2023

Gigafactory Report

Key Enterprises and Ventures

04 | Key Enterprises and Ventures

04 | Key Enterprises and Ventures

Introduction

Introduction

The global Gigafactory pipeline involves multiple enterprises coming together, sharing respective areas of core competence towards a complex and integrated production unit. Battery and automobile original equipment manufacturers (OEMs) corner the maximum share of the pipeline, largely through joint ventures and strategic partnerships. Others in the fray include mining companies, technology providers, startups, and equipment suppliers. Varied business structures and models are accordingly in the works.

The discussion about the business enterprises assumes significance because of the emerging dynamics in the business. Gigafactories’ verticalized structure is apparently counter to the conventional (and currently operational) globalized model in the capital-intensive manufacturing businesses. Many of the OEMs are, for instance, securing stakes in the mining business for an edge in access to active minerals of batteries. Meanwhile, technological innovations (e.g., solid- state batteries) are facilitating market entry in the Gigafactory business that is otherwise marked by its characteristic high entry barriers due to scale and funding.

OEM Partnerships/Joint Ventures

OEM Partnerships/Joint Ventures

Roughly three-quarters of the existing global Gigafactory pipeline is based on joint ventures and related partnership structures between the automobile and battery OEMs. Automakers lead the trend here. Most of them in the US and European markets are not fully prepared to make the transition from conventional to electric mobility. The Chinese competition is an exception in this regard, where the ongoing partnerships are predominantly aimed at capacity addition, supply security and market share retention.

The pattern in announcements of battery production partnerships is indicative of the rising interest in the field. Yet, the underlying business conditions continue to evolve. The latest announcements might thus be subject to cancellations if commercial terms subsequently appear less attractive. A few such cases are gradually surfacing. In May 2023, the automaker Volkswagen and major equipment manufacturer Bosch cancelled their plans to set up a battery manufacturing joint venture. In January 2023, Ford Motors and Sk Innovation cancelled their planned joint venture for a Turkish battery manufacturing plant. In the same month, General Motors and LG cancelled the planned fourth battery production plant under their existing joint venture enterprise Ultium.

Battery Production Partnership Announcements Since Mid-2021

Battery Production Partnership Announcements Since Mid-2021

For automobile OEMs, the joint ventures constitute a critical step to acquire and integrate the technology in the shifting vehicle powertrains. The luxury automotive manufacturers’ segment stands out in this. They need to develop typical high-performance and niche vehicles that can substitute the premium offerings in conventional engines. In September 2021, the Germany luxury automaker Mercedes-Benz took an equity stake in the European battery cell manufacturer Automotive Cells Company (ACC) for development and production of high-performance cells and modules. The sports car manufacturer Porsche AG is progressing similarly with acquisition of stakes in the US-based Group 14 Technologies, a producer of advanced silicon-based carbon technology for Lithium-ion batteries. The acquisition is aimed at securing battery supply for Porsche’s high-performance vehicle powertrains. Beyond such niche segment focus, the OEM partnerships are led by motivations of technology access – as of February 2023 about 10 leading automakers had a stake in the development and fine-tuning of solid- state battery technology. Though a promising option, it is still subject to technical challenges and is thus in the process of development and refinement.

The commercial arrangements of the OEM partnerships are getting finalized despite various extraneous challenges. The US-China trade restrictions, for instance, place impediments for companies on both sides seeking to capitalize on the opportunities. The joint venture partnerships are thus accordingly tweaked to accommodate requirements.

The Ford-CATL partnership is one notable example deviating from traditional model, with Ford Motors holding 100% ownership stake, licensing the Lithium Phosphate from CATL. Such an equity structure helps Ford qualify for the benefits under the US Inflation Reduction Act. Yet, the deal is not without challenges with policymakers in both countries placing it under scrutiny for implications in trade relations. The

partnerships with Chinese companies are nearly unavoidable, as their leadership lies in not just existing capacities but also the ongoing expansion in critical/active materials (over 90% share of globally planned cathode and anode expansion). The China-based world’s top battery producer CATL has tie-ups with most of the leading US and European automakers and in December 20222 commenced the first batch of its German battery cell manufacturing plant. The South Korean battery producers (LG, SK On) are following a similar route of OEM partnerships.

