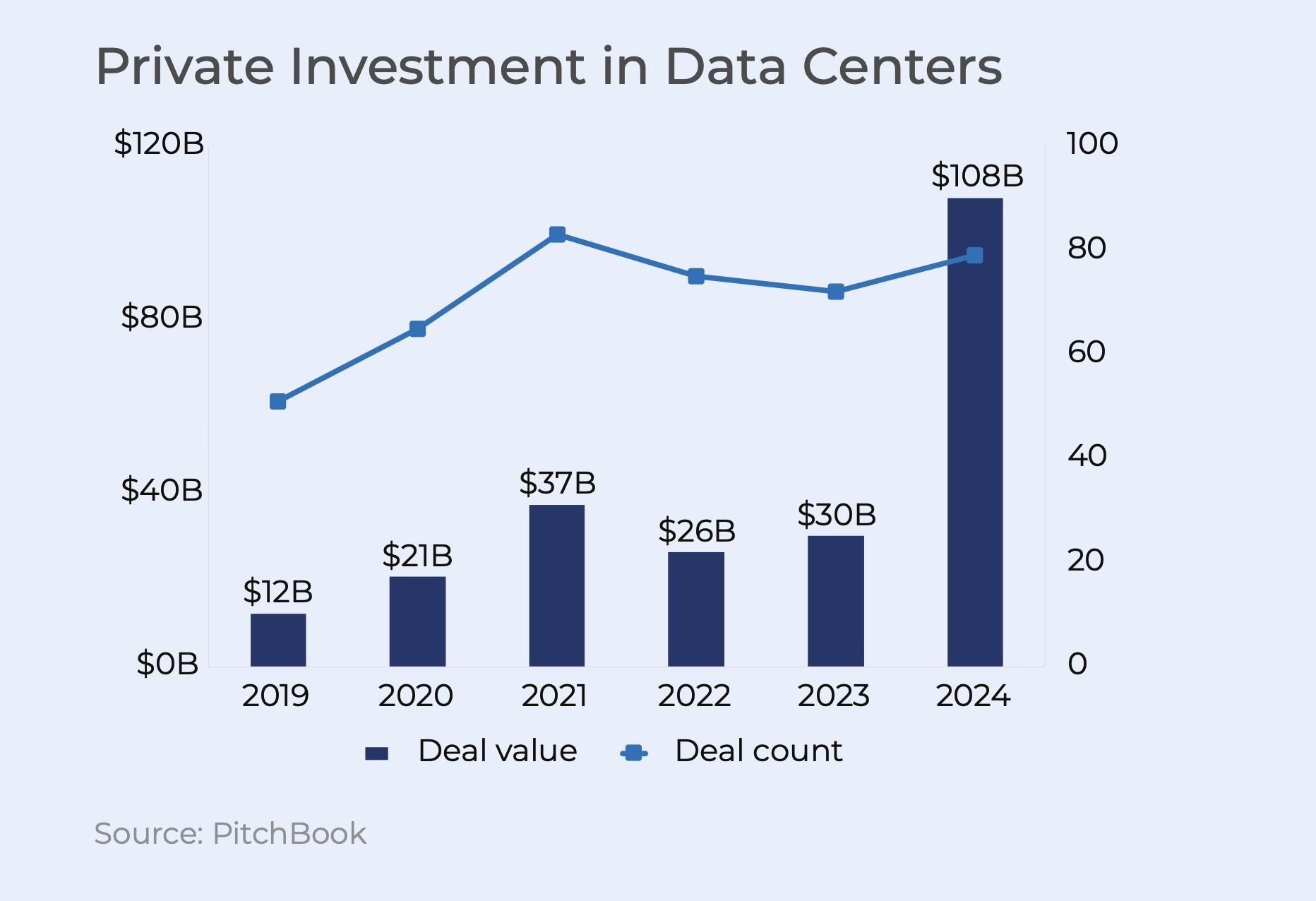

The growth in demand for AI technologies and the ensuing rush to build digital infrastructure fuelled the PE interest. For GPs and institutional investors, data center investments stand out for the attractive contractual cash flow from typical high-quality tenants. By the end of 2024, the total PE deal value reflected the bullish investment sentiments – it was three times that of the previous year (PitchBook, 2025).

