United Kingdom

AFs are one of the key technologies available to the UK government to decarbonize aviation, while alternative technologies such as hydrogen or battery-powered aircraft remain unavailable for use in commercial aviation. SAF is one of the six key measures in the UK government’s Jet Zero Strategy published in July 2022 (Transport, 2023). Other measures in the strategy include system efficiencies, zero emission flight (ZEF), markets and removals, influencing consumers, and addressing non- CO2 (UK Department for Transport, 2022).

The UK’s aviation industry being one of the global pioneers, recognizes the importance of SAF in achieving its decarbonization goals. Data released by the UK’s Department for Transport (Dft) showed that SAF used in the country jumped by 188.0% year-on- year to 138.1 million litres compared to 48.0 million litres in 2022, clearly indicating the active progress in SAF uptake (SAF Investor, 2024).

GDP (Current Prices) USD (2022) | 3,100 Bn |

Real GDP Growth Forecast (2023-2027) | 1.12% |

10-year Govt Bond Yield (12-month rolling average) | 4.18 |

Country Credit Rating | AA |

Average Daily Flights | 5,290 |

Existing Fuel Consumption | 12.46 million metric tons |

Usage Mandate | 2% SAF by 2025, rising to 10% SAF by 2030 |

Projected SAF Capacity Under Development (MT/Year) | 885,700 by 2030 |

Policy Support |

|

Aviation Industry Backdrop

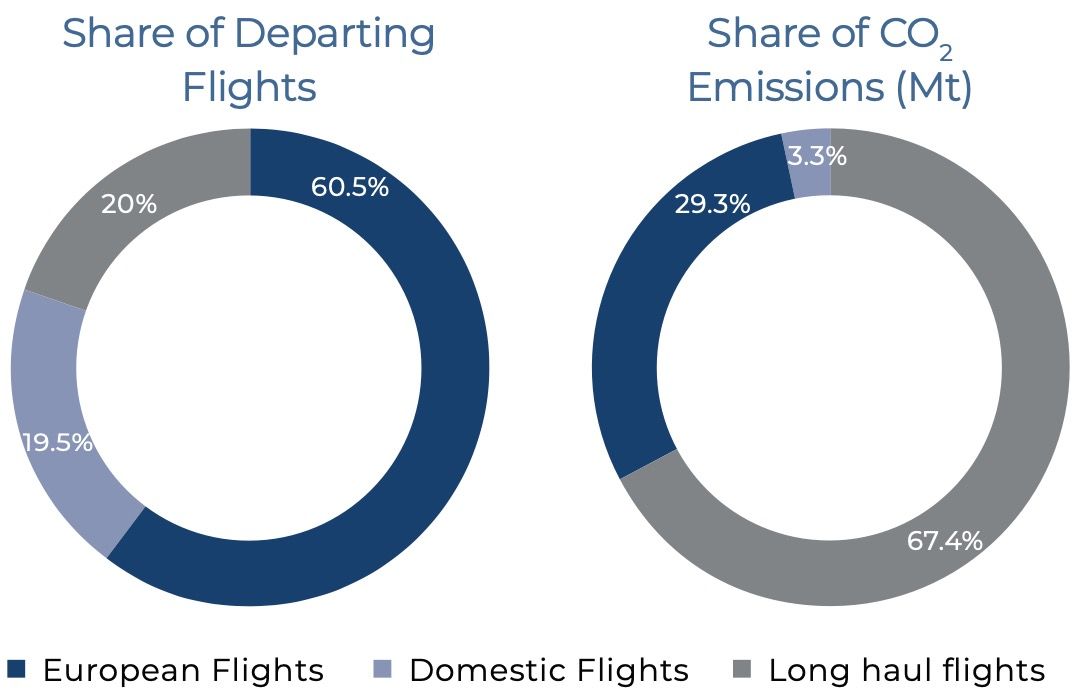

Share of Departing Flights from the UK and CO2 Emissions

Source: OAG

In 2023, approximately 940,000 flights departed from UK airports, registering 32.0 Mt of CO2 emissions. In comparison with 2022, this represented a total flight growth of 15.8% and CO2 emissions growth of 22.8%. The business is gradually recovering to reach the pre-pandemic peak – by the end of 2023 air traffic was at 87.6% of the 2019 level of total flights and 89.8% of CO2 emissions (UK Transport & Environment, 2024). EasyJet, British Airways and Ryanair are the three major players in the market and together account for well over half of UK departing flights and about 60.0% of carbon emissions (UK Transport & Environment, 2024). It is likely that 2024 will have higher emissions than 2023 based on current emission growth trends (UK Transport & Environment, 2024).