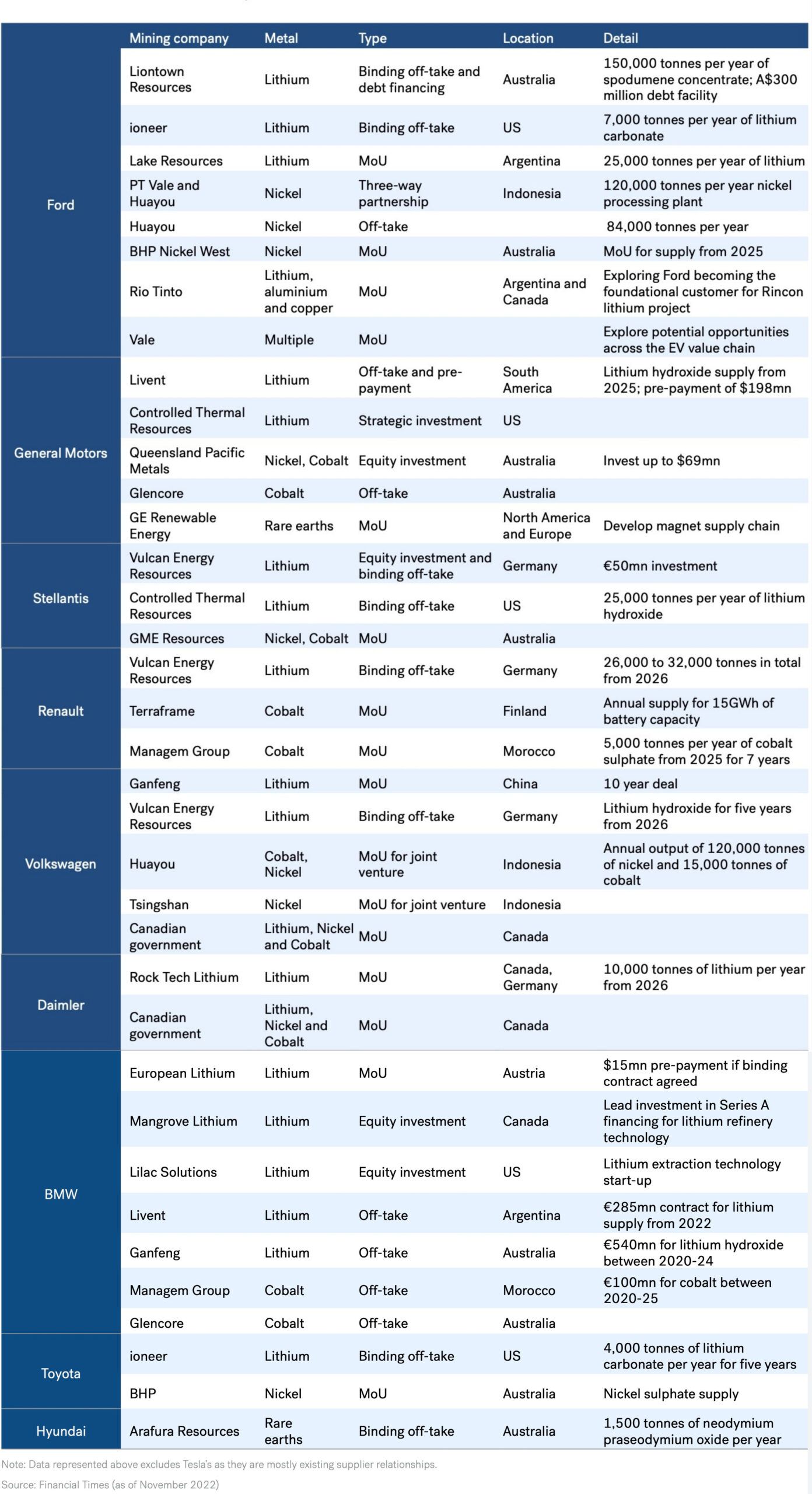

For many companies, joint venture partnerships also mean bypassing the conventional supply chains. The automakers have adopted this route to secure supply of essential metals including Lithium, Cobalt, Nickel, and Copper among others. Tesla, for instance, had been in discussions with Glencore to buy a stake in the latter’s cobalt mining assets. While Tesla’s planned deal did not materialize, CATL could finalize a 25% stake in Cobalt producer CMOC’s business (as of November 2022). In this context, the Chinese companies have been following this route for quite some time, with some their leading battery producers seeking African and Chilean Lithium mines.

The US and European companies, especially those in the automotive sector, currently lead the way due to the competition and demand pressure. Pure-play mining companies on a standalone basis may not have the supply ready in time. Furthermore, automakers and pure-play mining companies have a dichotomous relation to the critical metals/materials required – mining companies seek a multi- year investment cycle to meet long-term demand, whereas automakers’ horizon is much shorter with a focus on cheaper access through scale. Effectively, with contractual offtake agreements, automakers supply the capital to get such mining projects onstream which were otherwise not too attractive.

