2023

Gigafactory Report

Battery Recycling

07 | Battery Recycling

07 | Battery Recycling

Introduction

Introduction

The globally strong Gigafactory pipeline has brought to the fore the battery recycling segment of the chain that has otherwise been largely nascent till recently. Multiple factors, ranging from sustainability concerns to localization and supply chain diversification, contribute to a heighted business interest and investment in recycling. To be sure, it is still a

limited underlying base – predominant short-term demand arises from the Gigafactories’ production scrap till electric vehicle fleet expands reasonably for end-of-life batteries. The leading global markets in Gigafactory capacities are more likely to overlap with the upcoming demand hotspots in battery recycling.

Battery Production Scraps are the Primary Global Supply for Battery Recycling Until 2030

Battery Production Scraps are the Primary Global Supply for Battery Recycling Until 2030

Regulatory Thrust

Regulatory Thrust

With sustainability concerns in focus, policy and regulatory norms are laying down the required practices for the battery production, distribution, and disposal process. Such norms are notable in the backdrop of the major electric vehicle penetration in some of the major markets globally. An important case in point is the European region. Starting May 2023, the new European Battery Regulation came into force. It is to be implemented across the European Union member countries to mitigate the environmental impact of the installed base of electric vehicle batteries.

The elaborate regulations comprise critical elements for tracking and reporting the aspects related to the batteries’ specific parameters for environmental impact. One such requirement is the ‘battery passport’ – a digital document for the traceability of communication between manufacturers, users and the recycling operators. The digital documentation

will cease when the battery gets recycled. The documentation norm will be valid from May 2026, for batteries above 2kWh in the European Union market.

Carbon footprint is among the major parameters tracked, in which battery recycling is likely to play an important role. Using lifecycle assessment, the European regulations require mandatory declaration of carbon footprint from May 2024 onwards. On the supply side, another set of European Union regulations passed in March 2023, namely the Critical Minerals Act, set ambitious targets for recycling. It requires recycling to meet at least 15% of consumption by 2030. The European regulations help set the base for an otherwise nascent recycling industry in Lithium, among other minerals.

Policy propositions and packages vary across markets in terms of their impact on recycling. In the US, the federal legislation Inflation Reduction Act (IRA), made a major dent in attracting investments in electric vehicles and its related component manufacturing, especially in batteries. The legislation offers incentives through tax credits for indigenous manufacturing. The key point in this direction is that the tax credit disbursement for consumers is linked to the extent that the battery material is sourced from domestic production units, or from the US trade partners (foreign trade agreements).

In effect, the IRA sets incentives for OEMs who not only need to maximize the domestic production share but also diversify away from the Chinese sources in the supply chain. Recycling is critical to help meet the requirement. Recycling also helps meet the localization requirement in the US because most of the existing new mineral production or processing facilities

are beset with challenges in procedural approvals. The complementary support for this regulation is observed in the policy funding made available for recycling. In February 2023, the battery material and recycling startup Redwood Materials secured a $2 billion conditional loan from the US Department of Energy to augment supply of critical minerals involved in the battery supply chain.

To be sure, the role of policy and regulatory initiatives is contingent on the underlying segment’s growth. When observed in this perspective, the implications of such initiatives will take some time to materialize. The critical mass required for the battery recycling business is yet to be reached. The total supply chain is still concentrated in the Chinese industrial ecosystem. It is thus the emerging demand and opportunity in this business that the investors are likely to track and pursue.

Major Battery Demand Segments

Major Battery Demand Segments

The recycling demand for electric vehicle batteries is largely limited to production scrap. An expansion in the electric vehicle fleet will shift the recycling focus to end-of-life batteries. Most of the industry reports such as Mckinsey’s concur that it will be

only after 2030 when the end-of-life electric vehicle batteries can be available as a critical demand base for recycling. Thus, over the next decade or so, the production scrap of electric vehicle batteries is the major demand driver.

