2023

Global Onshore Wind Market Report

Developing Trends

Onshore wind energy stands as one of the mature and proven renewable energy technologies, widely deployed on a commercial scale across the globe. Accounting for approximately a quarter of global renewable energy capacity, onshore wind plays a pivotal role in shaping energy transition policies worldwide. Its growth trajectory represents a significant consideration in the broader context of transitioning to sustainable energy sources. There has been a noticeable uptick in capacity additions (Figure 4 1), with an average of 277GW added in the three years leading up to 2022, a marked increase from the 177GW averaged during 2017-2019 (IRENA, 2023).

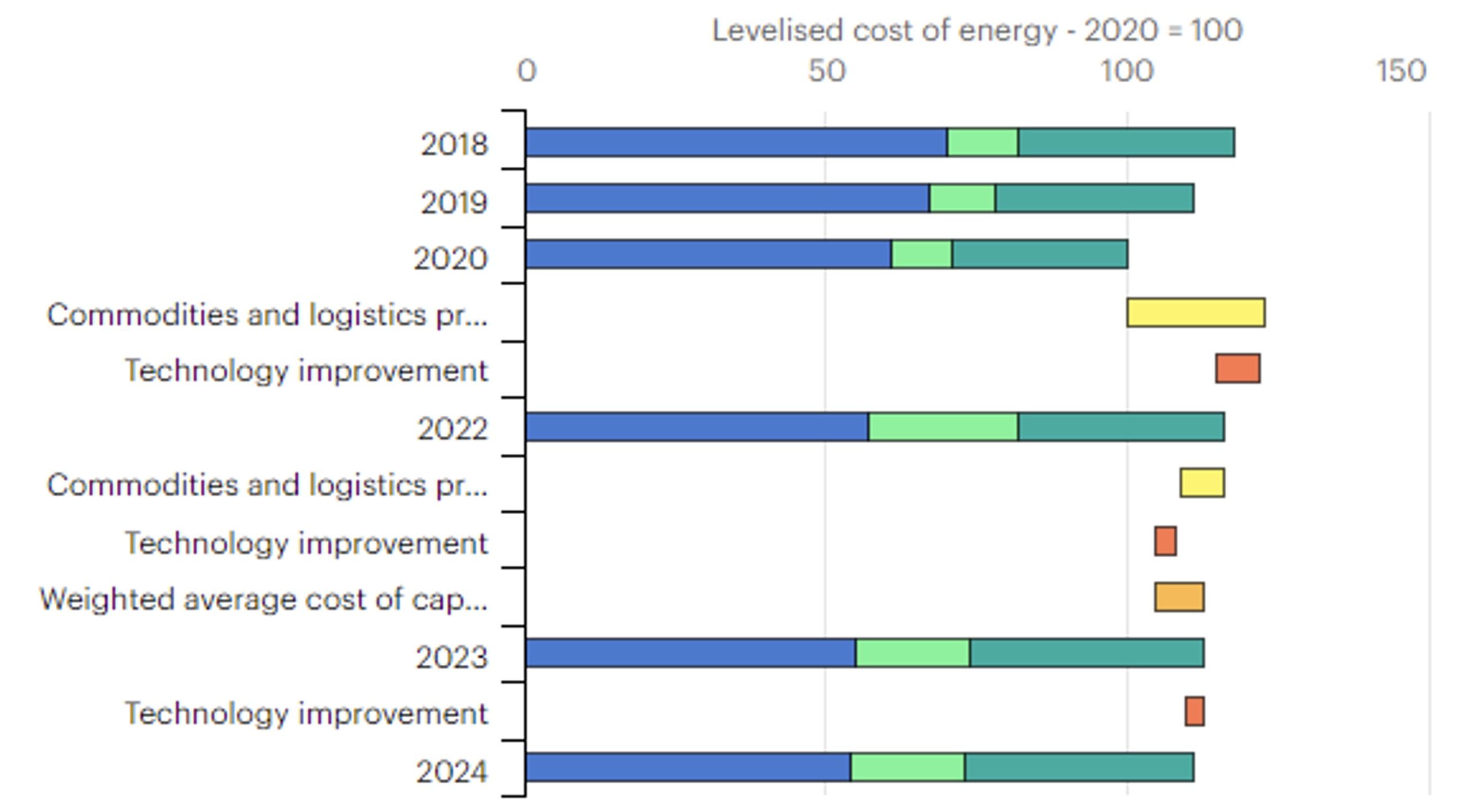

However, the capital costs of onshore wind projects have experienced upward pressure recently (Figure 4 4). This rise in costs can be attributed to inflationary impacts on essential raw materials, development expenses, and financing costs. Although costs have reduced since the peak in 2022, following the Russia-Ukraine conflict and global supply constraints, they still remain higher compared to pre-pandemic levels. Notably, high upfront costs constitute a significant portion of the overall project economics, with operational and maintenance expenses being relatively minimal in comparison.

The landscape of global onshore wind power projects is undergoing significant challenges, impacting the cost dynamics. Recent estimates from the International Energy Agency (IEA, 2023) indicate a 10%-15% increase in the levelized cost of energy compared to 2020 levels over the next year. Several factors contribute to this rise, with one prominent factor being the escalating financing costs faced by developers. Many countries are witnessing a surge in lending rates, elevating the overall expenses for project initiators.

Moreover, sustained increases in material costs have created substantial hurdles for developers. From 2000 to 2022, steel prices surged by 160% in the US and 270% in Europe, while copper and aluminum prices rose by 60%-80%. Freight rates spiked dramatically, increasing sixfold during this period. Consequently, commodities and logistics jointly accounted for about 30%-35% of the capital expenditure for wind power projects in 2022. Although there has been a slight softening in commodity prices, they remain significantly higher than pre-pandemic levels, adding persistent pressure on project budgets.

