2023

Global Solar PV Market Report

Key Regional Markets

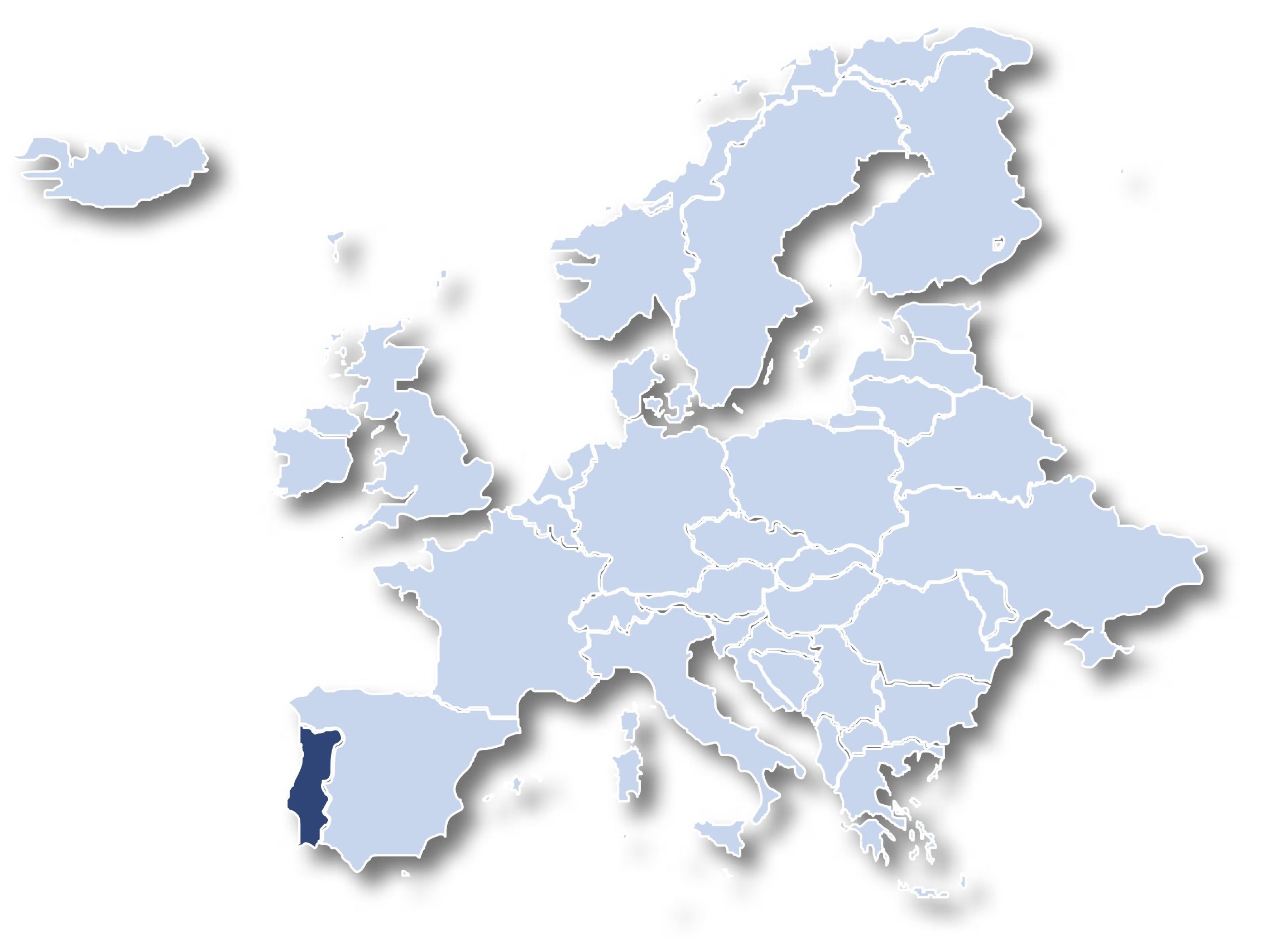

Portugal

Solar PV Capacity

2.53GW

GDP (Current Prices) USD (2022) | 252.38bn |

GDP Growth Forecast (constant prices) (2023-2027) | 1.72% |

Currency | USD ($) |

Country Credit Rating (S&P) | BBB+ |

Renewable Energy capacity (2022) | 16.3GW |

Solar PV Share in Renewables (2022) | 16% |

Renewable Energy Target |

Aims to generate 80% of its annual electricity usage from renewable sources by 2026

|

Portugal’s energy mix has historically been dominated by imported fossil fuels. However, imports have been severely affected due to the Russian-Ukrainian war, jeopardizing energy security. Thus, the country has focused heavily on renewable energy, mainly wind and solar, which has helped lower its energy import dependence to below 80%. As Portugal develops its renewable energy base, its dependence on fossil fuels is expected to decline to 65% by 2030. Over the last few years, this sector has grown through a well-structured incentive system and the adoption of ambitious targets.