With its $16 Bn AirTrunk deal of 2024, Blackstone became the largest investor/provider of data centers worldwide, thus rapidly progressing toward a leadership position in future AI infrastructure assets. This deal is related to the Asia-Pacific (APAC) region, which is attracting rising investor attention with the resulting premium in asset valuations. In comparison, the North American region has fewer new companies because of historically intense dealmaking and the subsequent long holding period of PE firms. The quality of tenants adds to the attractiveness of the potential assets. The Hyperscalers are part of AirTrunk’s tenants in Hong Kong and Johor (Malaysia) locations, which reinforced its premium pricing. The second-largest PE deal of 2024 – the $9.2 Bn investment in Vantage Data Center Management Company, is aimed at supporting the hyperscalers in meeting the cloud and AI demand (S&P, 2025).

The Ten Largest PE Data Center Deals in 2024

| Company | Select Investors | Deal Size | Deal Date | Deal Type |

|---|---|---|---|---|

| AirTrunk | Blackstone, Canada Pension Plan Investment Board | $16.0B | 4-Sep-24 | Buyout |

| Vantage Data Centers Management Company | DigitalBridge Group, GiantLeap Capital, Pantheon Infrastructure, Silver Lake | $9.2B | 3-Jun-24 | PE Growth |

| DataBank (Dallas) | Ardian, AustralianSuper, DigitalBridge Group, Swiss Life Asset Management, | $2.0B | 15-Oct-24 | PE Growth |

| EdgeCore Internet Real Estate | Partners Group | $1.9B | 6-Sep-24 | PE Growth |

| Echelon Data Centres | Starwood Capital Group | $1.9B | 15-Feb-24 | Buyout |

| eStruxture Data Centers | Fengate Asset Management, Pantheon, Partners Group | $1.3B | 18-Jun-24 | Buyout |

| ST Telemedia Global Data Centres | KKR, Singtel | $1.3B | 1-Jun-24 | PE Growth |

| Cellnex Austria | EDF Invest, MEAG, Vauban Infrastructure Partners | $0.9B | 9-Aug-24 | Buyout |

| SummitIG | SDC Capital Partners | $0.8B | 30-Apr-24 | Buyout |

| DC BLOX | Bain Capital Credit, Post Road Group | $0.7B | 8-Oct-24 | PE Growth |

Behind these significant transactions lies a diverse set of investors and financial instruments that are accelerating the progress of digital transformation. The surge in development pipeline and investor interest is not merely a reflection of regional growth but also an indication of evolving investment strategies. Institutional investors, private equity firms, and sovereign wealth funds are increasingly recognizing the strategic importance of data centers as critical infrastructure in the current landscape. These investors are deploying a wide range of financial instruments, from direct equity investments to complex debt financing structures, to capitalise on the growing demand for data center capacity. This influx of capital has not only enabled the expansion of existing facilities but has also fuelled the development of new data center projects across key markets.