Projected Global Supply of Electric Vehicle Battery for Recycling

Projected Global Supply of Electric Vehicle Battery for Recycling

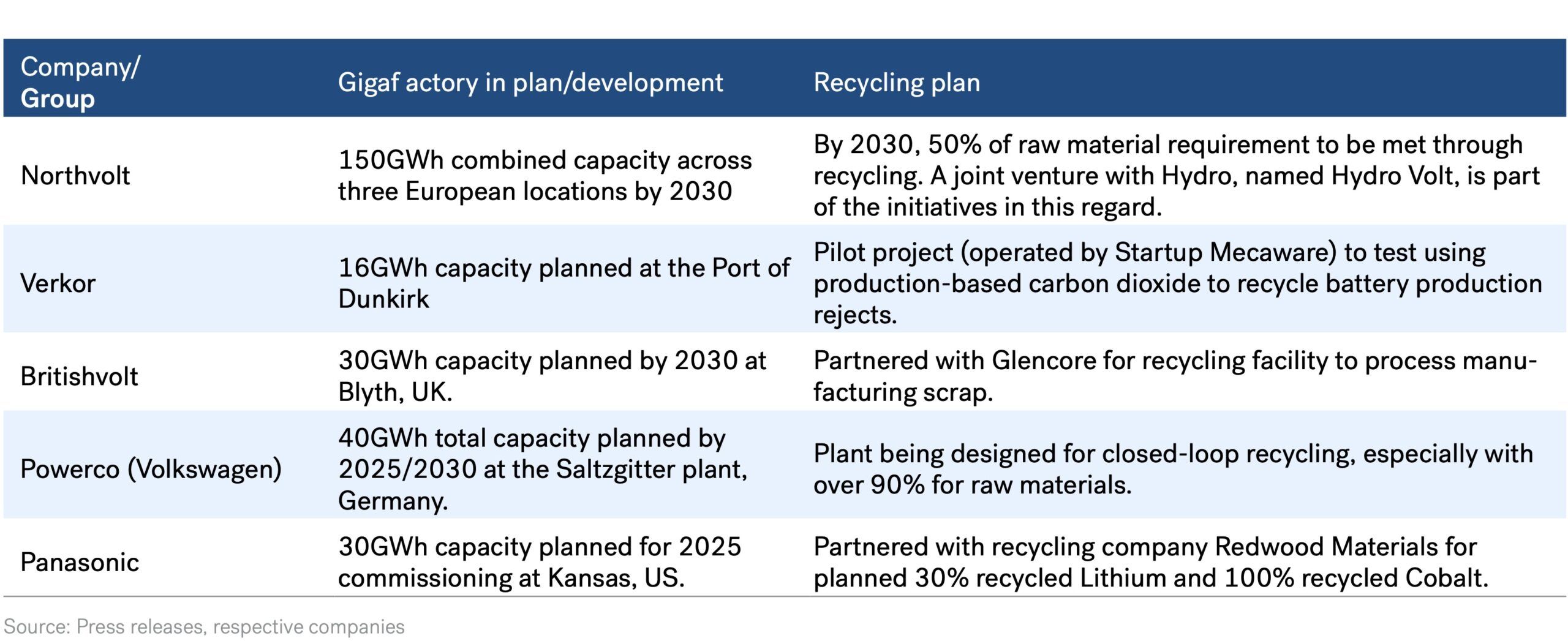

The Gigafactory pipeline is a major demand driver for battery recycling. Some of the major projects under development incorporate recycling in the design and plan. This is in keeping with a circular manufacturing process – one involving a production and supply chain to recover or recycle the resources used in creating the products. A Gigafactory has an

estimated average scrap rate of 8% – 10%. But such average estimates are conditional to the assumptions of technology and plant-specific parameters. EY’s report for instance refers to Gigafactory scrap rates at 20%-30% in the early stages of production.

Gigafactories in Pipeline with Battery Recycling Facilities

Gigafactories in Pipeline with Battery Recycling Facilities

Scale is an important factor in ensuring profitability. Other factors in the scheme include recovered metals’ price, battery cell chemistry, and battery supply chain localization. With some assumptions in the battery closed loop recycling and extraction/processing costs, the ballpark estimate of the

monetary value is $600 per tonne of battery material by 2025 (McKinsey, March 2023). The same projections suggest the potential value addition growth reaching closer to the path of primary metals, based on technology maturity and its adoption.