The UK Government’s Jet Zero Strategy forecasts aviation emissions to reach 39.0MT (million tonnes) of carbon dioxide equivalent (CO2e) in 2030, decreasing to 29.5MT in 2050. To achieve net zero, the remaining CO2e must be addressed using both in-sector (SAF) and out-of-sector (carbon removal) mechanisms. The government expects 1.2MT of SAF to be needed in 2030, and 7.0MT by 2050 to achieve net zero (in a central case with 75.0% of residual carbon addressed by SAF) (ICF, 2023).

Source: OECD.Stat, 2024

Note: Thousand tonnes of CO2-equivalent

Policy Regulation

Following its departure from the European Union, the UK has developed an independent regulatory framework for SAF, demonstrating its commitment to sustainable aviation. The UK’s approach combines demand and supply-side mechanisms to drive investment and adoption of SAF (IATA, 2024).

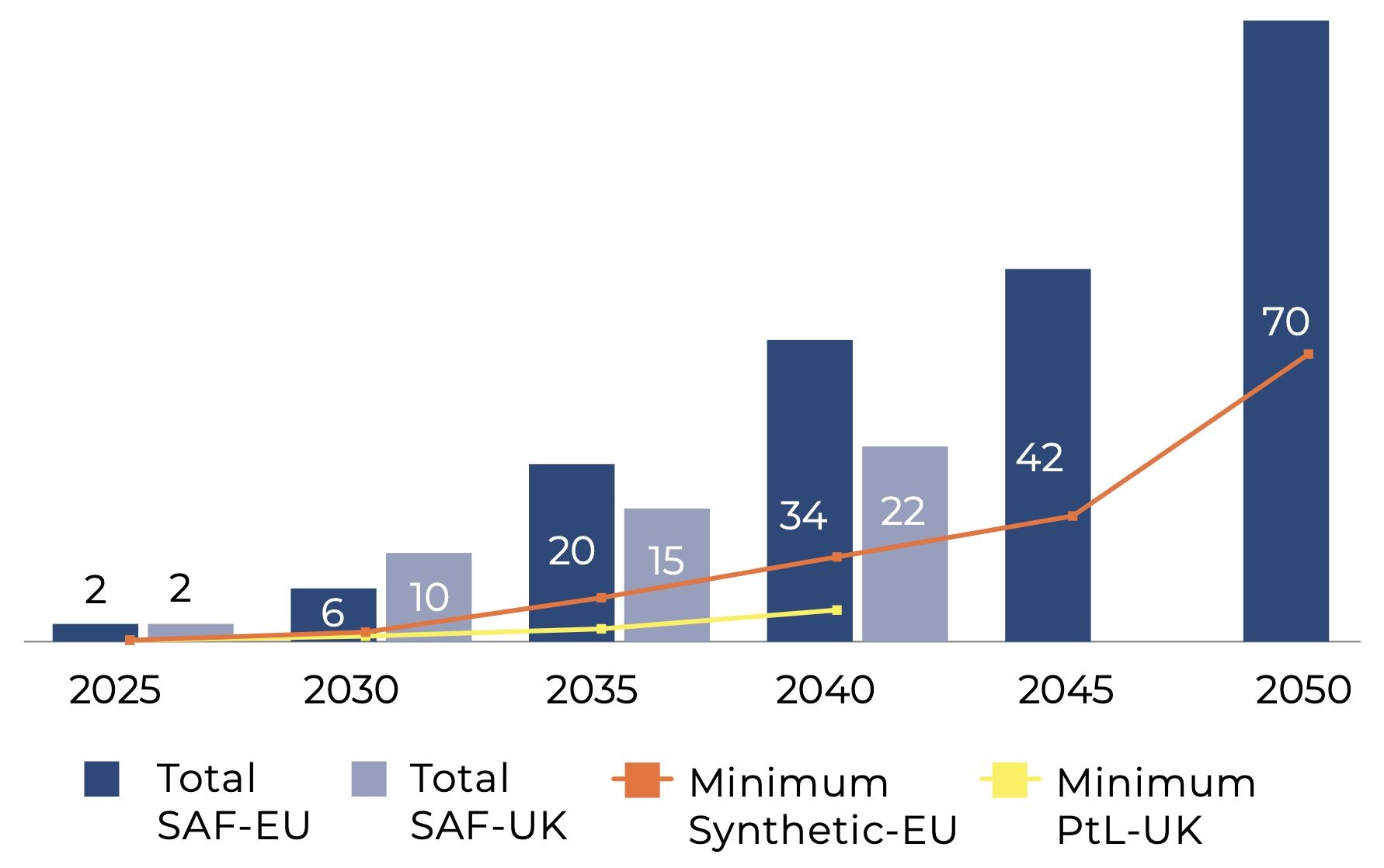

The UK SAF Mandate, effective from 1 January 2025, sets progressive targets for aviation fuel suppliers, requiring them to provide increasing amounts of SAF, reaching 10.0% of total jet fuel by 2030 and 22.0% by 2040. On the supply-side, government support has been extended in the form of a £135.0 million allocation under the Advanced Fuels Fund to support the commercialisation of new SAF technologies (Department for Transport, UK, 2023).

The government has also launched a consultation on a revenue certainty mechanism to support the development of the UK’s domestic SAF industry. The mechanism aims to reduce the risks of uncertain revenues for new SAF plants and attract investment. The consultation includes options such as a guaranteed strike price (GSP), buyer of last resort (BOLR), mandate auto-ratchet (MAR), and mandate floor price (MFP) (Transport U. D., 2024).

A new green tax on airline passengers is also being proposed. In December 2023, the Environmental Audit Committee (EAC) recommended that the government develop policies to reduce carbon emissions in the aviation sector, including a frequent flyer levy (POLITICO, 2024).