Automakers’ Direct Deals/Partnerships with Miners

Automakers’ Direct Deals/Partnerships with Miners

Technology Providers and Developers

Technology Providers and Developers

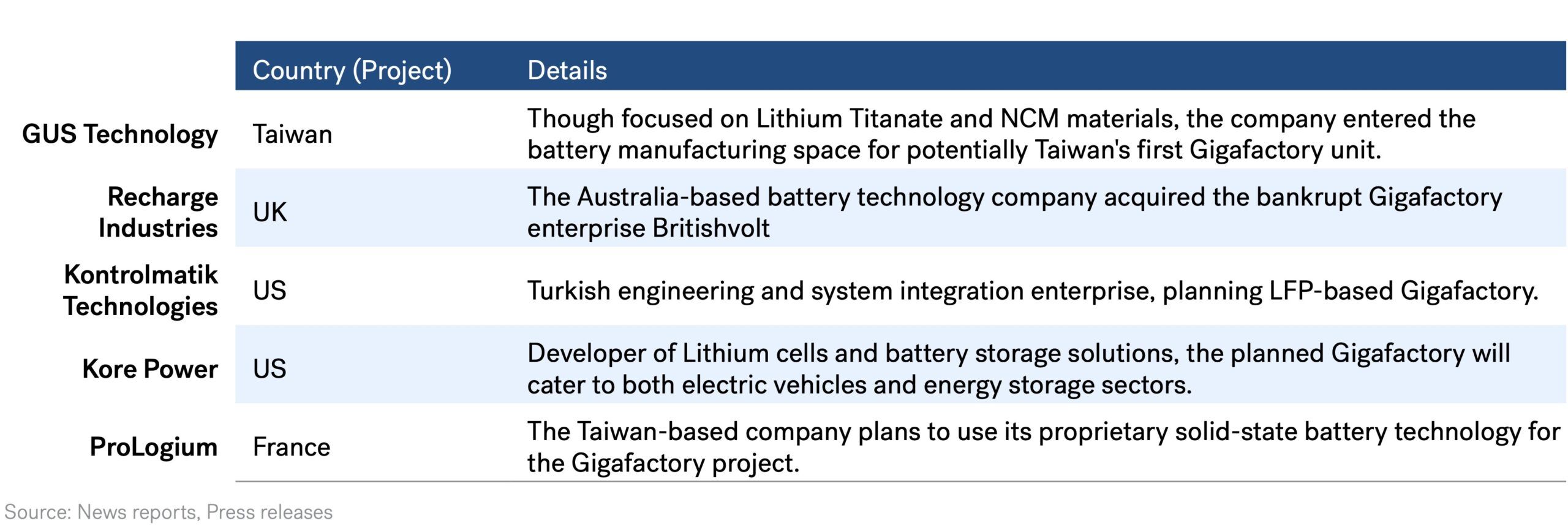

The manufacturing pipeline for electric vehicle batteries is not limited to the OEM partnerships. Though relatively lesser in proportion, a part of the upcoming capacities is led by technology providers, or those entities engaged in the development chain of battery cell components based on certain technology configuration. Supply linkage in the battery

components together with technological know-how enabled market entry for these enterprises. The competitive edge of such enterprises would lie within technology, considering that the scale and profitability are two key known entry barriers in the Gigafactory landscape.

Technology Providers Setting up Battery Manufacturing Capacities (illustrative)

Technology Providers Setting up Battery Manufacturing Capacities (illustrative)

To an extent, within technology providers, one could also consider the potential involvement of equipment suppliers and their related entities. Mckinsey estimates indicate that about 60% of the Gigafactories’ total planned investment could be directed at manufacturing equipment. The same report also points out that the majority of the equipment manufacturers for Gigafactories will be from the Asia-Pacific

region. Volkswagen’s Saltzgitter Gigafactory’s equipment manufacturing contract went to China-based Wuxi Lead Intelligent Equipment. But, with limited production capacities and longer team times, the enterprises are likely to be acquired or engaged with strategic partnership arrangements. Tesla had acquired Grohmann Engineering in 2017, as part of measures to acquire the know-how and capabilities.