Additionally, the impact of these higher prices extends to project contracts. Several Original Equipment Manufacturers (OEMs) faced challenges in passing on the increased costs due to fixed terms in contractual obligations. Consequently, with the renewal or formation of fresh contracts, higher project costs are effectively transferred to the developers (Wood Mackenzie, 2023). Major OEMs, such as GE Renewable, Nordex, Siemens Gamesa, and Vestas, who collectively supply over 90% of the global market outside China, faced substantial losses in 2022. To address profitability concerns, these OEMs reported significant revisions in nameplate equipment prices. This contrasted sharply with wind power operators who experienced gains due to rising power prices in 2022, emphasizing the complex economic challenges faced by the industry (S&P Global, 2023).

Figure 4 5: IEA’s Estimate on Onshore Wind LCOE Index by Key Inputs (IEA, 2023)

The onshore wind industry faces significant challenges due to squeezed profit margins and financial constraints (Figure 4 6), leaving limited room for technology-led innovations. Many OEMs are currently focusing on stabilizing their profit margins rather than investing heavily in research-led product innovations. However, technological advancements are expected to play a crucial role in reducing the Levelized Cost of Energy (LCOE) by improving efficiencies. The International Energy Agency predicts (IEA, 2023) that ongoing technological improvements will lead to a moderation in costs by 2024, assuming a stabilization of inflationary pressures.

Several OEMs are actively working on product developments to enhance their offerings. For example, Vestas is in the process of developing turbines with a remarkable 15MW rating, featuring a rotor diameter of 236m and blades measuring 115.5m. Similarly, Siemens Gamesa is working on turbines with a 222m rotor and 108m blades (CNBC, 2022). Currently, the largest onshore wind turbines in operation have nameplate capacities over 7MW, such as Vestas’ 7.2MW V172 turbine and Enercon’s 7.58MW E126 turbine (Our World of Energy, 2022).

The industry’s focus has shifted towards higher rated turbines positioned at greater heights, especially in sub-optimal wind-rich sites. Chinese wind turbine OEMs are notably progressing with higher capacity ratings in their offerings, outpacing their Western counterparts. Reports from Wood Mackenzie (Wood Mackenzie, 2023) indicate that the average turbine size rating for Chinese OEM orders exceeds 5.4MW, compared to the 4.2MW rating for Western OEMs. This trend underscores the growing pressure to secure efficient turbine units, intensified by the dynamics of the wind power procurement market and the fierce competition for power purchase contracts. As the industry navigates these challenges, ongoing innovations in turbine technology remain critical for its future growth and sustainability.

