2025

Global Data Center Market Report

Regional Market Overviews

Chile

Chile’s data center market is steadily expanding, fueled by the growing demand for affordable and adaptable data center solutions. Key drivers include rising data traffic, the adoption of cloud services, and the increasing need for scalable and portable data infrastructure (6WResearch, 2024). The market was valued at $741.0 Mn in 2023 and is expected to reach $1.4 Bn by 2029, achieving a CAGR of 10.8% (Arizton, 2024). In terms of installed capacity, the market is projected to reach 338.3MW in 2025, rising to 554.5MW by 2030, representing a CAGR of 10.4% (Mordor Intelligence, n.d.).

Moreover, the country’s stable political and economic environment, combined with abundant renewable energy resources, has made it an attractive destination for data center operators. At present, Chile has a renewable energy capacity of 21.5GW, representing 63.9% of its total installed electricity capacity(IRENA, 2024). In addition, government initiatives, such as the Roadmap for Digital Transformation and incentives for foreign investment, alongside a deregulated energy market, have further bolstered this growth, encouraging both local and global operators to invest in Chile’s digital infrastructure landscape.

GDP (Current Prices) USD (2023) | 336 Bn |

Projected Average GDP Growth (2024-2028) | 2.4% |

10-year Govt Bond Yield (12-month rolling average) | 5.8% |

Country Credit Rating | A |

Renewable Energy Share | 38% |

Data Center Capacity (H1 2024) | 198MW |

Note: Renewable Energy Share excludes hydro-power

Market Dynamics and Growth Factors

Despite its relatively small size and population, Chile has developed a diverse data center market, encompassing retail, hyperscale, and public cloud providers, creating a strong ecosystem within Latin America. In 2024, the country recorded a vacancy rate of just 1.1%, with hyperscale and public cloud providers contributing to rising energy demand (CBRE, 2024).

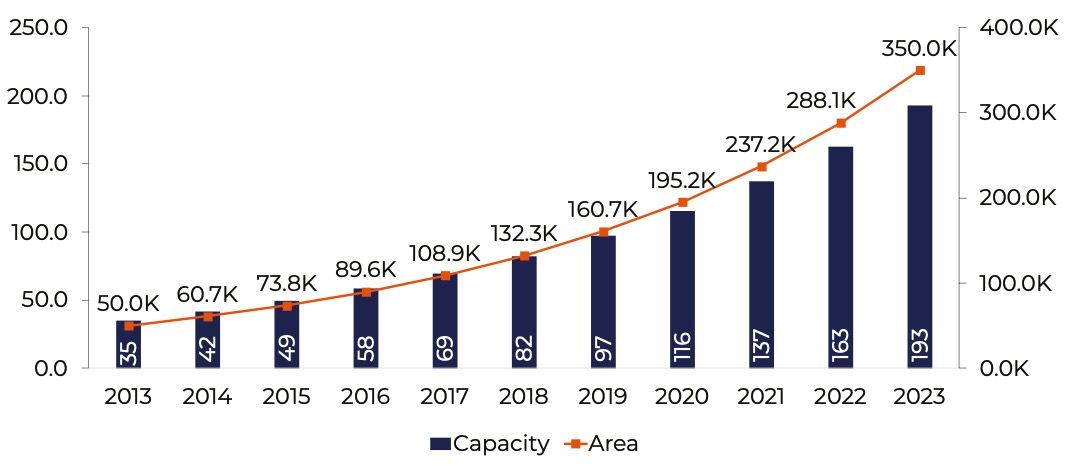

Chile’s data center market has experienced steady expansion, with significant growth in facility development over the past decade. Installed capacity has consistently increased, starting at under 35.0MW in 2013 and more than doubling to 82.3MW by 2018. By the end of 2023, capacity surged to 193.0MW, reflecting a CAGR of 18.6% over the last ten years (Data Center Dynamics, 2024). The momentum continued into H1 2024, with installed capacity increasing by over 66% year-over-year, climbing from 119MW to 198MW (InvestChile, 2024)