Startups

Startups

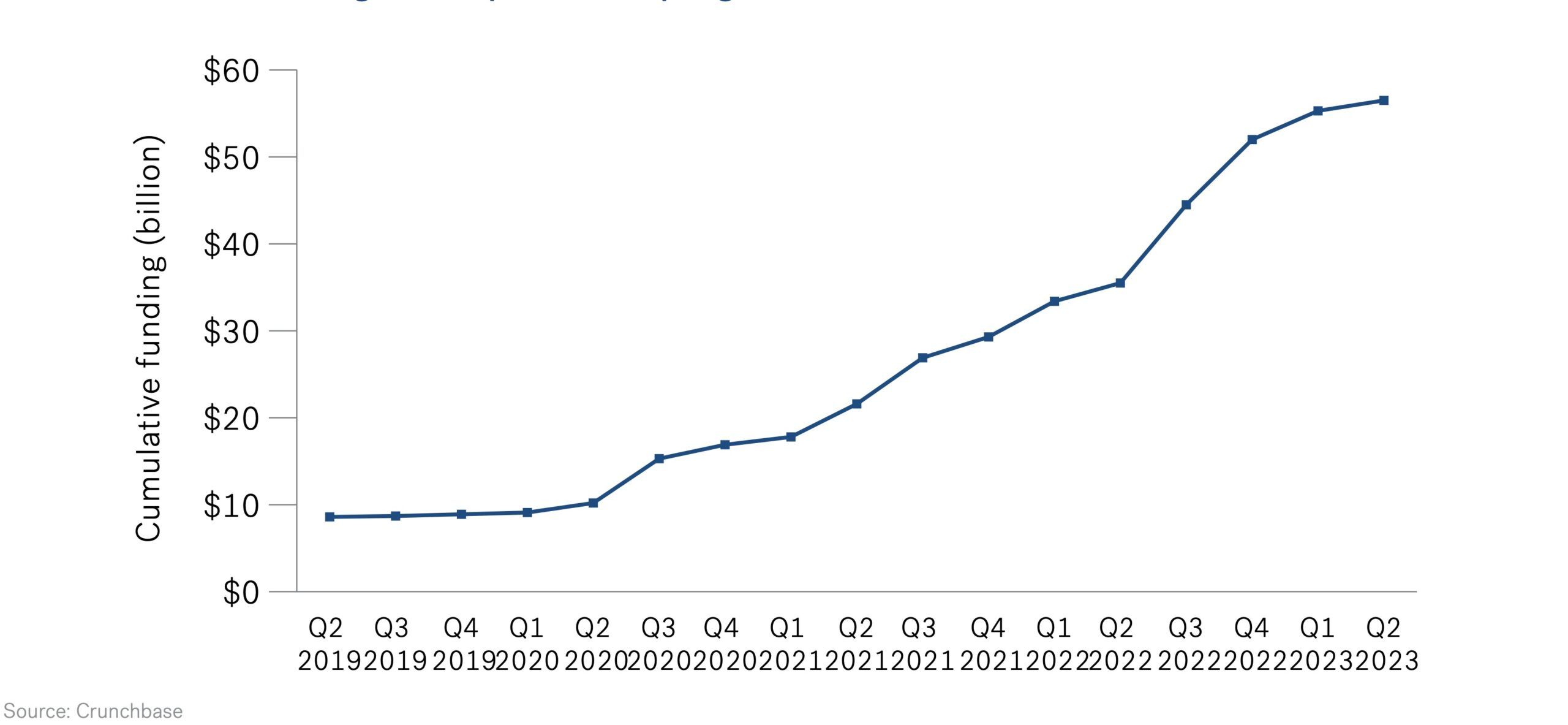

Startups are leading some of the major Gigafactory projects under development. Investor interest, as reflected in the venture capital (VC) funding, helped get the enterprises take off. Battery energy is part of the overall clean energy theme where VC investments have been directed the most. By end of 2022, about two-thirds of the total global VC investment was towards batteries, energy storage and renewable energy.

PitchBook’s February 2023 estimate held the Swedish Gigafactory manufacturer Northvolt as the highest-funded European startup for the $5.5 billion raised till that date. French battery startup Verkor and the US-based Our Next Energy (ONE) are other notable case of startups engaged in the Gigafactory line-up. There are others similarly engaged in the development process.

In quite a few cases, the technology-led differentiation of the startups is clear. Nanotech Energy, founded in 2014, is in the process of finalizing the site for its planned £1 billion Gigafactory in the UK. The company offers a proprietary non-flammable electrolyte for its lithium-ion batteries and graphene-based electrodes which together result in a battery packs with a higher value proposition. Another similar example is that of Natron Energy, whose sodium-ion battery packs helped attract funding from entities including United Airlines and Liberty Energy.

Trend in Cumulative Funding in Battery Tech/Startup Segment

Trend in Cumulative Funding in Battery Tech/Startup Segment

Market entry of well-funded startups in the Gigafactory space is an encouraging factor for market depth. While necessary though, it is not a sufficient condition for growth

and sustenance. The profitability of the business will be tested for every enterprise regardless of its legacy endowment in resources or strategic arrangement in supply chain.