The strategy of auction-led capacity allocation is gaining prominence globally, reshaping the landscape of renewable energy projects. Notably, the European Union has accelerated its adoption of renewable energy through recent policy changes. In July 2023, Albania made significant strides in this direction, conducting its inaugural auction for onshore wind power capacity. With support from the European Bank for Reconstruction and Development, the Albanian regulator successfully allocated a total of 222.48MW across three entities (EBRD, 2023). Concurrently, France held auctions that allocated over 1.1GW of capacity, surpassing the targeted 925MW due to oversubscription (EQ, 2023). These auctions showcased an average price of €85.29/MWh across the 70 winning bids, reflecting the competitiveness of the market.

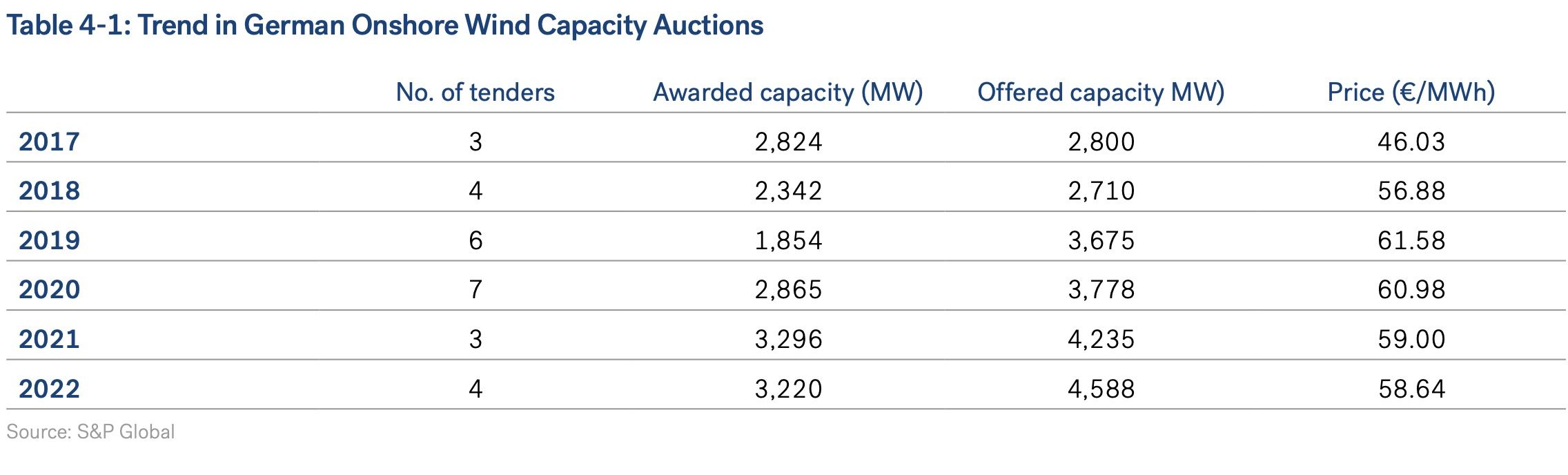

However, challenges persist in this approach, as demonstrated by Germany’s experience. The country’s onshore wind capacity auctions (Table 4 1) have been plagued by under-subscription due to project permitting delays, compounded by material costs and interest rate fluctuations. In the March 2023 tender, Germany received bids for only 1.5GW, less than half of the anticipated capacity. Efforts are underway to address procedural delays, but a significant turnaround in investor response may require time and further interventions.

These instances highlight the evolving nature of energy auctions, underscoring the need for streamlined procedures and policy frameworks to optimize the potential of renewable energy projects globally. As nations navigate these challenges, addressing bottlenecks and encouraging investor confidence will be essential for sustainable growth in the renewable energy sector.