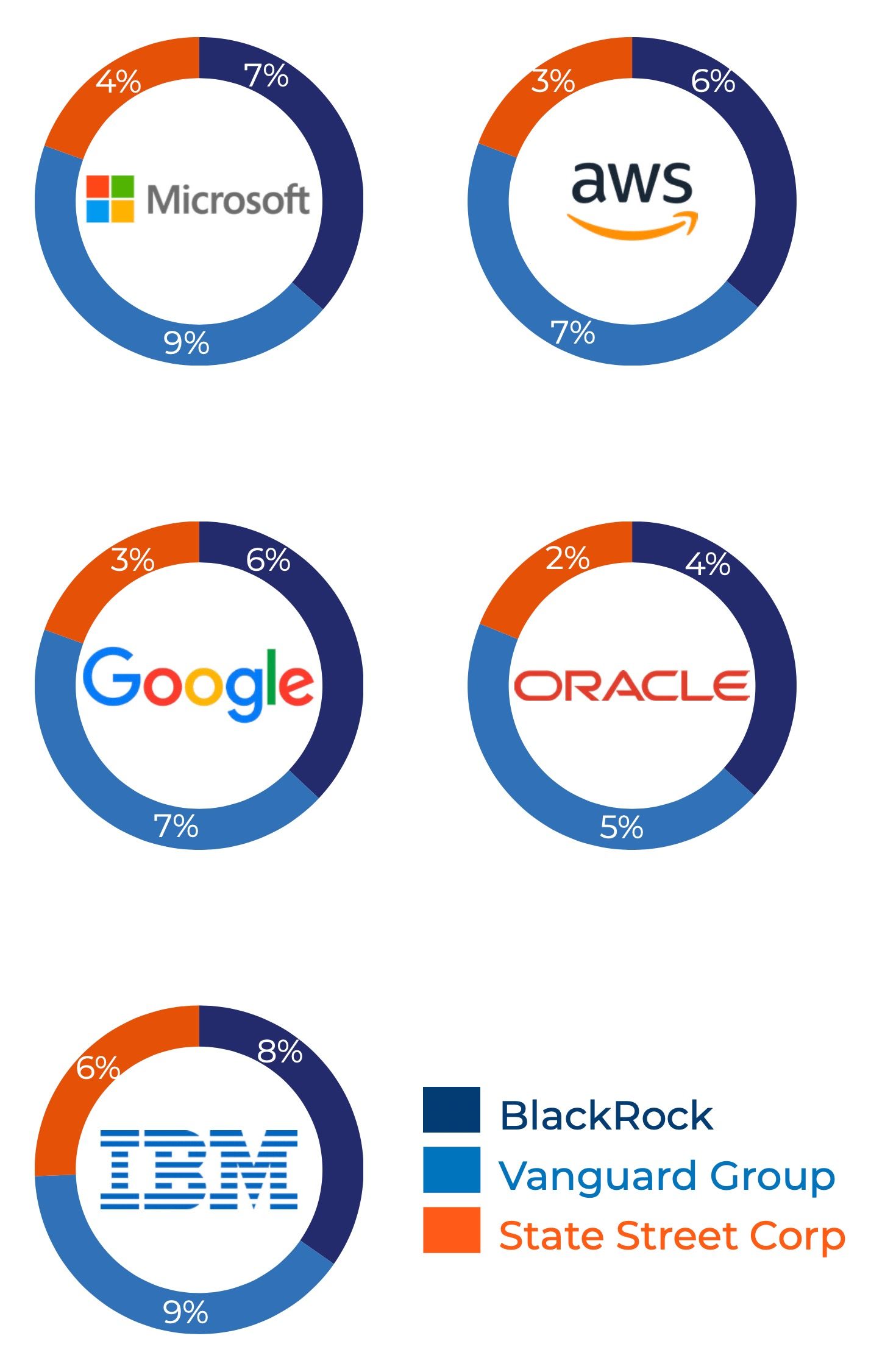

The role of institutional investors, particularly the “Big Three” U.S. index fund managers, underscores the shift towards viewing data centers as long-term, stable investments with significant growth potential. These firms have emerged as major stakeholders in the industry, owning significant shares in leading digital companies such as Microsoft, AWS, and Alphabet Inc. Their involvement in the sector is also driving a broader focus on sustainability, as they push for greener operations and increased efficiency among the companies they invest in (S&P Global, 2024). This dynamic interplay between financial strategy and operational execution is a key factor in the continued expansion and innovation within the global data center market.

Furthermore, the surge in data center investments has also been supported by a diverse set of financial instruments, with Real Estate Investment Trusts (REITs) emerging as a particularly significant vehicle. Specialised REITs focused on data centers have gained traction, attracting a broad spectrum of investors, including individuals and institutional entities such as pension funds, insurers, mutual funds, hedge funds, and endowments. These REITs offer investors exposure to the real estate that underpins the digital infrastructure, providing stable, long-term returns driven by the increasing demand for data processing and storage capabilities (ETF Trends, 2024).

Equity Ownership of the Big Three in Hyperscale Cloud Service Providers

Note: The above data was sourced as of January 2024

Source: S&P Global

Top Data Center REITs

| REIT | Facilities |

|---|---|

| Equinix | The world’s largest digital infrastructure company, with over 260 data centers close to clouds and networks for optimal hybrid architectures |

| Digital Reality | Management of over 300 data centers across 50+ metro locations globally, with solution delivery across data centers, colocation and interconnection. |

| American Tower | The portfolio comprises about 149,000 communication sites and a highly interconnected footprint of US data centers. In 2021, it acquired CoreSite in the US for the latter’s data center capacities. |

| Digital Bridge | A digital infrastructure firm operating in the verticals of data centers, cell towers, fibre networks, small cells, and edge infrastructure |

Data center REITs like Digital Realty and Equinix have become key players in the market, managing extensive portfolios of income- generating properties. These REITs not only manage extensive portfolios of properties but also play a crucial role in expanding global data center capacity. Additionally, their ability to attract and manage large-scale investments reflects the market’s confidence in their continued growth and the essential services they provide to the industry.

