2023

Global Solar PV Market Report

Key Regional Markets

The Netherlands

Solar PV Capacity

22.59GW

GDP (Current Prices) USD (2022) | 993.68bn |

GDP Growth Forecast (constant prices) (2023-2027) | 1.37% |

Currency | Euro |

Country Credit Rating (S&P) | AAA |

Renewable Energy capacity (2022) | 32.8GW |

Solar PV Share in Renewables (2022) | 69% |

Renewable Energy Target | Generate 70% of electricity from renewable sources, primarily solar and wind power by 2030 |

GDP Source: IMF WEO, S&P and IRENA

Pros

-

Promotion of renewable development through competitive auctions to award operational subsidies

-

Substantial progress made by floating solar deployments and technologies

Cons

-

Decline in annual capacity additions anticpated as fewer auctions per year is prescribed by subsidy scheme

-

Lack of grid capacity at the middle and high voltage levels expected to lead to long delays and possibly non-realization of the projects

Renewable Energy Mix

Installed Capacity: Status and Trend

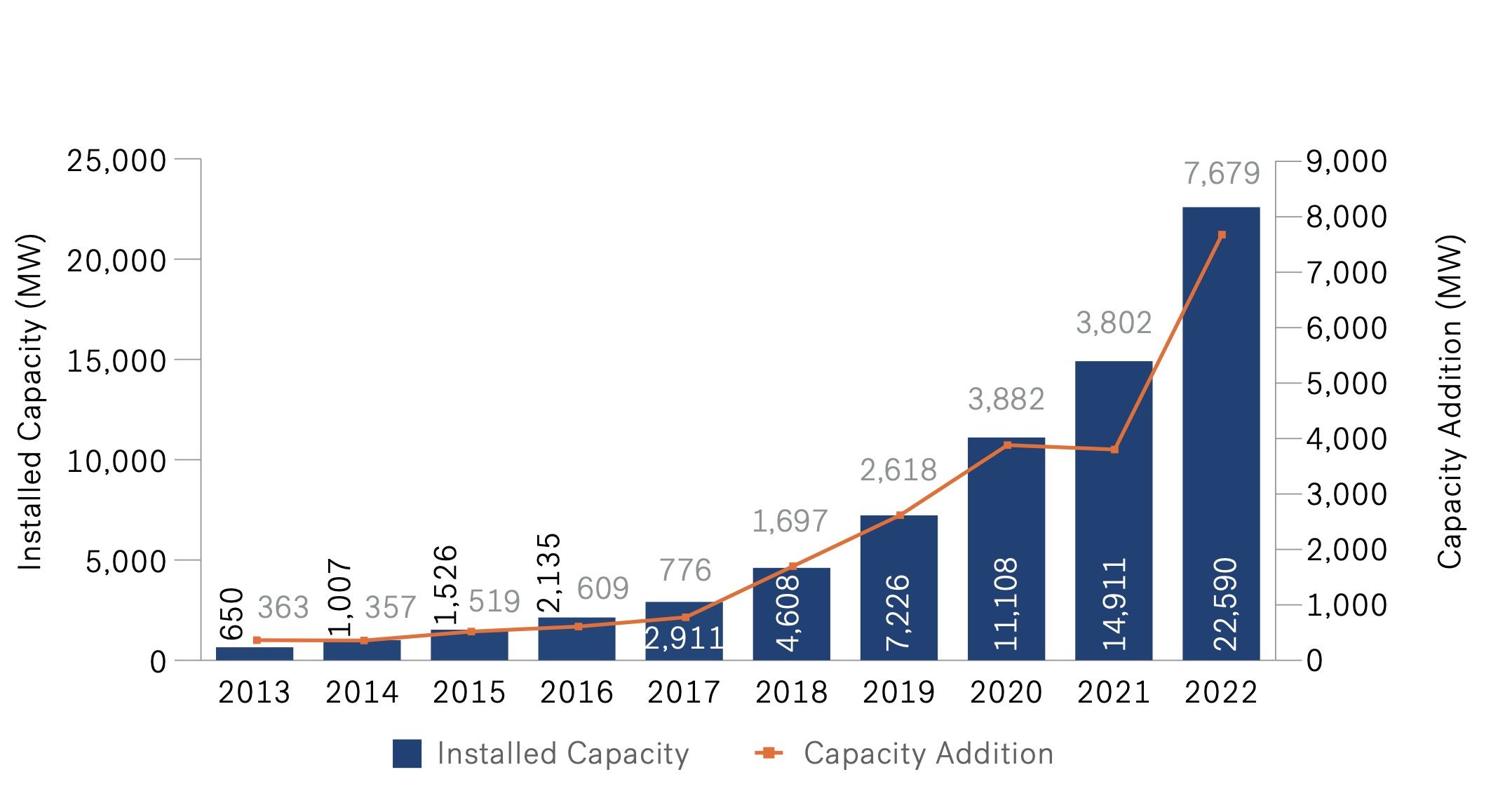

Trend in Installed Solar PV Capacity

Source: IRENA Renewable Capacity Statistics April 2023

There was a record amount of solar capacity added in 2022, with around 7.7GW deployed. The residential segment contributed the lion’s share of this growth thanks to an attractive net-metering policy. The C&I segment, on the other hand, has lost some traction due to decreasing subsidies from the SDE++ scheme and increased logistics and technology costs.

Still, the Dutch market retains a good balance among its different segments, which is why it ranks first in Europe in terms of solar capacity per capita. Netherlands reached this remarkable milestone in 2022, when it installed more than 1,000 watts of solar power per capita, 28% more than in 2021. This has widened the distance to Europe’s powerhouse, Germany, which had 816W/capita installed at the end of 2022.