Estimated Monetary Value in Per Tonne of Electric Vehicle Battery Recycling

Estimated Monetary Value in Per Tonne of Electric Vehicle Battery Recycling

The demand for recycling is not restricted to the Gigafactories under development. The existing battery manufacturing capacities are headed in the same direction. Tesla is among the notable and earliest movers in this regard. The company had reported over 90% recycling rate in battery raw materials (as of 2021). Panasonic’s battery cells at Tesla’s Nevada Gigafactory progressively incorporate a higher rate of recycling for raw materials. In January 2023, the world’s largest electric vehicle battery producer CATL announced a $3.4 billion (¥23.8 billion) investment for battery recycling capacity in China, through its subsidiary Brunp. In the Chinese market, Brunp and GEM contribute half of the recycling business. The momentum is picking up in similar pattern in South Korea, where a clustered presence of top manufacturers (LG, Samsung and Sk On, among others) made it a ripe market for recycling for the electric vehicle demand.

After electric vehicles, the next major battery demand segment is that of grid-scale energy storage. It is gradually coming to the fore with expansion in deployment. Recycled batteries, whether generated in the manufacturing process, or through the end-of-life stage of the electric vehicle fleet, are finding way in the battery storage systems. One such project, and the largest of its kind, was commissioned in February 2023, connected with a Californian solar farm. It uses repurposed electric vehicle batteries. The same batteries, once fully exhausted in the storage application, can then be part of the recycling process for commercial extraction value. A rising base of renewable-plus storage projects feeds the recycling demand, especially with regulatory requirements. Yet, this is a nascent and emerging sub-segment of battery recycling with lack of defined policy and framework in many of the leading global markets.