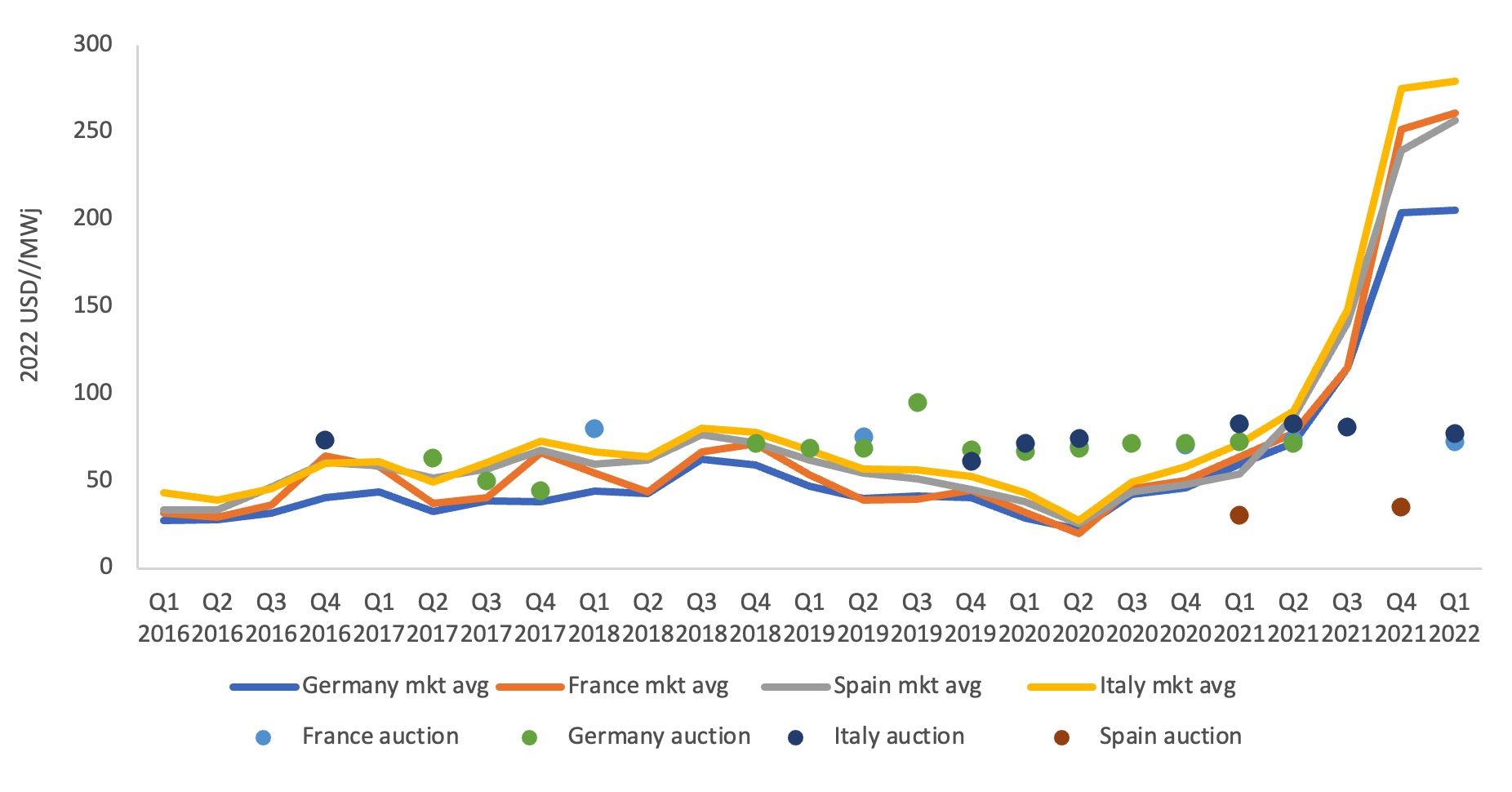

The aftermath of the Russia-Ukraine armed conflict outbreak led to a significant spotlight on European wind power projects and other renewable energy units. The surge in wholesale market prices, primarily driven by natural gas prices, created substantial potential gains for renewable energy projects. To curb excessive profits, temporary windfall gains taxes were imposed, prompting generators to shift towards long-term power purchase contracts instead of volatile spot prices in the wholesale market.