Another key sign of industry growth in Chile has been the rapid expansion of space dedicated to data centers, which increased from around 50,000 square meters in 2013 to 350,000 square meters by 2023, reflecting a CAGR of 21.5% (Data Center Dynamics, 2024). This expansion accelerated further, and by the end of June 2024, the total surface area had reached 670,000 square meters (InvestChile, 2024). This impressive growth has been fueled by the adoption of new technologies and the expansion of the fibre optic network across Latin America. These advancements culminated in a significant $300.0 Mn industry investment in Chile in 2023, solidifying the country’s role as a leading hub for digital infrastructure in the region (Data Center Dynamics, 2024).

Data Center Market Capacity (MW) & Area (Thousand Square Meters)

Source: (Data Center Dynamics, 2024)

Chile’s data center industry currently spans 31 operational facilities, with significant capacity expansion is anticipated in the coming years, with 20 projects either under construction or in the planning phase. These include new data centers from AWS, Huawei, and Scala, along with expansions of existing facilities like those of Google and Claro. The approved projects represent a total investment of $400.0 Mn, a figure that is likely to increase as more projects are confirmed. Notably, the market is dominated by three major players (Google, Ascenty, and Odata), which collectively account for nearly 70.0% of Chile’s installed capacity (Data Center Dynamics, 2024).

Chile’s energy mix consists of nearly 50.0% renewable energy generation sources, such as hydroelectric, wind, and solar power. This diverse range of renewable energy options enables data center operators to seek sustainability-linked financing for their projects. In 2022, EdgeConnex secured $150.0 Mn in such financing for developments in both Chile and Colombia. Additionally, Chile’s deregulated energy market provides added flexibility, enabling data center operators to directly negotiate power purchase agreements (PPAs) with energy suppliers, including those focused on renewable energy (EdgeConneX, 2022) .

The capital city, Santiago, stands as the epicenter of data center activity in Chile, anchoring the southern and western regions of Latin America (Cushman and Wakefield, 2024). Santiago features advanced technological infrastructure and outstanding connectivity, both essential for data center operations. The city also enjoys strong institutional stability, creating a dependable environment for long-term investments (InvestChile, 2023). The city has attracted significant interest from hyperscale providers, fueling rapid growth in its data center market. Its strategic position is further enhanced by access to a cable landing station, which facilitates six undersea connections to major markets along the Pacific coast of the Americas (Cushman and Wakefield, 2024).

The Chilean government has positioned the capital and its surrounding metropolitan area as one of Latin America’s key data center hubs by leveraging free trade agreements to attract new investment. Chile has negotiated 33 trade agreements covering 65 economies which includes major agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the U.S.-Chile Free Trade Agreement. The CPTPP, which includes countries like Japan, Canada, and Australia, facilitates smoother trade and investment flows and creates a favorable trade environment attracting foreign direct investment (FDI), which is crucial for the development and expansion of data centers (International Trade Administration, 2023). Chile’s data center industry currently spans 31 operational facilities (InvestChile, 2024). In addition to government incentives encouraging businesses to offload compute loads, the market’s growing renewable energy capacity has also driven increased interest. Moving forward, Santiago is poised for continued growth as hyperscale providers expand their presence and colocation services scale up (Rest of World, 2024).

The growing presence of cloud providers and the rising demand for data and IoT services have simultaneously driven data center expansion in Valparaíso (Aligned, 2024). Located near Santiago, Valparaíso offers a strategic advantage due to its proximity to key submarine cable landing stations, making it an ideal location for data center operations. The city benefits from strong connectivity and its proximity to the Santiago metropolitan area, further enhancing its appeal. Santiago is connected to several submarine cables via Valparaíso, including the $400.0 Mn Humboldt submarine cable project, a public-private partnership with Google, which is set to launch in 2026 and will link Chile to Sydney (CBRE, 2024).