The attractiveness of these data center-focused REITs is evident in their growing weight within the FTSE Nareit All Equity REITs Index. Since 2017, the data center segment within this index has seen substantial growth, showcasing the sector’s increasing importance within the broader real estate market. This trend has also driven consolidation, with several publicly traded data center REITs being taken private or merged with other public REITs (Morgan Stanley, 2023).

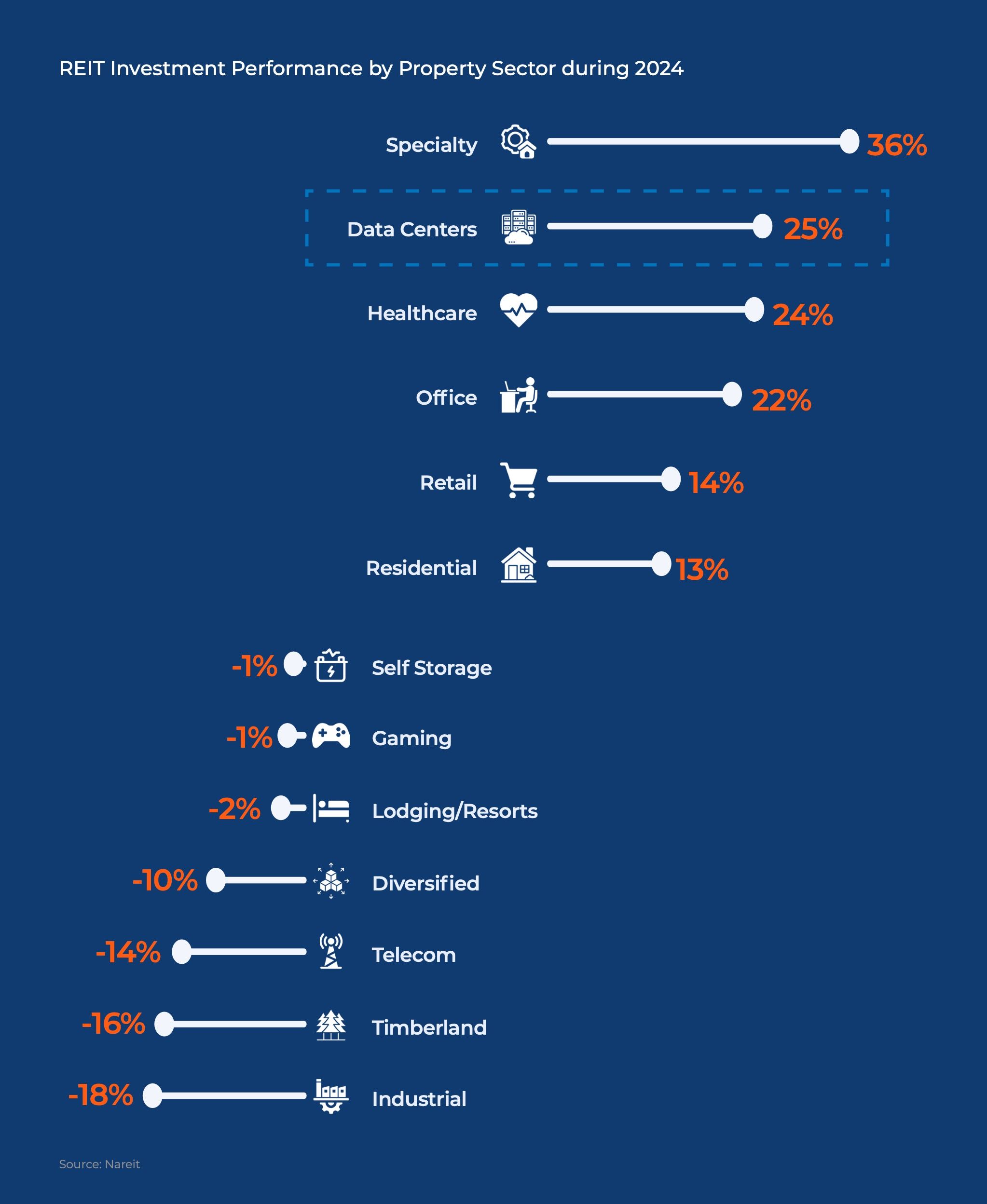

Data centers have also outperformed other real estate sectors in terms of returns. As of the end of 2024, global real estate performance data shows that the data center segment ranks at the top for its returns, underscoring the strong investor interest and the robust demand for digital infrastructure (Nareit, 2025).