Several European countries, including Germany, the Netherlands, and Denmark, adopted a regulatory approach featuring sliding feed-in premiums (FIPs) with competitive bidding prices as the baseline. This allowed generators to sell in the spot market while subsidies provided additional revenue, leveraging the high wholesale market prices to their advantage.

Moreover, the elevated wholesale market prices provided incentives for a relatively minor yet crucial sub-segment of wind power projects: repowering. With limited resources in onshore wind siting and stringent project approval conditions, the European onshore wind power market witnessed a rising trend in repowered capacity. This trend gained traction due to the aging onshore wind farm capacity in the European region (Figure 4 9). Germany, as of December 2022, had 17GW of capacity older than 15 years, with an additional 14GW operating for over two decades. Similarly, Denmark, Spain, and Portugal had wind turbine vintages averaging over 12 years, emphasizing the need for upgrading and repowering efforts in these regions (Wind Europe, 2023). The confluence of regulatory measures, high market prices, and the imperative to revamp aging infrastructure has spurred a new wave of innovation and investment in Europe’s wind power sector.

The significance of wind power repowering transcends geographical boundaries and is not solely dictated by the age of assets. In the United States, for example, wind turbine refurbishment is not only driven by the age of the turbines but also by strategic considerations. As of the end of 2022, the median age of wind turbine refurbishment in the US stood at 11 years (US Department of Energy, 2023).

Figure 4 8: Onshore Wind Auction Contract and Wholesale Prices in Select European Union Countries (IEA, 2022)

One of the pivotal factors motivating wind power repowering in the US market is the opportunity to access tax incentives, particularly the requalification for production tax credits. These incentives serve as catalysts for retrofitting and repowering existing wind turbines, creating a strong financial incentive for investors and developers.

Efficiency plays a pivotal role in this process. Wind power projects are driven to upgrade their turbines, leading to orders that involve higher power ratings and larger rotor sizes. These upgrades enhance the overall efficiency and energy output of the turbines, aligning them with modern technological standards and maximizing their energy generation potential.

The energy crisis of 2022 sent shockwaves through global energy markets, prompting significant reconsideration of conventional practices. In response, the European region geared up for transformative energy market reforms set to be implemented from 2023 onwards. These reforms herald a departure from traditional market practices, potentially elevating mechanisms such as Power Purchase Agreements (PPAs) and Contracts for Difference (CFD) to more prominent roles in wind power project economics.

Estimates from the International Energy Agency (IEA, 2023) indicate that approximately one-fifth of total power procurement in utility-scale wind and solar projects during 2023-2024 will be channeled through market-based routes. However, regional variations are crucial in this scenario. China, boasting a leading share in capacity and procurement, relies on fixed tariffs and premiums set by provincial authorities following the phasing out of feed-in tariffs. When excluding the Chinese market, a substantial 36% of power procurement will be market-based in 2023-2024, indicating a global trend towards market-driven renewable energy procurement.

