Year Founded: 1985

AUM: $951.00B | Dry Powder: $153.76B

Key Contacts

-

Stephen SchwarzmanCo-Founder, CEO & Chairman

-

Jonathan GrayPresident, Chief Operating Officer and Member of Board of Directors

-

Michael Chae JDCFO and Member of the Management Committee

Investment Preferences

-

Preferred IndustriesEnergy Services, Exploration, Production and Refining, Healthcare Services, Insurance, IT Services, Media, Metals, Minerals & Mining, Transportation, Chemicals & Gases, etc.

-

Geographical Preference

N/A

-

Preferred Deal TypesBuyout/LBO, Debt – General, Merger/Acquisition, Mezzanine, PE Growth/Expansion

-

Other Investment Preferences

- Invests in GP Stakes

- Long-Term Investor

- Prefers majority stake

- Prefers minority stake

- Seeks ESG investments

- Seeks Impact investments

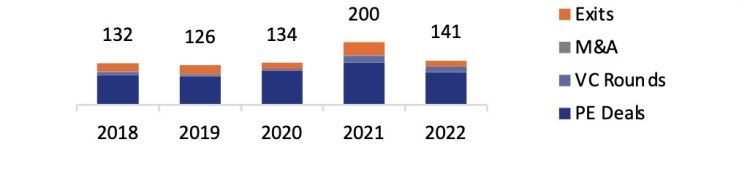

Investments By Year

Funds Closed

Size: $3.3B

Dry Powder: $1.7B

Details: The fund invests in energy infrastructure, digital infrastructure, water and waste

Size: $25.4B

Dry Powder: $14.7B

Details:The fund targets to invest in IT, B2C and TMT

Size: $4.3B

Dry Powder: $2.1B

Details:The fund targets to invest in oil and gas sector

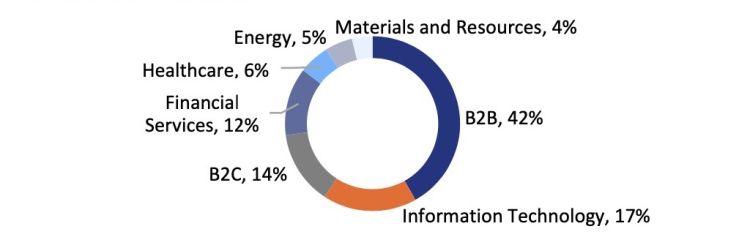

Investments By Industry

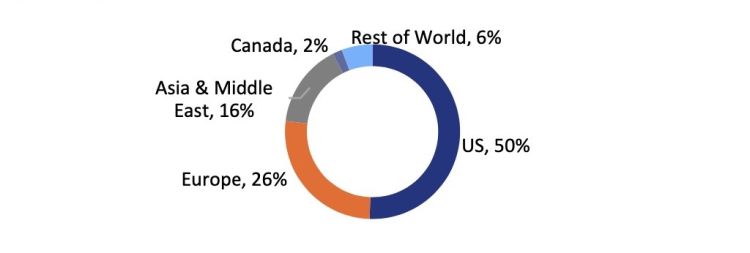

Investments By Region

Key Investments

In December 2022, Blackstone and Rivean Capital completed acquisition of Esdec Solar Group for an undisclosed sum. Esdec develops and supplies professional solar rooftop mounting solutions for the residential, commercial roofs. The Group secured over 3.5GW on residential, commercial, and industrial rooftops all over the world

In March 2022, ION Solar LLC secured an investment of an undisclosed amount, led by credit division of Blackstone Inc & Energy Impact Partners, Greenbelt Capital Partners, Trilantic Energy Partners II North America and other investors

In January 2022, Blackstone invested $3 billion of development capital in Invenergy Renewables. The investment will provide capital to accelerate the company’s renewables development activities

In January 2022, Blackstone through its funds, signed a definitive agreement with Caisse de dépôt et placement du Québec and Invenergy to make an equity investment of $3 billion in renewable energy developer Invenergy Renewables Holdings. Invenergy management and CDPQ will remain majority owners of the company and Invenergy will continue as managing member

In November 2021, Ample, a battery technology company in San Francisco, raised an additional $50 million in funding from Blackstone Group along with Spanish bank Banco Santander. Ample uses Modular Battery Swapping that dramatically reduces the cost and time it takes to install EV infrastructure. Recently, Ample extended its partnership with Uber, which will bring Ample’s battery swapping technology to EV drivers across Europe

In August 2021, Blackstone Energy Partners committed to inject $350 million into US solar tracker maker Array Technologies Inc. Array Technologies agreed to sell up to $500 million of perpetual preferred stock to Blackstone Inc’s energy-focused private equity business

In April 2021, Blackstone signed an agreement to acquire Sabre Industries, Inc. from The Jordan Company, citing the company’s positioning to benefit from the emerging energy transition. Sabre is a leading designer and manufacturer of highly-engineered, mission-critical overhead steel poles, towers, battery storage solutions, and related services for electrical utility and telecom end markets

In December 2020, Altus Power America, Inc. completed the acquisition of approximately 100MW of distributed solar assets across California, Maryland, Massachusetts, Minnesota, New York and Vermont, via its financial sponsors The Blackstone Group, FS Investments, Blackstone Credit, Goldman Sachs Growth Equity and FS Energy and Power Fund for an undisclosed amount

In November 2020, Altus Power America, Inc. completed the acquisition of a 2.5MW operating solar project in Charlotte, Vermont via its financial sponsor The Blackstone Group, GSO Capital Partners, Goldman Sachs Growth Equity and FS Investments for an undisclosed amount. The acquired project generates approximately 3 million kilowatt hours of electricity annually

Other Details

The Blackstone Group Inc. operates as an investment company. The company invests on a global basis across a wide range of asset classes including private equity, real estate, public debt and equity, growth equity, opportunistic, non-investment grade credit, real assets and secondary funds. Blackstone Group serves customers worldwide. It invests in Core+ and Core infrastructure assets principally in the US. Total Enterprise Value of its portfolio companies in the infrastructure sector is $110 billion with $31 billion of assets under management

The latest open fund Blackstone Energy Transition Partners IV is an oil and gas fund managed by Blackstone. The fund is located in New York, New York. The fund targets investments in the energy sector. The fund’s target size is $6.03 billion. As of December 2022, the fund secured just over $1 billion

406 Ventures, 1/0 Capital, 3i Group, ABRY Partners, Acacium Group, Accel, Acrisure, Adage Capital Management, Aetna Ventures, AEW Capital Management, Affiliated Managers Group, Aisling Capital, Alcentra Capital BDC, Alderwoods Group, Alight Solutions, AllianceBernstein, Alliant Insurance Services, Apax Partners are some of the institutional investors who invest along with Blackstone