Beyond publicly listed REITs, unlisted REITs and evergreen funds are also playing a significant role in data center investments. Companies like Blackstone and Brookfield have made substantial commitments to the sector, with Blackstone managing assets valued at $112.0 Bn as of May 2024, and Brookfield overseeing $9.1 Bn in commitments since its inception in 2018 (PitchBook, 2024).

Debt Financing

The rapid expansion of the data center market has also led to significant shifts in financing strategies, particularly as traditional financing methods face limitations due to market saturation and bank balance sheet constraints. As a result, project financing options are being reconsidered, with asset-backed securitisation (ABS) emerging as a notable trend. Historically, securitisation was primarily associated with long-term contracts involving major players like Microsoft and Amazon. However, in recent years, retail and colocation market participants have increasingly entered the securitisation space as well, benefiting from better creditworthiness and ratings. The sticky nature of contracts and the high reliability of renewals have made these players more attractive to financiers, leading to a deepening and growth of the ABS market (Infrastructure Investor, 2024).

Since 2023, the cost of data center asset-backed securities has decreased. Even as the base rate remains elevated, ABS spreads have narrowed compared to levels seen during the credit crisis, making securitisation an increasingly viable financing option. Although securitisation has predominantly been a U.S.-centric market, the model is gradually gaining traction in Europe, with ABS and Commercial-Backed Mortgage Securities beginning to make an entry into the region (Infrastructure Investor, 2024).

Key Recent Financing Transactions in Data Centers

| Date | Company/Enterprise | Financiers/Credit Facility | Amount |

|---|---|---|---|

|

January 2025 |

Blue Owl | JP Morgan | $2.3 Bn |

| September 2024 | Digital Realty | Senior unsecured multi-currency global revolving credit | $4.2 Bn |

| October 2024 | Global Artificial Intelligence Investment Partnership | Microsoft, Blackrock, and Global Infrastructure Partners | $30 Bn |

| May 2024 | CoreWeave | Blackstone, Carlyle Group and Blackrock | Blackrock $7.5 Bn |

Source: CNBC, Wall Street Journal, PR Newswire

Debt financing remains a critical tool for data center operators, particularly for funding new developments and refinancing existing projects. There has been an important number of debt transactions over the past years that provide billions of dollars to the data center market with different investors involved. Many of these financings are aligned with sustainability- linked loan principles, where the pricing of debt facilities is adjusted based on the borrower’s performance in achieving greenhouse gas (GHG) reduction targets. For example, in 2024, Stack Infrastructure announced a $1.3 Bn financing package, including $506.0 Mn in green construction debt, to support its global development plans. This brings the company’s total raised capital to $12.0 Bn to date, with $2.6 Bn being securitized notes as of 2023, rated “A-” by S&P (Stack Infrastructure, 2024). Similarly, CyrusOne secured $9.7 Bn in debt capital in 2024, which is split into a $7.9 Bn Warehouse Credit Facility and a $1.8 Bn Revolving Credit Facility, both aligned with sustainability-linked loan principles (CyrusOne, 2024).

The rise of specialised funding entities has also been a key factor in the robust performance of private digital infrastructure over the past decade. These entities, including private equity firms and real estate funds, have committed a cumulative $800.0 Bn to private infrastructure and real estate funds that invest in digital infrastructure. Specialist digital infrastructure funds, which invest exclusively or near- exclusively in this space, have raised $44.0 Bn over the past decade, underscoring the growing investor interest in data center assets (PitchBook, 2024).