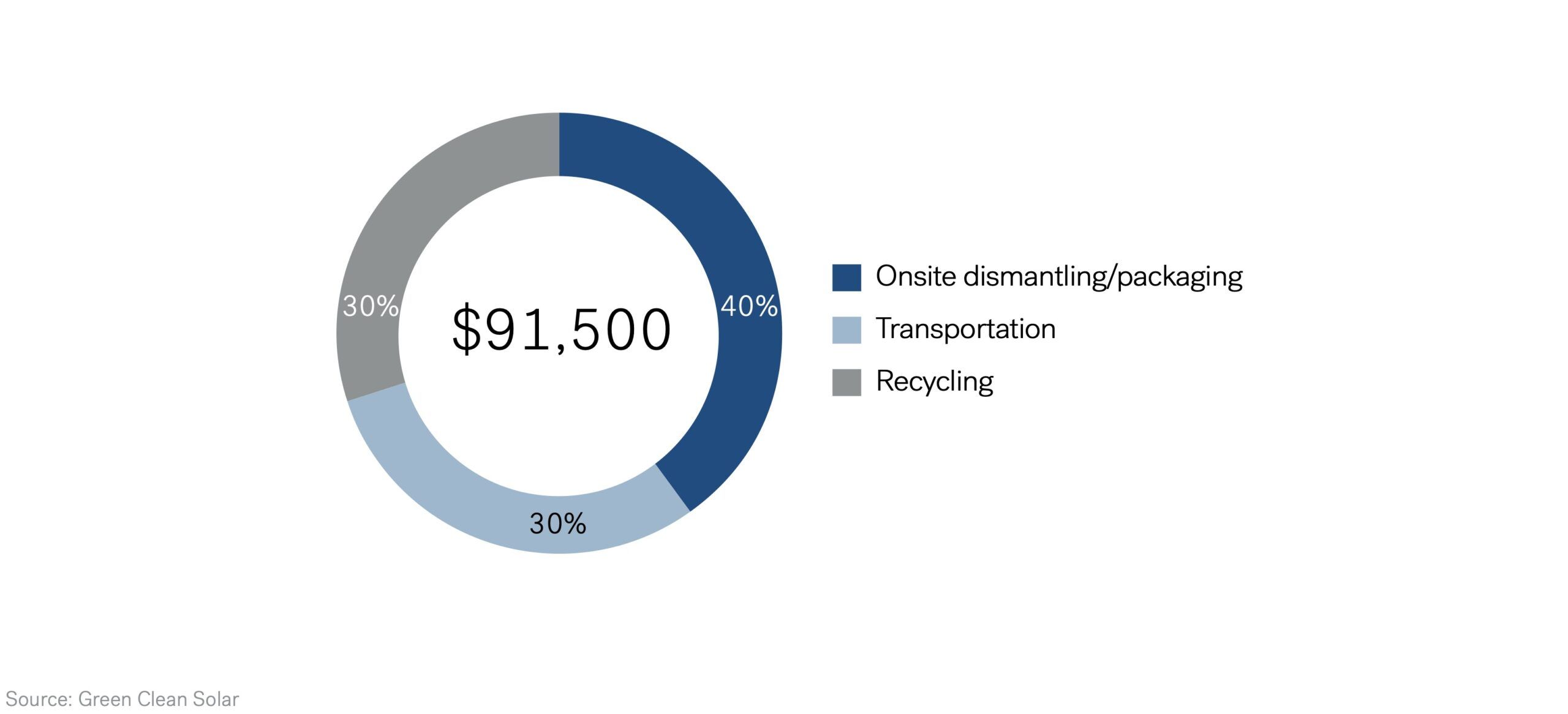

Cost Breakup of Decommissioning a 1-MWh NMC Lithium-Ion Battery Storage System

Cost Breakup of Decommissioning a 1-MWh NMC Lithium-Ion Battery Storage System

Technology and Key Market Players

Technology and Key Market Players

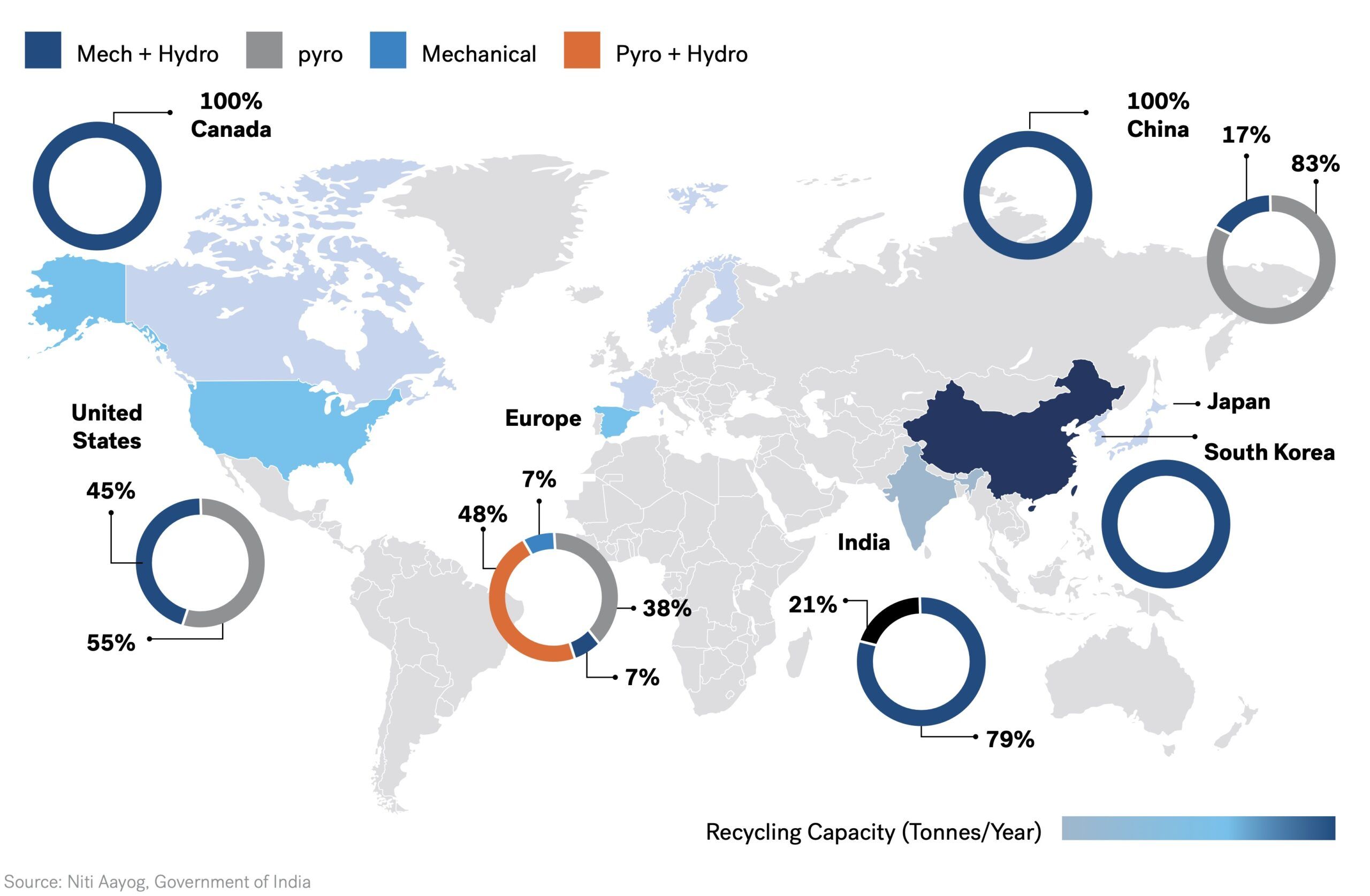

There are established recycling technologies in place for the typical Lithium-Ion and other major battery chemistries in use. The process entails multiple stages based on the choice/ requirement of recycling, input feedstock and expected output quality (largely critical minerals). To generalize though, there are four steps, namely preparation, pre-treatment (pyrolysis and mechanical), pyro-metallurgy and hydrometallurgy. The combination of the steps varies across the recycling plants. In some cases, there are standalone recycling capacities, adopting either one of mechanical, pyrometallurgical or hydrometallurgical processes.

Global Recycling Capacity by Technology

Global Recycling Capacity by Technology

The technology profile of battery recycling varies across countries and regions. This is in part a reflection of the existing industrial base in mineral processing and refining. China’s dominance is a given factor. The European and US- based capacity is gradually coming to the fore, with incentives

available for the domestic manufacturing units. The prevalent recycling processes vary between Chinese hybrid modes of mechanical with hydro and European combination of mechanical, hydro and pyrometallurgy.

Existing and Planned Lithium-Ion Battery Recycling Capacity by Region (2021)

Existing and Planned Lithium-Ion Battery Recycling Capacity by Region (2021)