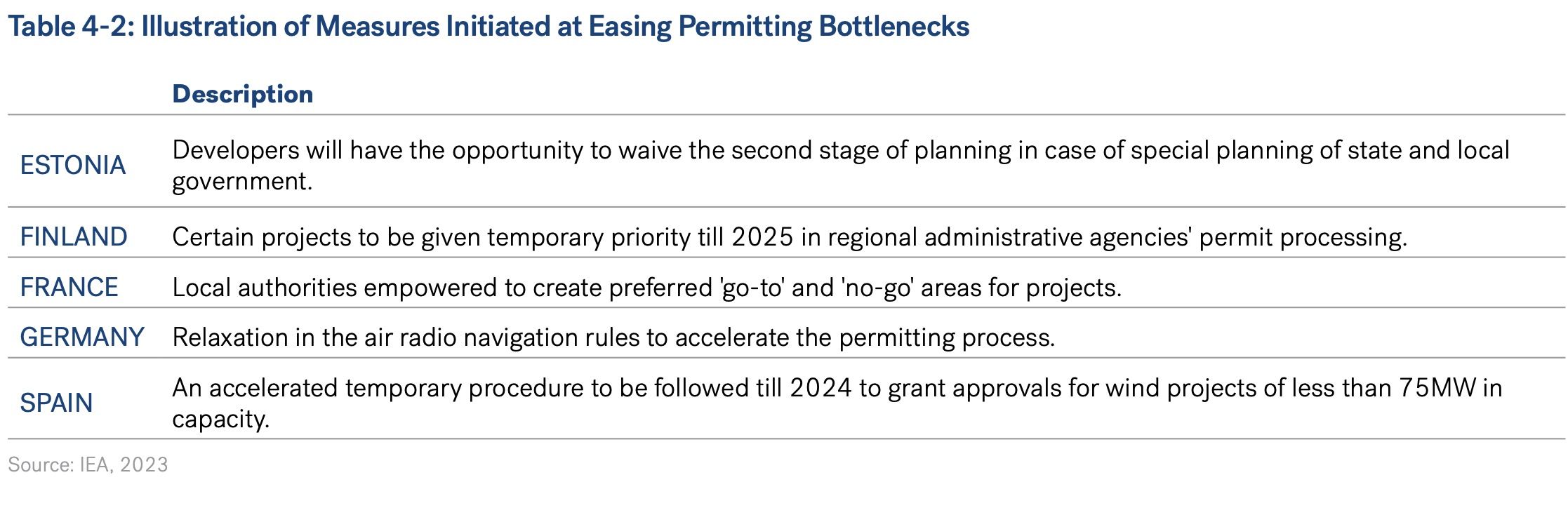

In the landscape of onshore wind power, specific policy measures aimed at accelerating project development have emerged as pivotal market drivers. One significant challenge faced globally has been the procedural delays in developing onshore wind power projects. Europe, in particular, has been grappling with this issue, as evidenced by research from Energy Monitor in June 2023 (Energy Monitor, 2023). The study revealed that Europe had a staggering 97GW of wind capacity held up in permitting, a figure five times greater than the capacity under construction, which stood at around 20GW.

Recognizing the urgency, the European Union took proactive steps by instituting a stipulated two-year timeframe for project approvals (Table 4 2). While this reform is a progressive move, its implementation across all member countries will take time. According to a study by Ember involving 18 countries, all nations exceeded the designated timeframe to varying degrees. Nevertheless, deliberate policy actions across European countries to ease permitting restrictions signify a significant shift. These measures are vital, given the enhanced renewable energy targets that mandate a rapid and sustained increase in capacity addition over the next 3-5 years.