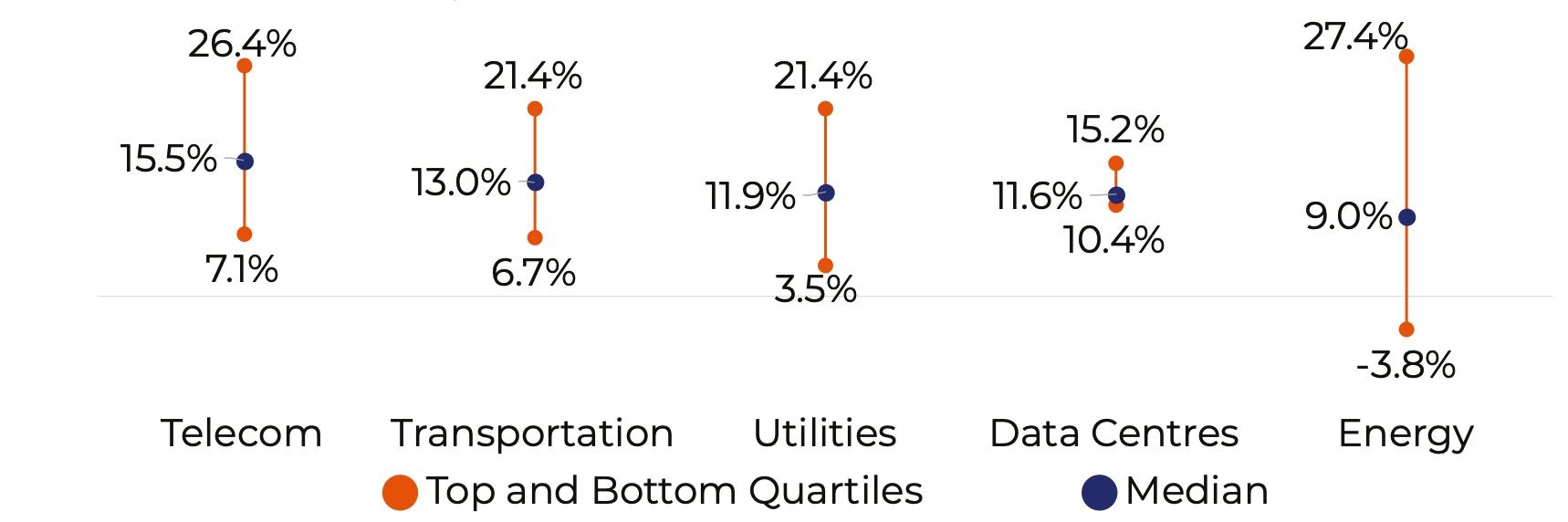

As the demand for data center capacity continues to grow, specialised funding entities such as Digital Bridge, Iconiq, and Grain Management have played an increasingly prominent role in financing these assets. These entities have raised billions in capital, with Digital Bridge leading the way with $14.6 Bn raised across five specialist funds since 2014 (PitchBook, 2024). The performance of private infrastructure funds has been strong, with digital infrastructure and public equities in this sector outperforming benchmarks like the S&P 500 and the Morningstar US Utilities Index. Additionally, private infrastructure funds have never had negative returns since 2009, unlike other private capital strategies (PitchBook, 2024).

In summary, as data center operators continue to expand and innovate, they are increasingly turning to diverse financing strategies, including asset-backed securitisation, sustainability- linked loans, and specialised funding entities, to support their growth and meet the demands of the digital economy.