Some of the key global recyclers include Ecobat, Umicore, Accurec, SunEel, Kyoei Seiko, and Brunp, among others. Most of the recycling companies’ existing production systems are configured for multiple battery chemistries and production scraps. With Lithium-Ion batteries lately assuming a significant share, there is progressively a business case for redesigning for efficiency. With rising demand for recycling, the upcoming investments are not just for capacity expansion but also to re-configure for a diversified input feedstock in Lithium-Ion and other leading battery formulations. In February 2023 for instance, the US-based multi-national recycling company Ecobat announced the setting up of a dedicated Lithium-Ion recycling facility in Arizona, US.

The dynamic business landscape of battery supply chain, led primarily by Gigafactory pipeline, impacts the linkages of recycling industries as well. Various business models are in the play, as enterprises find the best and optimal route to capitalize upon opportunities. Progressively, the direction is towards integration and consolidation as enterprises situated at different points of the value chain find business interest to control the specific areas of backward and forward linkages. The Gigafactories in development are already visible examples of integrated operations.

Emerging Integrated Structure in Recycling Business

Emerging Integrated Structure in Recycling Business

The shifting industry structure and consolidation could also enable a wider space for new technologies, and innovations. The policy push to incentivize localization coupled with regulatory and business focus on the carbon footprint would also bring in competitive focus on carbon footprint. The investors’ thrust on sustainability tracking of battery capacities

adds to the momentum. Leading European companies in the battery recycling space, for instance, could be progressing towards a vastly lower carbon footprint than their Asian counterparts. For the similar reasons, Asian recyclers are also seeking entry in European markets for expansion.

End-of-life Batteries will be the Primary Source for Battery Recycling after 2040

End-of-life Batteries will be the Primary Source for Battery Recycling after 2040