Pros

-

Fast tracked the 2030 target of 80% renewable electricity by 2026

-

Government’s plans to mobilise €25 billion in the next 10 years to expand its renewable capacity

Cons

-

Permitting hurdles delaying project

-

Grid capacity limitation for utility scale projects

Renewable Energy Mix

Portugal’s new national energy and climate plan for 2030 and roadmap to carbon neutrality by 2050 plays the most important role in decarbonizing the energy sector. A robust push for renewable development was evident when the country fast-tracked its 2030 target of 80% renewable electricity by 2026 through solar energy licensing, wind tower renovation, hydrogen support, and offshore wind development. Good wind and solar conditions helped Portugal generate 60% of its electricity from renewable sources in 2022.

Based on the progress made regarding public transportation, hydrogen, and ending coal-fired power stations, Portugal is on track to achieve carbon neutrality by 2045 instead of 2050.

Portugal’s renewable energy mix is dominated by wind energy, holding a 40% share, closely being followed by hydropower at 36%. Solar PV represented a 19% share in the mix in 2022, growing 7% YoY. The wind and solar sectors are poised to increase their share in the energy mix, replacing slashed hydropower capacity due to droughts.

Installed Capacity: Status and Trend

Trend in Installed Solar PV Capacity

Source: IRENA Renewable Capacity Statistics April 2023

Solar PV installed capacity has seen slow growth over the years up to 2018, after which capacity additions started to increase, reaching peak in 2022. The government’s recovery plan for 2020 aimed to contain the decline in renewable energy overall, thereby generating positive momentum. During the period 2020-2022, capacity additions grew at a CAGR of 52%, indicating a strong market momentum.

Between January and September 2022, Portugal installed approximately 700MW of new solar PV capacity, setting a record. By the end of 2022, Portugal added 190MW of additional solar capacity, bringing its total to 2.5GW. The growth was primarily driven by three factors, which include the 2019 and 2020 utility-scale auction projects reaching completion and grid connection, rising self-consumption market and the influx of floating solar segment.

Demand Drivers

Portugal’s long-term goal to generate 47% of its gross final energy consumption from renewable sources by 2030 is the primary demand driver for solar deployment. The country now aims to reach 9GW of solar by 2026, which translates to roughly 1.6GW of capacity addition every year. To achieve this, the country introduced a long-term plan called ‘Roadmap to Carbon Neutrality 2050’. In 2022, the government also announced that it plans to mobilise €25 billion in the next 10 years to expand its renewable capacity.

With the European Commission’s proposal to promote solar PV installations in buildings, Portugal’s decentralised solar PV capacity could grow significantly. To promote the deployment of decentralized solar PV systems on residential rooftops, the Portuguese government offers two financial incentives. One of them is the “Vale Eficiência” programme (efficiency voucher programme), which will distribute 100,000 “efficiency vouchers” of €1,300 + VAT by 2025 to economically vulnerable families, reducing energy poverty and strengthening the renovation of buildings, including solar panels. The other programme is the “Apoio Edifícios + Sustentáveis” (Support + Sustainable Buildings programme) which has a contribution rate of 85% up to €2,500 for the installation of PV panels, with or without storage.

Among other things, auctions have been a strong driver for solar deployment. The auction model was used to ensure compliance with proposed targets in the most cost-effective manner. So far, 2.3GW have been auctioned for injection points to connect power plants where there is still grid availability or where expansion is planned. Besides that, the Decree-Law No. 15/2022 published at the beginning of 2022 introduced two new modalities that will allow the optimisation of the connection point: repowering (until 20% of the injection capacity) and hybridisation. It is expected that several wind farm operators will install solar PV power plants in the following years to maximize the amount of electricity they put into the grid.