Equity Returns

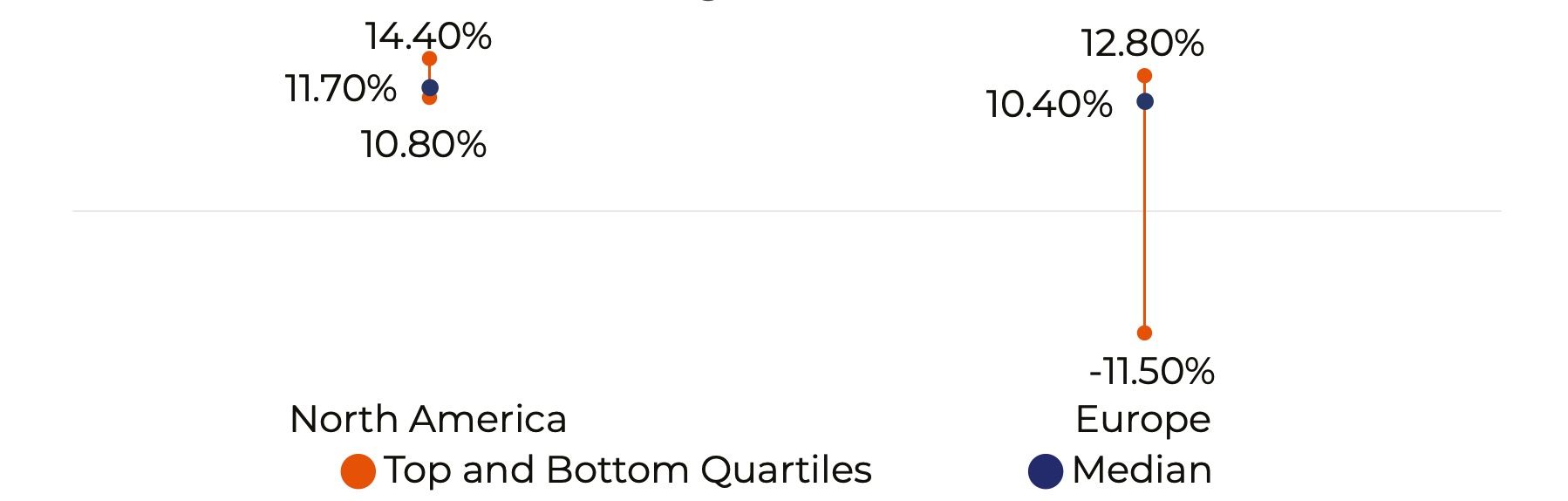

The data center market has demonstrated varying returns across regions, influenced by a mix of regulatory frameworks, market dynamics, and investor interest. In North America, the deal-level median IRR consistently surpasses those in Europe and the global average. This is largely due to the region’s favourable regulatory environment, which includes state-level tax incentives for data center developments and energy efficiency stipulations under the U.S. Inflation Reduction Act. These regulatory benefits have boosted returns, making North America a particularly attractive region for data center investments (PitchBook, 2024).

In contrast, the European market, while still attractive, shows lower IRRs at the deal level. The region’s stringent regulatory landscape, including policies under the General Data Protection Regulation (GDPR), has made investment slightly more challenging compared to North America. However, these regulations have also steered investments toward smaller European cities, enhancing the attractiveness of these locations for data center developments (PitchBook, 2024). Despite the lower IRRs, European data centers are still considered secure, long-term investments with strong potential returns, typically above 10.0% (Savills Research, 2024).

Global Deal-level IRRs by Sector (as of April 2024)

Source: PitchBook

IRRs of Data Center Deals Between Regions

Source: PitchBook

A closer look at deal-level IRRs reveals that Europe stands as the only region in the graph which contains negative returns for the bottom quartile range. Despite this, the European market is still drawing increased attention from investors, particularly as major asset management companies like PIMCO are in the process of raising capital for dedicated data center funds. PIMCO’s Europe-centric data center fund, which is currently in development, is targeting an ambitious IRR of 20.0%, reflecting the high level of confidence in the region’s long- term investment potential (PitchBook, 2024).

Moreover, data centers in the U.S. have shown remarkable resilience in maintaining their value, with year-end capitalization rates ranging from 5.5% to 7.5% in 2023, despite stress in the broader commercial real estate market (Moody’s, 2024) (Newmark, 2024).

In the fourth quarter of 2024, the data center sector experienced a notable compression in cap rates. The REIT implied cap rate for data centers decreased by 18 basis points, settling at 4.23%. This decline signifies a growing investor interest in data centers, likely driven by the increasing demand for digital infrastructure. Notably, the REIT implied cap rate for data centers is significantly lower than the private market cap rate of 5.48%, indicating that public market valuations have adjusted more swiftly to the sector’s dynamics compared to private market valuations (Centersquare, 2025).

The strong demand and confidence in the sector highlights the unique position of data centers as a secure and profitable investment class, even when other sectors, such as offices and retail, face higher capitalization rates and associated risks (Moody’s, 2024) (Newmark, 2024).

Sector-wise REIT Cap Rates (Q4 2024)

| Sector | REIT Implied Cap Rate | 3 Mo. Change (bps) | 12 Mo. Change (bps) | 5 Yr Avg Implied Cap Rate | Private Market Cap Rate | REIT vs Private Market Valuation Cap |