Similar to ReFuelEU, the UK’s SAF policy includes a sub-mandate on power-to-liquid (PtL) fuels, aiming to support this type of high-integrity SAF due to its high GHG emissions savings potential and low land use change risk. The target for PtL fuels will start in 2028 at 0.2% of total jet fuel demand, reaching 0.5% in 2030 and 3.5% in 2040 (Climate Catalyst, 2024) (Carbon Brief, 2024). Additionally, the UK has introduced a cap on HEFA fuels to allow for newer SAF technologies to compete effectively. The HEFA cap starts at 2.0% in 2025 and rises to 7.8% by 2040. The mandate also includes a buy-out mechanism that penalizes jet fuel providers if they do not provide enough SAF, with a price of £4.7 per litre for the main SAF obligation and £5.0 per litre for the PtL obligation. (Climate Catalyst, 2024)

Source: (Carbon Brief, 2024), (Climate Catalyst, 2024)

SAF blending targets in the UK SAF mandate compared to ReFuelEU Aviation mandate

Source: (Carbon Brief, 2024), (Climate Catalyst, 2024)

Market Opportunity

In 2023, as a percentage of total fuel supplied, SAF made up just 0.28% compared to 0.10% in 2022 (SAF Investor, 2024). Starting in 2025, 2.0% of the jet fuel supplied in the UK must be SAF which relates to approximately 230,000 tonnes compared to only 64,000 tonnes of SAF produced in 2023 (Norton Rose Fulbright, 2024). Thus, a transitional ramp-up of SAF production is required in order to close the gap between requirement and production. On a positive note, the UK’s SAF project pipeline is growing, with several notable initiatives underway. The latest developments indicate a trend towards partnerships and collaborations among various parties to develop SAF, with support from government funding.

SAF Initiatives: GreenCo, a major British energy company, aims to produce significant quantities of SAF by converting its existing facilities to support biofuel production, leveraging advanced technologies to ensure high efficiency and sustainability. This initiative is expected to contribute to the UK’s SAF production capacity and help meet the growing demand for sustainable aviation fuels.

EcoFuel, another leading energy company in the UK, is investing in SAF production through partnerships with technology providers and research institutions. By utilizing its extensive refinery network, EcoFuel plans to produce SAF on a large scale, further strengthening the UK’s position in the global SAF market.