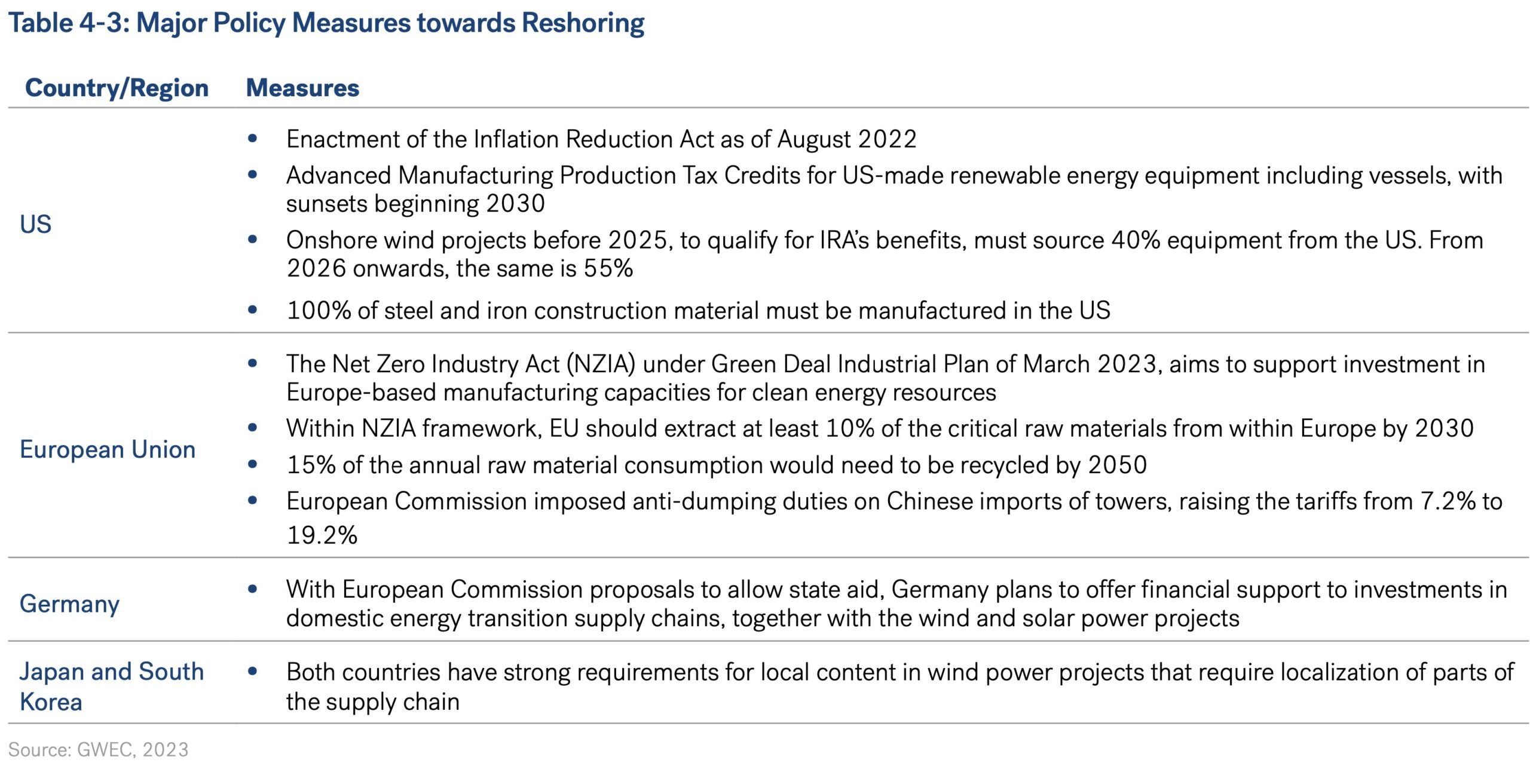

Recent policy deliberations across countries have emphasized a shift toward regionalization and reshoring of the supply chain in the onshore wind power sector. While the overarching goals include de-risking supply chain concentration and promoting localized sourcing, this transition is not without challenges. Despite these noble intentions, the lack of a coordinated approach could potentially jeopardize supply security for developers.

The Global Wind Energy Council’s latest report (GWEC, 2023) has raised concerns about a possible shortage in onshore wind turbine nacelles and other critical components by mid-decade in the United States and Europe. This scarcity is attributed to national policies impacting the free flow of trade, disrupting the global supply chain. These policy measures extend beyond major components, encompassing upstream industries involved in the production of essential materials like steel and rare earth elements crucial for wind power equipment and projects.

From the perspective of developers and OEMs, there exists a delicate balance between localization and affordability. In the current globalized landscape of wind power equipment supply, China stands as the principal supplier for many components. Approximately 70% of wind power projects’ powertrain equipment, including shafts, gearboxes, and generators, is globally sourced from Chinese facilities. In contrast, as of 2021, the United States lacked domestic wind power generation powertrain manufacturing capabilities.

The impact of policy incentives on trade flows creates a complex scenario. Artificially supplanting existing structures in favor of localization might not be financially justifiable. OEMs and developers are forced to weigh the advantages of localized production against the efficiency and cost-effectiveness of existing global supply chains.

This delicate balancing act underscores the necessity for thoughtful policy frameworks that promote both localized production and global cooperation. Achieving this balance is vital to ensuring a robust and secure supply chain capable of meeting the increasing demands of the onshore wind power industry. As nations grapple with these challenges, collaboration and strategic policy planning are key to ensuring a sustainable and resilient future for onshore wind power.