|---|---|---|---|---|---|---|

| Apartment | 5.40% | 18 | (62) | 5.12% | 5.19% | 5.19% |

| Industrial | 5.56% | 87 | 143 | 4.13% | 4.57% | -17.9% |

| Office | 7.52% | 39 | (27) | 6.94% | 6.98% | 7.2% |

| Retail | 6.28% | 6 | (50) | 6.87% | 7.05% | 12.1% |

| Hotel | 7.10% | (10) | 28 | 6.61% | 5.85% | -17.7% |

| REIT ODCE Proxy | 5.67% | 46 | 18 | 5.28% | 5.43% | -4.2% |

| Life Sci | 7.61% | 146 | 121 | 5.40% | 5.50% | -27.7% |

| Healthcare | 4.93% | 21 | (82) | 5.59% | 6.69% | 35.8% |

| Single Family Rentals | 5.51% | 10 | 4 | 4.79% | 4.74% | -13.9% |

| Manufactured Housing / RVs | 5.04% | 45 | 45 | 4.18% | 5.05% | 0.0% |

| Towers | 5.21% | 61 | 59 | 4.37% | 4.59% | -11.9% |

| Data Centers | 4.23% | 48 | 53 | 4.71% | 5.48% | 29.6% |

| Self Storage | 5.50% | 87 | 20 | 6.13% | 5.28% | 4.0% |

| REIT Alternative Proxy | 5.12% | 47 | 10 | 4.75% | 5.44% | 6.2% |

| All REITs | 5.67% | 35 | 1 | 6.18% | 5.74% | 1.2% |

Source: CenterSquare

Recent Trends

he data center market has seen a surge in innovative financing solutions and evolving investment trends that reflect the sector’s growing importance. One significant trend is the increasing reliance on green loans to meet data center operators’ debt financing needs. For instance, in April 2024, Vantage Data Centers secured a substantial $3.0 Bn green loan led by Wells Fargo Securities, with participation from TD Securities, Truist Securities, and Scotiabank. This financing supports Vantage’s North America expansion plans, covering both new and existing sites (Vantage Data Centers, 2024). Similarly, DataBank established a $725.0 Mn credit facility in the same month to fund its ongoing and future data center developments, with green loan facilities provided by a consortium of 14 banks (DataBank, 2024).

In addition, there have been further sustainable capital raising events like EdgeCore’s $440.0 Mn and Digital Edge’s $335.0 Mn debt financing solutions (Data Center Dynamics, 2023) (Data Center Dynamics, 2024). These examples highlight the growing trend of incorporating sustainability into the financial strategies of data center operators, driven by the need to align with global environmental goals.

Following the sustainability objectives and to maintain competitiveness, older data centers are also investing heavily in upgrades and adopting more efficient cooling technologies. For example, Empyrion DC obtained its first secured green loan of S$133.0 Mn in February 2024 to refinance and upgrade its existing operations (ET CIO, 2024). Similarly, Netrality secured a $380.0 Mn sustainability-linked loan in November 2023 to invest in innovative cooling technologies, highlighting the importance of energy efficiency in maintaining competitive data center operations (Data Center Dynamics, 2023).

Another key trend is the rise in the adoption of asset-backed securitization (ABS) as a financing route. In June 2024, Vantage Data Centers raised £600.0 Mn in securitized term notes, marking its first-ever securitization of data center assets in the EMEA region (Vantage Data Centers, 2024). The ABS route is increasingly favoured due to its ability to provide liquidity and stability for large-scale data center projects, especially in the U.S., where TierPoint completed a $1.06 Bn securitization financing in July 2023— the largest ABS issuance in the U.S. data center sector since 2021 (TierPoint, 2023).

In addition to ABS, Commercial Mortgage- Backed Securities (CMBS) are gaining traction as a financing method for data center projects. For example, in July 2024, CyrusOne secured $687.1 Mn in its first CMBS loan for its DFW1 data center in Carrollton, Texas, demonstrating the growing acceptance of CMBS in the sector (Data Center Dynamics, 2024). In relation to this, QTS Realty also secured a single asset, single borrower CMBS loan of $800.0 Mn in 2023 covering four US data centers (Data Centre Dynamics, 2023). This trend underscores the data center market’s maturity and the increasing willingness of investors to engage in complex financial structures to fund data center growth.

The market is also looking beyond traditional ABS and CMBS due to the high demand for data center capacity, leading to increased activity in project financing. For instance, Siemens Financial Services has been instrumental in providing customized project financing solutions, helping companies like Vantage Data Centers and Atman raise necessary funds for their development plans (Siemens Financial Services, 2024).

Institutional financing through partnerships and joint ventures is also playing a critical role in data center development. In April 2024, AdaniConneX, a joint venture between Adani Enterprises and EdgeConneX, secured $1.4 Bn in loans to develop data centers in India (Livemint, 2024), and PGIM Real Estate formed a $600.0 Mn joint venture to develop a hyperscale data center as part of its xScale hyperscale platform in Silicon Valley (Data Centre Dynamics, 2024). This illustrates the global reach and collaborative nature of modern data center financing.

The involvement of new banks and private credit groups in funding data centers, apart from traditional infrastructure investors, is expanding the investor spectrum and providing more flexible credit terms to data center developers (Newmark, 2024).

In conclusion, the data center financing landscape is evolving rapidly, with innovative financing structures such as green loans, ABS, and CMBS becoming increasingly prevalent. These trends reflect the sector’s robust growth prospects and the critical role that sustainable and flexible financing will play in supporting the continued expansion of global data center infrastructure.