Policy Regulation

Danish data centers are governed by GDPR and the Danish Data Protection Act, requiring companies to safeguard EU residents’ data and keep it within national borders. These regulations drive demand for data localisation, enhancing the appeal of Danish data centers and encouraging investment in advanced security measures like encryption and access controls. The regulatory environment is also boosting the adoption of cloud services, leading to new data center projects and expanded capacity (DLA Piper, 2024).

After the adoption of the EU-wide revised Energy Efficiency Directive (EED), which set a binding target of reducing overall energy consumption within the region and a scheme to rate the data centers based on certain sustainability criteria, it is expected that innovations and investments in green data center technologies are going to see more traction across the region (EUR-Lex, 2023). Data centers with capacities of 1.0MW or more must incorporate plans to connect to district heating systems before initiating any project. These systems, which provide heat to approximately 64.0% of Danish homes, reinforce the focus on sustainability by enabling data centers to contribute to energy-efficient heating solutions, further aligning with environmental regulations. This may pose challenges for smaller wholesale operators in Denmark, while domestic retail operators are mostly unaffected due to their lower power demands (DC Byte and Datacenter Forum, 2023) (Danish Data Center Industry, 2024).

The Danish Data Center Industry (DDI) and other Nordic data center associations have agreed to comply with the EU’s Energy Efficiency Directive (EED) while proposing modifications to the reporting criteria. They believe colocation providers and enterprise operators without access to data traffic information should be exempt from reporting it, as this could lead to suboptimal ratings and undermine the purpose of the rating system (Danish Data Center Industry, 2024).

Furthermore, the association also suggests lowering the eligibility threshold for energy efficiency reporting from 500.0kW to 100.0kW for data centers in Denmark. Lowering this threshold would mean that a greater number of smaller data centers, including colocation facilities and enterprise operators, would be subject to the same reporting requirements, thereby enhancing transparency in energy usage across the sector (Danish Data Center Industry, 2024). This aligns with Denmark’s aim to tighten sustainability regulations to achieve 55.0% renewable energy consumption by 2030 and carbon neutrality by 2050 (IEA, 2023) (Directorate-General for Climate Action, European Commission, 2023).

Outlook

Despite challenges, the Chilean data center market is expected to maintain its growth trajectory, driven by rising cloud adoption, digital transformation efforts, and significant investments from global technology companies. The market is poised to expand as international firms aim to capitalise on the region’s growth potential and Chile’s reliable energy supply. However, despite Chile’s appeal due to its renewable energy resources and strategic location, challenges such as power grid constraints, and competition from neighbouring markets must be addressed. Infrastructure limitations pose challenges for data centers in Chile. In some regions, the existing power grid cannot meet the rising demand, requiring investments in upgrades or alternative energy solutions for reliability. Additionally, achieving high-speed, reliable network connectivity, particularly in remote areas, is proving to be crucial for efficient data center operations. Moreover, intense competition from neighbouring countries like Brazil and Colombia, which are also improving their data center infrastructure, adds pressure as they compete for the same international investments, leading to aggressive pricing and potential margin squeezes (Credence Research, 2024).

Ensuring a stable workforce and mitigating risks from natural disasters will be crucial for sustaining long-term growth in the market. While Chile has a skilled workforce, there are occasional shortages of specialised talent for advanced data center operations, resulting in increased competition and higher labor costs. Continuous training and employee retention are vital. Initiatives like Microsoft’s “Transforma Chile” aim to improve digital skills, but ongoing efforts are necessary to keep pace with rapid technological changes (England, 2020). Additionally, Chile faces natural disaster risks such as earthquakes and droughts. To mitigate these, both the government and private sector are investing in resilient infrastructure.

Projects like the “Strengthening the Resilience of Infrastructure” initiative, supported by the Coalition for Disaster Resilient Infrastructure (CDRI) and the United Nations Office for Disaster Risk Reduction (UNDRR), focus on enhancing the resilience of critical infrastructure (UNDRR, 2023).