Historically, physical PPAs were the most common in Portugal, but financial PPAs are becoming more common lately. Also, merchant solar routes have become increasingly popular in the country, allowing producers and offtakers to negotiate freely. The prior government attempted to define a policy framework for merchant renewables facilities, but the apparent looseness of the permit regime led to a flood of applications. The Direção Geral de Energia e Geologia (DGEG) halted the processing of merchant solar project applications in March 2020, resulting in the benching of a mammoth 253GW capacity. To unlock the held-up potential, Decree-Law No. 30-A/2022 creates a temporary regime that permits power plants to operate without an operation licence or operation certificate if grid injection conditions are ensured by the grid operator. Among notable deals, Statkraft signed a PPA with NextEnergy Capital’s solar fund NextPower III ESG in Portugal to procure electricity from 210MW of solar PV plants currently under construction.

Market Opportunity

Portugal has a greater capacity waiting for permits than it has installed so far. There are 1.1GW of production permit requests in the country and another 3.2GW of solar PV awaiting an operating permit. These figures provide insight into the withheld capacity that will be unlocked, offering a plethora of opportunities to investors and operators. The investment injected by Portuguese government in support of international institutions is broadening the spread of the solar activities in the country. In June 2021, European Commission (EC) endorsed Portugal’s €16.6 billion recovery and resilience plan, of which 38% will be allocated to the climate objectives.

Also increasing at a promising rate is the capacity of decentralised solar PV, mostly for self-consumption. The first big jump occurred in 2019 when Portugal installed 110MW, bringing the total to 429MW, up from 176MW in 2015. The years 2021 and 2022 were the most productive for decentralised solar PV, with 210MW and 296MW being added respectively, aggregating to 1GW. In the next few years, decentralised solar PV is anticipated to grow at a rate of 250MW per year on average, following the pattern seen in 2021 and 2022.

According to the national energy-saving plan, the country aims to add 2.6GW of new solar capacity by the end of 2023. In this context, energy storage will prove pivotal if the country hopes to achieve its solar installation goals. Along with this, the booming hydrogen sector would also provide significant investment opportunities in renewable technologies since most of the electricity used for electrolysis will come from wind and solar power.

Floating solar systems are perfectly suited for the country’s dams and other water bodies, and researchers from Évora University have found that the installed capacity may exceed the 7GW target outlined in the country’s National Energy and Climate Plan 2030. In May 2023, the Empresa de Desenvolvimento e Infraestruturas do Alqueva (EDIA), controlled by the Ministry of Agriculture of Portugal, launched an international tender for the construction of 5 floating PV plants to capitalise on the untapped potential. A total of €4.3 million will be invested in the five projects, which will have a combined capacity of 4.5MW.

Outlook

Source: BNEF Global PV Market Outlook

In recent years, the solar segment in Portugal has experienced strong growth thanks to the streamlining of permitting processes, increased focus on identifying and resolving grid connection issues, and enhanced policy support. Floating solar generation and decentralised PV will play a critical role in enabling future development. As of now, Portugal is on track to meet its 2026 goals. It is, however, important to adjust those targets to the development of hydrogen and hybridisation potential.

There are some procedural challenges as well. Although significant progress has been made on the long-running environmental impact assessment study, few permitting hurdles remain. It is largely because of a lack of digitalisation and inter-organisational communication, which needs to be streamlined. Grid capacity limitations also create uncertainty for larger solar projects. If grid development does not accelerate, Portugal might not be able to unlock its large solar PV potential. Furthermore, self- consumption remains a limited market, owing to the lack of attractiveness of the government support system.

Despite these challenges, solar PV is rapidly gaining traction in the country and, although rooftop solar has grown rapidly, utility-scale solar will continue to dominate new installations. According to SolarPower Europe’s medium scenario, Portugal is poised to add 10.3GW of new PV between 2023 and 2026. In the high scenario, additional solar capacity could reach 15.7GW with subsidy-free solar activity and new renewable hydrogen projects. However, a cohesive strategy including setting higher auction volumes and accelerating deployments is needed to boost investor confidence.

Based on BNEF’s forecasts, the solar PV sector is expected to grow overall between 2022 and 2030. After the highest solar PV builds expected to take place in 2023, the activity is projected to dip in 2024. However, from then until the end of the forecast period, PV builds are predicted to grow slowly but steadily. Solar PV builds will be lower by 2030 as compared with 2023, according to projections.