BioTech, a global specialty chemicals company, is developing a commercial-scale plant in Leeds that focuses on producing cellulosic ethanol, which can be an essential component in SAF production. The technological advancements and expertise gained from this project are expected to benefit the UK’s SAF industry as a whole, driving innovation and improving production processes.

To further strengthen SAF production, in November 2023, the administration established the SAF Clearing House. The programme is funded by the DfT and provides cross-industry support for the development, testing, qualification, and production of sustainable aviation fuels (Ricardo, n.d.).

Airline Initiatives: Airlines such as British Airways and easyJet are actively participating in SAF projects, forming alliances with fuel producers to secure SAF supplies and reduce their carbon footprint. These collaborations often include long-term purchase agreements and joint research efforts to optimize SAF use in commercial flights. In November 2023, the UK Civil Aviation Authority (CAA) issued Virgin Atlantic with a permit to fly the first ever 100.0% SAF fuelled transatlantic flight (Civil Aviation Authority, 2023).

Government Funding: The British government, in conjunction with EU funding programs like Horizon Europe and the European Green Deal, is providing substantial financial support to SAF projects. In November 2023, UK DfT through its Advanced Fuels Fund, awarded £6.0 million funding to ExxonMobil (a member of the Solent Cluster). The funding will be used to assess the potential SAF production using ExxonMobil proprietary Methanol to Jet (MtJ) technology (Exxon Mobil, 2023) (The Solent Cluster, 2023).

UK Live Funding Mechanisms Relevant to Sustainable Aviation Fuels

| Fund Name | Organisation(s) | Total Fund |

|---|---|---|

| Strategic Programme |

|

£685 million to 2025, with industry co-funding taking the total to >£1 billion. |

| Future Flight Challenge Fund |

|

£300 million co-invested by government and industry. |

| Accelerating research outcomes to deliver a prosperous net zero |

|

£7,500,000. |

| UKRI SME innovation loans | UKRI | Not specified. |

| Tomorrow’s Engineering Research Challenges | EPSRC | £7,000,000 |

| Emerging Energy Technologies Fund (EETF) | Scottish Government | £180 million |

Outlook

The Jet Zero Council, formed of senior industry representatives and policymakers, provides strategic oversight of the government’s plans as key stakeholders in the aviation sector’s transition. SAF is poised to be one of the key levers available to government and industry to accelerate the transition to net-zero aviation. A collaborative effort between government and industry is expected to result in five plants being under construction by 2025. The government has a leading role in delivering this huge opportunity by establishing a sustainable, high- integrity SAF market for the UK and beyond (Climate Catalyst, 2024).

Besides existing policy support, the government is continually exploring new ways to curb emissions and boost SAF adoption. It is possible that emission reduction assumptions for using SAF under the UK Emissions Trading Scheme (ETS) may change to consider a lifecycle analysis of the fuel type used, which will incentivize PtL fuels more than biofuels. Additionally, the UK is also exploring a long-missing kerosene tax in aviation that will help to level the playing field between the cost of conventional jet fuel and SAFs, and particularly PtL fuels. Estimates suggest that revenues generated through taxation could be c.£6.7 billion per year (Climate Catalyst, 2024).

Economic growth and national well-being will be significantly boosted by the growth of the SAF industry. According to ICF analysis, by 2030, the UK’s SAF industry could contribute £1.8 billion in gross added value, with much of it coming from upstream activities. As of 2050, this may amount to £10.1 billion, of which £1.7 billion could come from direct/ construction and the remainder from upstream value chains (ICF, 2023).

However, the UK faces certain roadblocks on its path to becoming a leading SAF market. For example, EPC capabilities with respect to SAF plants are stretched and are likely to remain so given the anticipated pipeline of infrastructure and energy projects. Additionally, SAF projects are also hindered by a high dependence on debt financing. SAF projects typically carry a cost ticket of between £500.0 million and £1.0 billion. It is too big for venture capital, and since the initial projects will be the first of their kind, it is too risky for most private equity or hedge fund investors. In order to offer debt financing at a reasonable cost of capital, significant safeguards need to be in place. The primary challenge is to develop a mechanism that will give sufficient revenue confidence to make a project bankable and quickly deployable (New, 2022).

Source: Sustainable-Aviation-SAF-Roadmap-Final.pdf (sustainableaviation.co.uk)