In 2022, electricity production remained unchanged compared to the previous year whereas 40% of total electricity production came from renewable sources, up from 33%. Statistics Netherlands (CBS) reported that in 2022, electricity production from renewable sources increased by 20% year-on-year to 47 billion kWh and production from fossil sources fell by 11%. Solar power production increased by 54%, while wind power production was up by 17%.

Demand Drivers

An important instrument to promote renewable development is the Stimulering Duurzame Energietransitie (SDE++) support scheme that uses competitive auctions to award operational subsidies to new renewable energy projects. SDE++ was implemented after the expansion of SDE+ in 2020, which was designed for large-scale renewable technologies, but did not cover other technologies such as carbon capture and storage. During the period 2011 to 2020, the precursor SDE+ allocated up to €60 billion in subsidies, which are paid over 15 years based on renewable energy production. For the 2022 SDE++ program, the budget was €13 billion, the highest budget for the program to date. Among the largest projects funded by SDE subsidies in 2022 is a 136MW solar farm in Haarlemmermeer, which is 100% locally owned. The project is expected to be finished in 2023 and was developed in co- creation with local citizens.

This SDE++ tendering scheme is the primary driver of the commercial and utility-scale solar energy markets in the Netherlands. Under the scheme solar energy competes with other renewable energy projects and CO2 reducing technologies such as CCS. A total of 2.3GW in solar projects applied for subsidy in the 2022 round, of which 1GW were ground-mounted, 38MW were floating, and 1.3GW were large rooftop installations.

Net metering is another important mechanism for solar growth in the country, which is key to the residential solar market. The Netherlands’ net metering system, set up in 2004, allows households with solar panels to offset their green electricity production against their consumption. With the support policy, more than 2 million homes are currently generating renewable energy. However, a proposal by the Dutch solar sector to gradually phase out net-metering with 9% reductions every year until 2031 is awaiting a vote in parliament. This degressive approach is based on a seven-year payback period for the prosumer, assuming 30% self- consumption and optimal system conditions.

Over the past few years, there have been growing concerns from the insurance sector related to rooftop solar installation causing fires, which had a negative impact on the rooftop solar market. Consequently, the Dutch government conducted an independent study in November 2021 that proved there were limited fire risks. Additionally, a code of conduct was developed, which has been in place for a year now, resulting in higher insurability, thereby enhancing commercial solar installations.

Market Opportunity

Netherlands is one of Europe’s leading markets for corporate power purchase agreements. Over the period 2014-2022, BNEF has tracked 2,381MW of corporate renewable energy PPAs in the Netherlands. Local companies with high electricity demand and sustainability objectives also contribute to this success.

With available farmland being limited, industry operators have been experimenting with innovative solutions to find space for solar farms. This includes exploring ways to make solar plants work alongside agricultural production. One such project involves growing strawberries and raspberries below a solar panel roof, replacing the plastic cover traditionally used by farmers. In an innovative attempt to utilize land, Dutch solar developer TPSolar installed 23,000 solar panels on a landfill site in Armhoede capable of producing 8.9MW of green electricity.

SCE (Subsidy Cooperative Energy Production 2021) has been successfully supporting the development of cooperative projects among organized citizens and will continue to do so. Additional methods of participation, financial or otherwise, have also been implemented and will be included in the solar sector’s Code of Conduct. This ensures a level playing field for commercial project developers and residents.

In addition, floating solar deployments and technologies have made substantial progress in the country, thanks to the country’s abundant water resources, covering approximately 20% of its surface area. Several solar power developers have taken advantage of this by building farms on artificial lakes. Dutch company GroenLeven has installed more than 500,000 solar panels on Dutch waters. Furthermore, the Netherlands has deployed an innovative floating solar farm that tracks the sun’s path through the sky, maximizing energy production. The farm was developed by the Portuguese company Solaris Float that can be installed on lakes, reservoirs and in coastal areas, potentially solving many issues plaguing solar technology.

There has been a growing appetite for large-scale battery energy storage systems in the country, primarily to tackle the shortages of renewable capacity on the grid caused by grid constraints and procedural delays. The storage requirement is estimated to be 10GW by 2030. Naturally, movement in the battery storage market has picked up over the last 12 months. The largest operational system in the country was brought online in October last year by GIGA Buffalo, followed in quick succession by the largest under- construction projects being launched by Rolls-Royce and Alfen in November 2022 and February 2023, respectively.

Outlook

Source: BNEF Global PV Market Outlook

Note: The above data, as sourced from BNEF, are based on a ‘low’ investment scenario

Based on preliminary studies conducted by the Dutch Foundation for Applied Water Research (STOWA) and the Netherlands Organisation for Applied Scientific Research (TNO), the country has the potential to generate 11GW of solar energy. Furthermore, green electricity demand is anticipated to grow by 10-20TWh by 2030, resulting in the possible continuation of the SDE++ scheme in 2023-2025 for solar and wind projects. It is planned that the new round of SDE++ 2023 will be launched in September this year, with phase 1 to be held on September 5, 2023. Subsequent phases up to 5 will be conducted by October 2, 2023, depending on the subsidy intensity.

The limited capacity of the Dutch power grid could pose a significant obstacle to solar deployment. Lack of grid capacity at the middle and high voltage levels is expected to lead to long delays and possibly non-realization of the projects. Furthermore, the utility-scale segment faces the challenge of securing suitable land for solar installations. Land availability concerns often coexist with concerns about public acceptance when it comes to the use of agricultural land for solar projects. As part of its efforts to address these issues, the industry seeks to ensure a quota of local participation in renewable energy projects and create a biodiversity label for large-scale projects. However, the Dutch government is currently examining ways to alter site planning and financial support to encourage the build-out of more solar farms with better landscape integration.